Singapore initiates tokenization pilots: What does it entail?

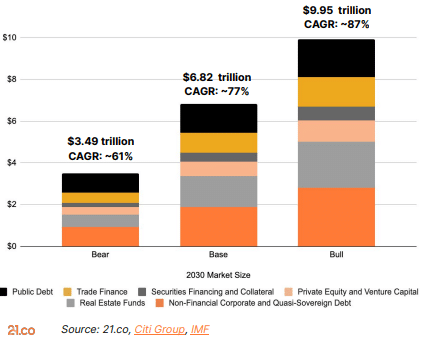

- A recent report estimated the market value of tokenized assets to be $3.5-$10 trillion by 2030.

- Japan, the United Kingdom, and Switzerland are also part of the project.

The Monetary Authority of Singapore (MAS) announced that it is initiating tests around tokenization use cases. The bank is partnering with major financial services firms, including BNY Mellon, DBS, J.P. Morgan, and MUFG.

The tests will explore bilateral digital asset trades, cross-border currency payments, multi-currency clearing and settlement, fund records management, and automated portfolio customization.

The MAS will apparently build an open, digital infrastructure called Global Layer One (GL1). It will host tokenized financial assets and applications.

It is also working to develop an Interlinked Network Model (INM) to serve as a common framework for exchanging virtual assets across independent networks.

The asset tokenization enterprise is a part of Project Guardian, which also includes Japan, the United Kingdom, and Switzerland.

In addition to Japan’s Financial Services Agency (FSA), the U.K.’s Financial Conduct Authority (FCA), the Swiss Financial Market Supervisory Authority (FINMA), and Singapore’s MAS. The International Monetary Fund (IMF) is also a part of the policymaker group behind the project.

Tokenized assets to reach $3.5-$10 trillion by 2030

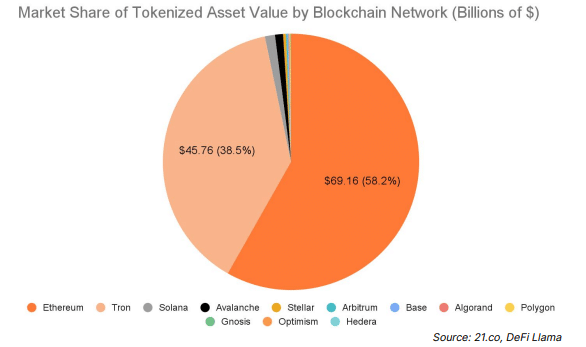

Last month, 21.co—the company behind investment group 21Shares—released a report on the state of tokenization. It estimated the total value of tokenized assets across public blockchains to be $118.57 billion.

Ethereum [ETH] accounted for over 58.33%, or $69.16 billion of all tokenized assets, followed by Tron [TRX] supporting tokens worth $45.76 billion or 38.59% of total assets.

So far, a total of seven asset classes have been tokenized such as U.S. treasuries, real estate, corporate bonds, etc. Stablecoins pegged to the U.S. dollar accounted for ~97% of all tokenized assets, the report mentioned.

As of now, there are roughly 47 million holders of tokenized assets. They accounted for only 10% of the estimated 431 million crypto owners.

The report estimated that the market value for tokenized assets will be between $3.5 trillion and $10 trillion by 2030.