XRP liquidity across ODL platforms may close at a lower index for the first time in 2020

Despite the value of XRP being restricted to $0.19, ODL platforms remained highly active in 2020. However, the indices that were reporting heightened liquidity by the end of every month in 2020, has been witnessing low liquidity in April.

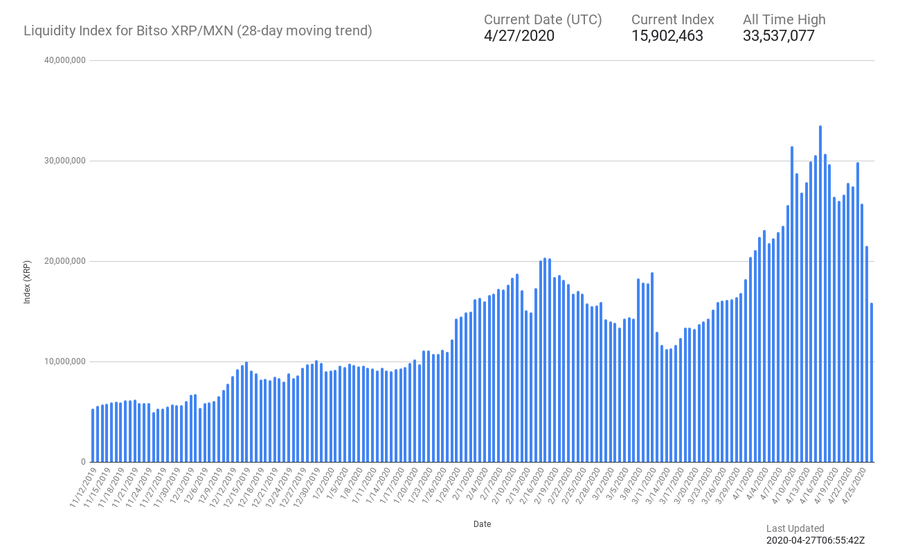

XRP/MXN

Source: Liquidity Index Bot

XRP/MXN has been the oldest active index among the three indices. It has been active since 2019 and kickstarted 2020 with 9.053 million liquidity. The index climbed to 14.902 million liquidity by January end. At the same time, the price of XRP was receiving support from the market as XRP was valued at $0.2387 as the month ended.

February saw a rush of bulls in the market carrying the third-largest coin to its 2020 peak at $0.3491, while March dragged the price of the crypto back down to $0.1000. Despite the volatility in the spot market, the liquidity on the ODL platforms remained active and closed higher, at the end of February and March. The XRP/MXN index marked ATH on 16 April 2020 at 33.537 Million in liquidity. In the following days, the liquidity dropped and as the month ends, it would be the first month that the liquidity was closing at a low.

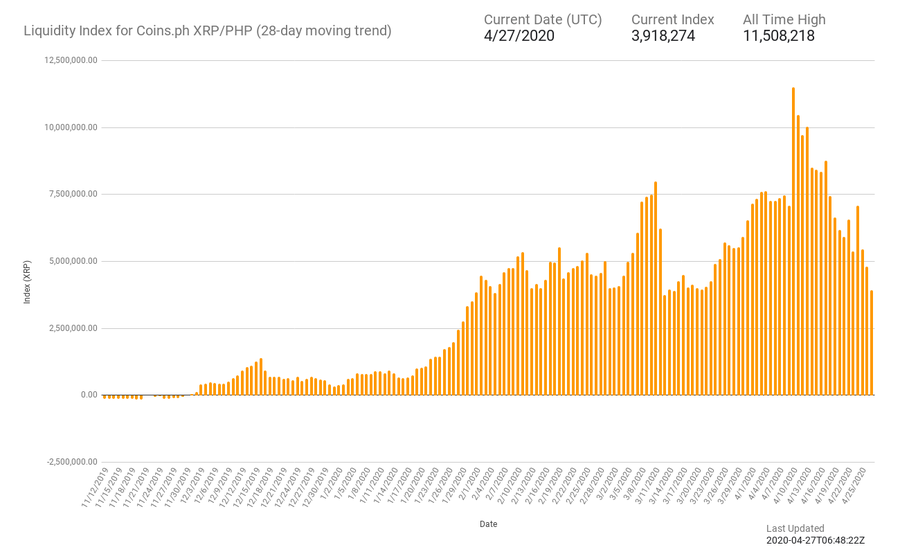

XRP/PHP

Source: Liquidity Index Bot

XRP/PHP had gained momentum in 2020, as it marked an ATH on 10 April at 11.508 million. This surge in liquidity on the corridor was reduced at once. The liquidity reported on the index on 1 April was 7.146 million, which was slashed to 4.793 million on 26 April.

