Here’s why falling ETH inflows should concern DeFi traders

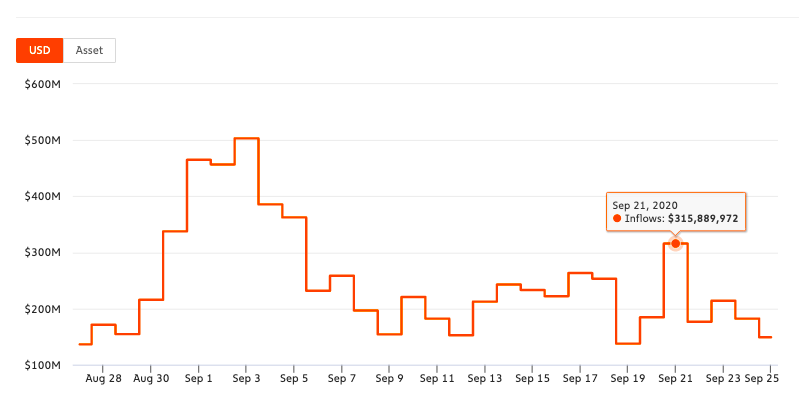

ETH inflows to exchanges have dropped by 53% in less than a week, a development that may sound alarming to DeFi traders. The inflows to exchanges dropped from $3.15M on 21 September 2020 to $1.48M, at the time of writing. While a drop in ETH held on exchanges may be perceived as a bearish signal, the price has dropped by less than 5% in the past 30 days.

Source: Chainalysis

Ethereum’s network has also been home to a lot of activity lately. In fact, the same can be attributed to the active participation of the market’s DeFi traders. While this adds to congestion and places a high demand on the network, it highlights the fact that Ethereum’s liquidity is crucial to DeFi.

In fact, liquidity is the backbone of DeFi’s entire ecosystem. The sustainability and growth of lending, and borrowing decentralized applications, margin trading, liquidity protocols, stablecoins, insurance, and derivatives depends on the flow of liquidity in different DeFi protocols.

This is the reason why several liquidity pools have emerged to contribute to this liquidity. However, the total liquidity in these decentralized pools remains small, especially when compared to trade volume on exchanges. Ergo, the volume of Ethereum being traded and held on exchanges has a direct impact on the price and TVL of several DeFi projects.

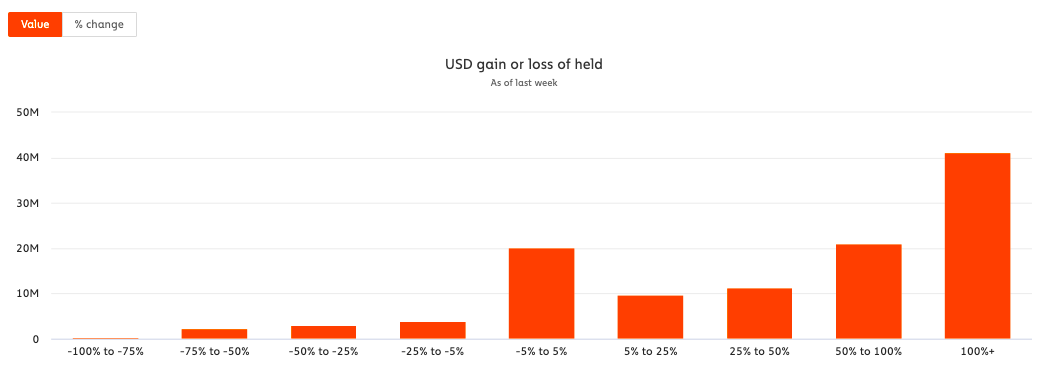

The drop in ETH liquidity may have a direct impact on ETH miners and traders invested in DeFi projects. Before DeFi’s growth, HODLers’ unrealized gains were affected by ETH’s price action. However, when fees on the ETH network hit new ATHs with increased DeFi activity, these unrealized gains only rose higher.

Source: Chainalysis

100% + unrealized gains have grown by 2.57M ETH in one week. DeFi’s growth is the sole reason for this gain as a drop in the volume of ETH held on exchanges would lead to the opposite.

