Ethereum: Network growth takes ETH to $1.8K – $2K

- ETH’s Supply on Exchanges dropped to its ATL

- There was a steady rise in Open Interest as well

Ethereum [ETH] made a decisive move past $1,800 after the U.S. Federal Reserve’s (Fed) decision to keep the interest rates unchanged at 5.25%-5.50%.

Is your portfolio green? Check out the ETH Profit Calculator

At press time, the king of altcoins exchanged hands at $1,848, up 2.33% in the last 24 hours, reaching levels last seen before the mid-August crash, per CoinMarketCap.

Ethereum sees network growth

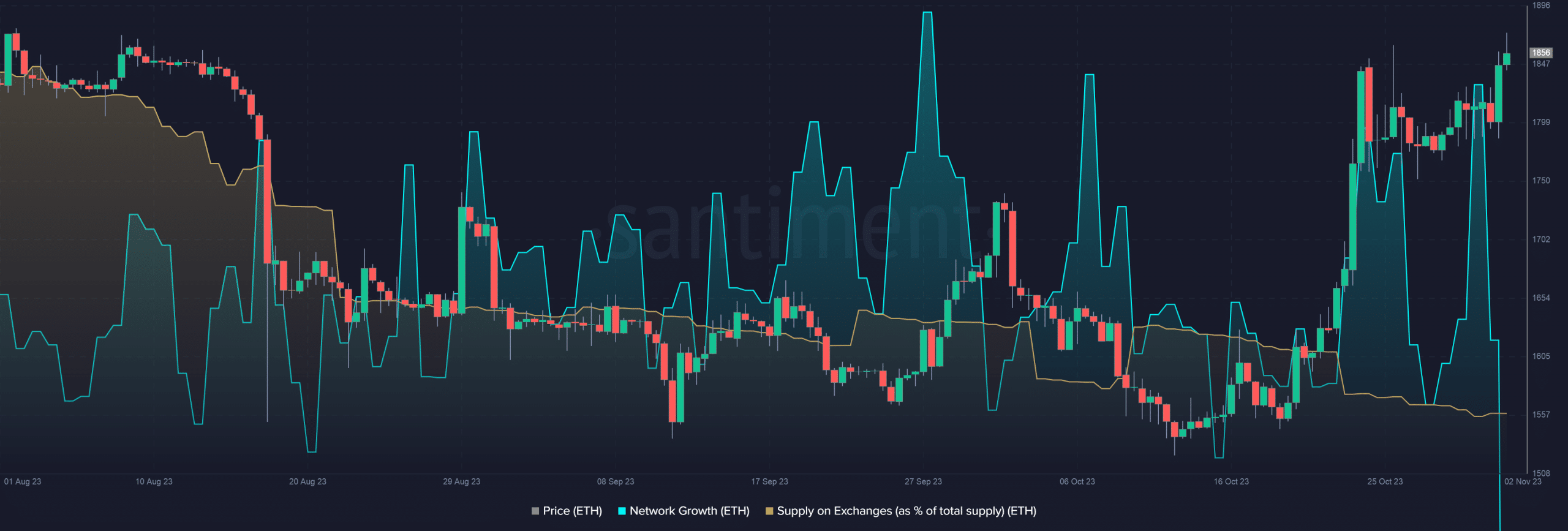

Apparently, the latest upside was boosted by new participants on the network. According to on-chain analytics firm Santiment, new ETH addresses climbed to a 24-day high at the end of October.

Typically, a spike in Network Growth indicates that a project is gaining considerable traction.

At the same time, ETH’s liquid supply sank to new depths. Indeed, the supply on centralized exchanges was just 8.38% of the total circulating supply as of press time, the lowest since ETH started to move between public hands.

The fall in exchange supply meant that there was no imminent sell pressure on ETH’s price.

As things stand, ETH has nearly recouped all the losses made since the market crash in August. Santiment futher noted that if the network continues to grow steadily, and exchange supply falls further, there were strong chances of ETH breaching $2000 in the near future.

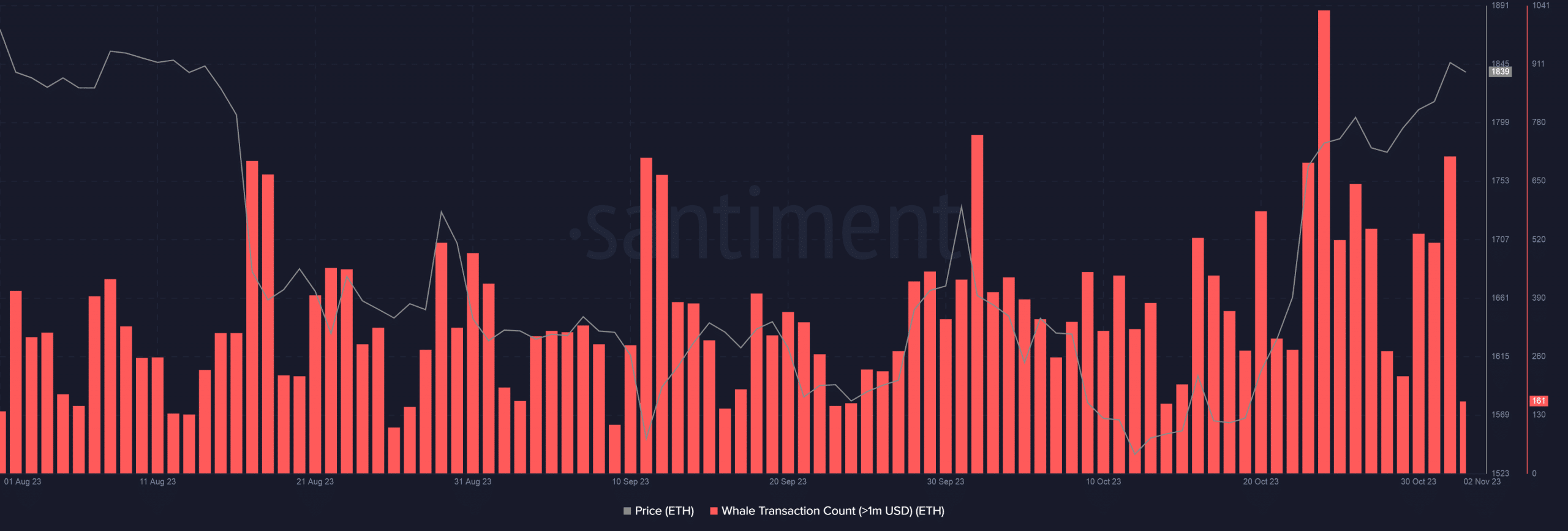

ETH whales step up their game

Meanwhile, the price rise grabbed the interest of whale investors. Transactions worth more than $1 million in ETH jumped 37% on 1 November. Notably, this was one of the largest single-day spikes in whale transfers over the last three months.

Derivatives market gives bullish signals

The shift in ETH’s market structure was reflected in the derivatives sectors as well. Open Interest (OI) in ETH futures contracts rose to $5.36 billion, the highest since 17 August, according to Coinglass.

Read Ethereum’s [ETH] Price Prediction 2023-24

The steady upward trajectory of OI, coinciding with a jump in price, implied that new money was coming into the market at press time.

Furthermore, ETH’s funding rates across most exchanges were positive, meaning long traders paid fees to short traders. When funding rates are positive and increase over time, it’s a strong indicator of a bullish market.