“DeFi can solve this” or is it too soon to tell?

Bitcoin took a 3% hit as OKEx announced the temporary suspension of crypto withdrawals on 16 October. Reports state that the exchange is being investigated by the Chinese police, however, the nature of this investigation is still not clear. This news definitely caused a wave of panic across the crypto market causing altcoins also to lose chunks of their values.

Ethereum, the second-largest crypto in the market noted a fall of 3.94% upon the news break, but later met with another selling pressure which pushed it price lower by 2.5%. However, Ethereum had a secret weapon in its arsenal in the form of decentralized finance, which helped it bounce back from the second crash and its current value was at $368.73.

DeFi or CeFi?

The market observers have been assessing the reach of the impact following this news. Even though most have been focusing on the crypto assets, others have shifted focus to decentralized finance [DeFi] and how it could be an alternative to such events in the plain sight.

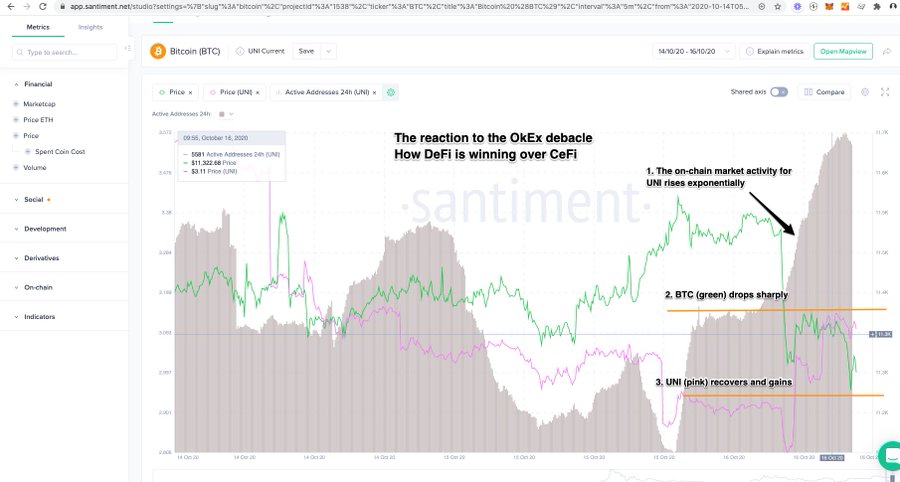

According to the founder of Santiment, Maksim Balashevich provided a chart that highlighted the DeFi performance over CeFi post the OKEx debacle.

Source: Twitter

Uniswap’s UNI token saw the traders entering its market as the news went public. The UNI token took a hit initially going with the market flow and ETH’s reaction, but the following hour saw a glorious recovery making its way through.

Source: UNIUSDT on TradingView

AS UNI exhibited a positive spike, many crypto users were stunned while others thought DeFi was a “safe haven against centralized exchanges.” Market analyzer @Akadosang tweeted:

“BREAKING: Cryptocurrency investors flock to $UNI as they realize it’s a safe haven against centralized exchanges. #DeFi has seen a surge of inflows with some DEXes surpassing Coinbase in volume.”

While @mrjasonchoi sated:

“”Hold on a minute, DeFi solves this right?” – thought process of the average market participant on $UNI past hour”

Source: Twitter

However, Bitcoiners and other crypto enthusiasts were quick to shut this narrative as “flawed logic.” The traders argued that the UNI price pumped to squeeze shorter, as it had dumped on the news breaking.

While others who argued in favor of decentralized exchange pumping to centralized exchanges suffering was also shut down by Udi Wertheimer recalling that:

“The defi markets are 100x easier to stop than the centralized exchanges.. but don’t let the facts other you”

The debate will carry on as the market tries to become more decentralized and the question of whether “DeFi solves this” may have to be tried and tested before jumping the gun.