Do Bitcoin futures exchanges live up to the hype?

BTC futures were first launched in December 2017, and their initial performance was contrary to the hype that surrounded it. Market expectations ranged from a sudden climb in BTC spot price to increase liquidity on spot exchanges. However, the two most popular Bitcoin futures exchanges – CME and CBOE faced two different fates.

Before CME’s BTC futures launch, the spot market price of Bitcoin was expected to reflect optimism. Just as it did, in the case of CBOE. Immediately after the launch event the price climbed up from $13400 and hit $15400. CBOE’s website went down as futures trading launched, but this was mainly because of a spike in interest. Within an hour of CME’s launch, Bitcoin’s spot price dropped 5%.

A week, a month and a year later

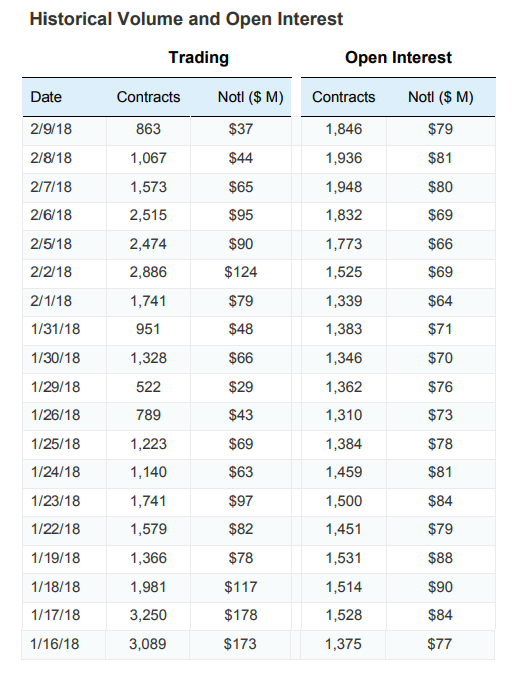

While day-one of the launch showed market fatigue, after a month upwards of 1500 contracts were exchanged daily in.

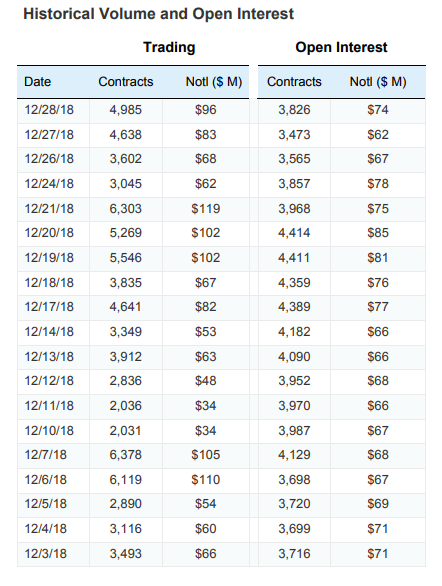

A year later, in December 2019 the average daily volume was upwards of 4500.

At the end of 2019, it crossed 5000. The point is, there is growth however it is slow. This could be attributed to the price limits on derivatives exchanges and the reference drawn from unregulated exchanges for the cash settlements.

To keep a check on volatility, CME’s contracts are priced at a premium above Bitcoin’s price. It is expected that this will minimize the adverse impact of price swings on the market, however, more often than not, they cut into traders’ profits. On CME, cash-settled Bitcoin futures contracts take the reference price for Bitcoin from unregulated markets. When Bitcoin price goes up on spot exchanges, derivatives traders are unable to benefit from it due to these limits. Additionally, unregulated Bitcoin exchanges provide a reference price for the asset.

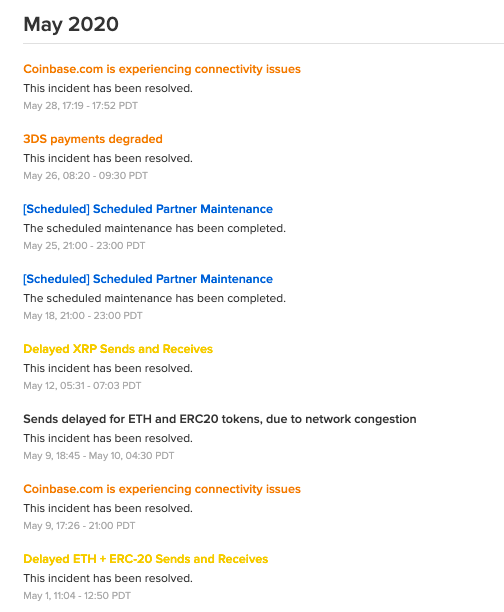

These exchanges are subjected to market manipulation. Several instances of wash trading have come to light. These exchanges announce their downtime and suffer frequent outages. This adds to the unreliability of spot exchange prices. In May 2020, Coinbase suffered a brief outage and the price of Bitcoin crashed 10%. This is not the first instance, as Coinbase had experienced a similar outage when bitcoin rallied 15% to $8900.

Despite such incidents, it is typical of Bitcoin Futures to cause hype on spot exchanges. Looking to turn a quick profit, many traders on spot exchanges resort to panic buying/ selling and cause sudden volatility in the price on unregulated exchanges. Futures are also popular for the optimism that brings new buyers to the market. If liquidity doesn’t match the demand, short-lived volatility, and price manipulation occur.

In the midst of uncertainty triggered by a drop in BTC futures volume on exchanges, Huobi Group’s crypto derivatives market – Huobi Future is launching BTC futures. The exchange will go live with BTC futures on September 1, 2020. Will the exchange live up to the hype surrounding it?