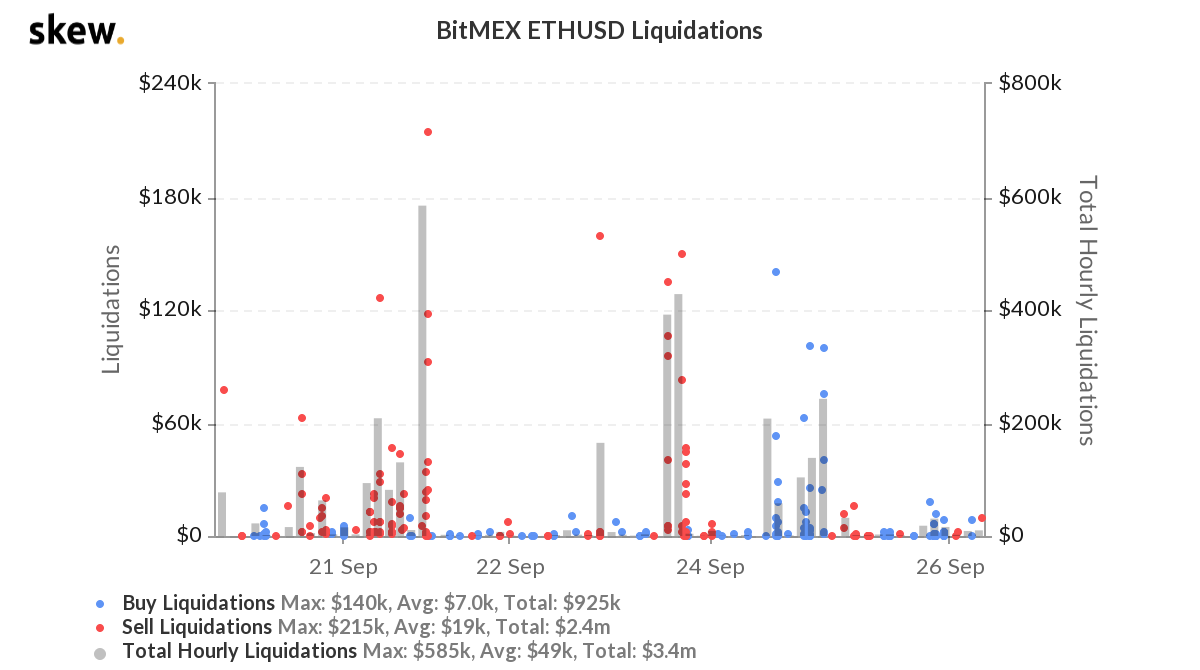

While the impact of the drop in ETH’s liquidity is not evident on spot exchanges yet, the same is visible on derivatives exchanges.

Source: Skew

On BitMEX, for instance, over the past week, short positions worth $2.4M were liquidated against $925k long positions. While traders on derivatives exchanges are betting on the bearish signal, a drop in the TVL of DeFi may be the necessary trigger for ETH’s price.

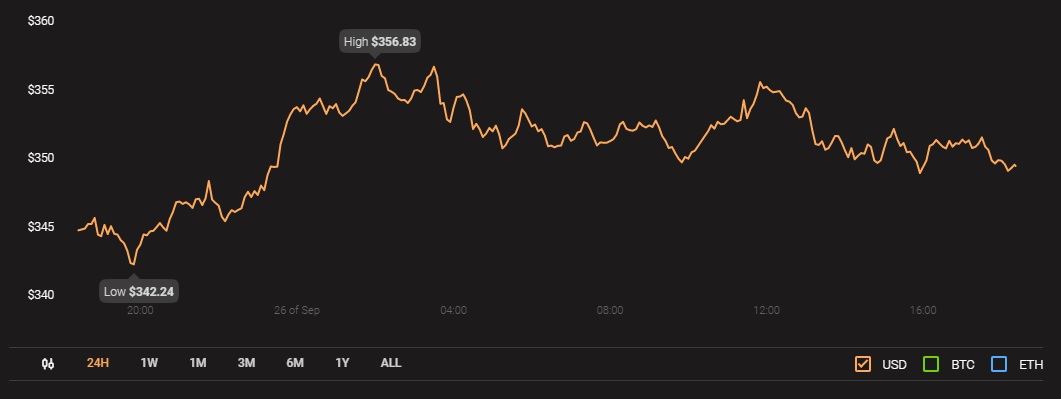

Source: Coinstats

This may also have a cascading effect on top DeFi projects and the anticipated bubble burst may follow as a result of dropping ETH inflows.

This may change if HODLers choose to book unrealized gains and flood exchanges with ETH. However, the impact may possibly be sudden and the aftermath prolonged.