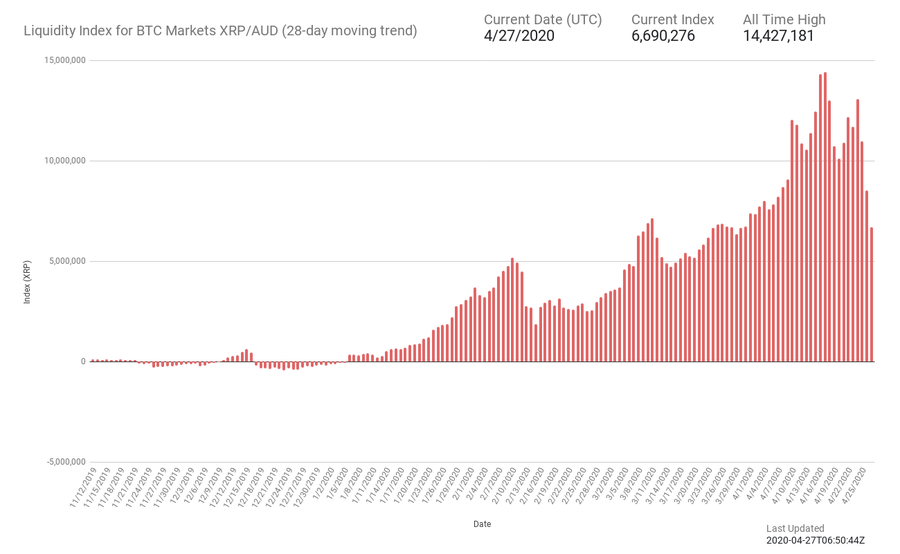

XRP/AUD

Source: Liquidity Index Bot

XRP/AUD has been the newly activated index, which saw a negative start to year market liquidity of -189,898. However, the extensive use on the index drove the liquidity on the platform as it ended January with 3.094 million liquidity. As the liquidity in the market touched a million, it continued to mark subsequent all-time highs. There was a consistent rise in the liquidity on the platform in April as it began the month with 7.380 million and marked an ATH on 17 April at 14.427 million.

However, like other indices, the liquidity has shrunk to 8.540 million on 26 April.

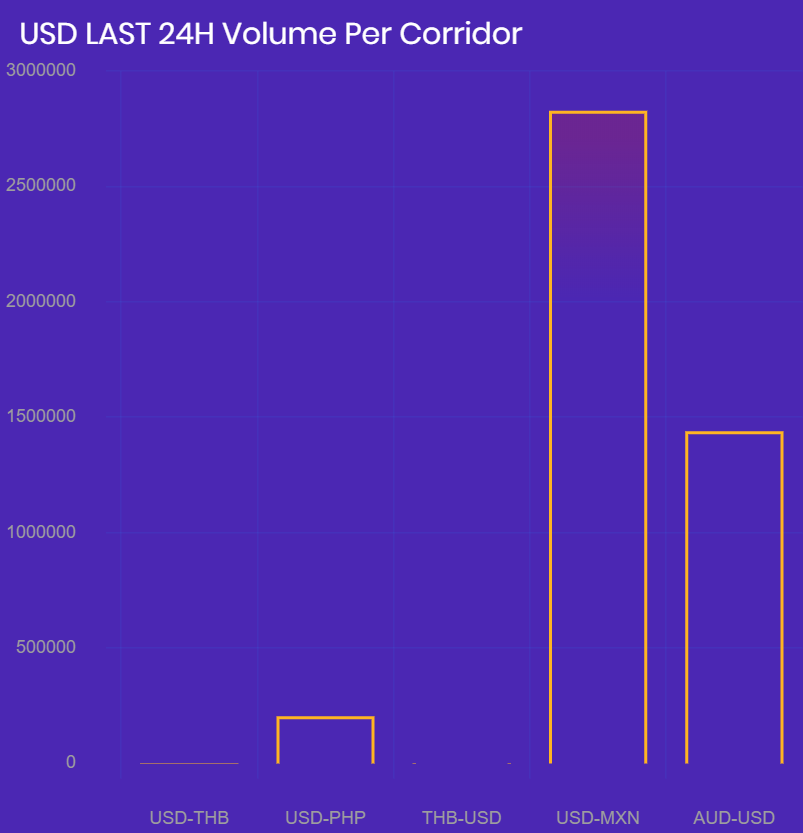

Volume across platforms

Source: Utility Scan

Meanwhile, USD/MXN has been the most liquid and active network, as it has been reporting a strong volume between the two countries on a daily basis. According to data provider, Utility Scan, USD-MXN corridor recorded $3.146 million. While the AUD-USD corridor surpassed USD-PHP for the second position as its daily volume was $1.570 million. USD-PHP did not reflect much activity on the ODL platform as the recorded daily volume was $304,221.