Here’s why staking 32 ETH isn’t an easy proposition

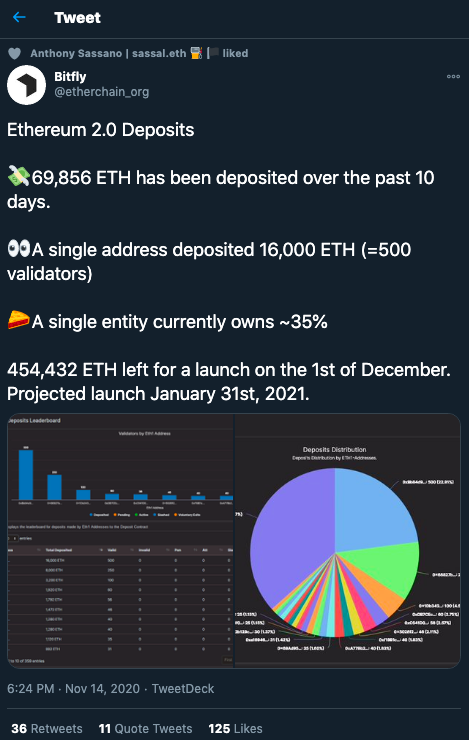

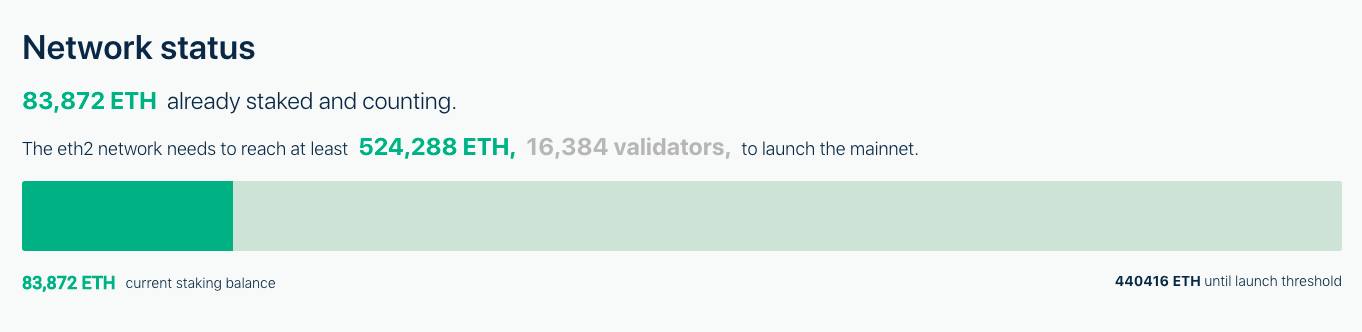

Running an ETH 2.0 validator node is a lucrative prospect, at least for ETH Maximalists. It takes 32 ETH to run one on your own. Naturally, since 32 ETH is a substantial amount, many have instead turned to pools. In fact, so far, 83,872 ETH have been staked. However, what’s interesting here is that a single entity controls approx. 35% of all the validator nodes.

Source: Twitter

Yesterday, on 14 November 2020, a single address deposited 16000 ETH. Whoever s/he is, they aren’t the only ones either as Ethereum’s Vitalik Buterin himself deposited $1.4M worth of ETH in the Phase 0 contract in the first week of November. This is interesting since the staking rewards are yields north of 20%.

ETH Network Status || Source: ETH Launchpad

However, stakers tackle the risks of having their ETH locked in for an indefinite period. To top that, there’s the risk that not performing their duties effectively would get them “slashed.” The risk is dual, despite the lucrative rewards involved here. To examine whether it is worth running a validator node, traders would look for accurate price trends and signals on ETH’s price and Open Interest charts.

Doing so would be a very useful cue since ETH’s price seems to be responding to the excitement of ETH 2.0’s launch, and the network and HODLers seem positive about the impact on the price. However, several issues still persist. Namely, if you do indeed decide to stake, you’d need a roadmap to tackle challenges like,

- The high initial stake, considering the volatility of ETH’s price over the past month

- There is an uncertain roadmap of staking rewards

- Moving from ETH to ETH 2.0 is relatively more complicated, even for validators

- The staking rewards may vary over time

And finally, there is an uptime to maintain. While Vitalik Vuterin did claim that 65% would be enough, that is still considerable uptime.

Apart from these issues, the fear that ETH 2.0 may be a Zombie Chain persists. With billions in market capitalization and as some claim ‘low utility,’ many ERC-20 projects have turned out to be zombies. Lack of tangible benefits may lead ETH 2.0 down the same road. In a very twisted sense, ETH 2.0 might become very similar to rival Tezos, a project dubbed a zombie chain by many in the Ethereum community.

In fact, while Buterin has been fairly complimentary about Tezos lately, commenting, “I hope Tezos does well. It has genuinely interesting and well-thought-out tech and governance philosophy, even if I don’t personally agree with some of the latter,” many in the community have called Tezos out for supposedly being a “Zombie Chain.”

Though there are real risks involved in the running infrastructure, ETH maximalists have no doubt about ETH 2.0’s performance on ETH’s prospective price rally post the launch of ETH 2.0. They’d run a validator node anyway, on their own, or pooled together. The question remains, is it worth the risk?