Cardano long-term price analysis: 30 August

Cardano’s descent has been quick and steep but the coin looks primed for a reversal. At press time, the coin needed to drop to immediate support before it can actually reverse the downtrend.

Dropping from the 8th rank, ADA had a market cap of 3.58 billion and had seen an 8.1% decline in the past week and a 1.5% surge in the last day. The drop in its rank is perhaps due to the quick surge of Polkadot.

ADA 4-hour chart

ADAUSD TradingView

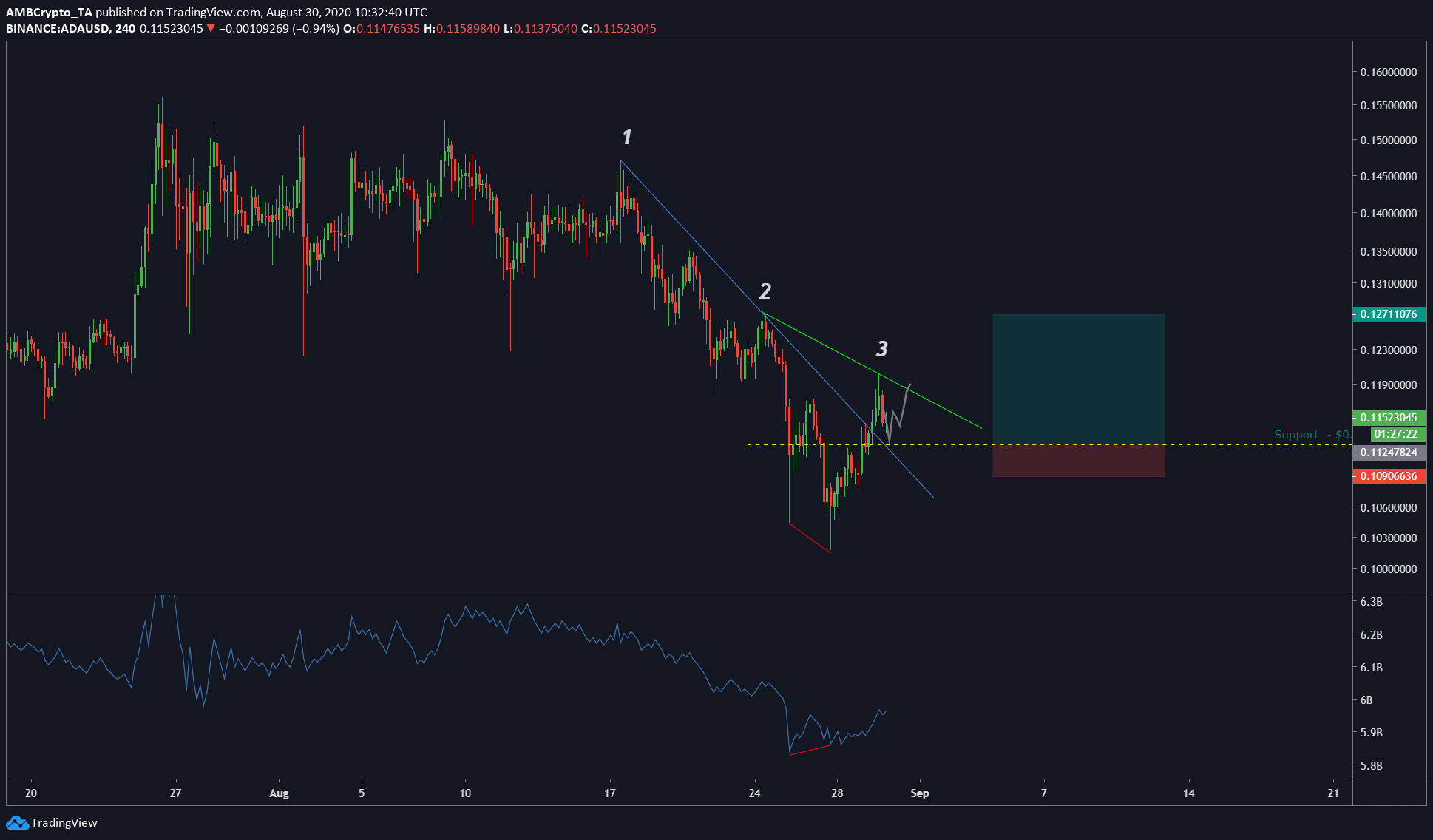

The Chuvashov fork can be seen on the downtrend with a fork emerging from the point “2” and connecting to “3”. The line between 2 and 3 [green] will decide if Cardano can actually reverse the trend. The initial efforts for this reversal can be seen as price developed a higher low while OBV [on-balance volume] printed a higher high. This bullish divergence initiated the reversal, however, the continuation of this reversal hinges on price breaking the 2-3 line.

Hence, the first thing to expect is the retracement from the fork to reach the downtrend line [blue]. If the price bounces from here and closes above the green line, then a reversal can be expected to happen in full-force. If not, another retracement can be expected.

Therefore, opening a long position from the support at $0.11238, [yellow dashed line] albeit risky, can be used to maximize profits. The entry can be at this support with a target at $0.12711 aka a 13% surge with a stop-loss at $0.1090.

All-in-all, the continuation of the downtrend seems less than likely for ADA, especially considering its sideways movement for over 40 days. With proper leverage and stop-loss, the profits can be more than doubled with the current set up for ADA.