Bitcoin remains an investor favorite, but is its monetary view self-limiting?

Bitcoin continues to be a rising star among traditional and institutional investors as greater regulatory clarity and new investment products are introduced. The suspicion and mistrust initially associated with crypto seem to be finally fading away as Bitcoin today is considered a legitimate store of value asset, one rivaling traditional assets like gold.

However, despite the larger ecosystem’s developments, disparities remain. The best evidence of the same is Bitcoin continuing to maintain a significant lead over the second-largest cryptocurrency, Ethereum, when it comes to new investors.

On the latest episode of the Unchained podcast, Cathie Wood, CEO and CIO of ARK Invest, and Yassine Elmandjra, ARK’s Thematic Analyst, highlighted how Bitcoin continues to be the go-to asset for institutional investors, while also discussing intricate details between the networks of Bitcoin and Ethereum and their role in driving investor confidence and adoption rates. Wood pointed out the key reasoning behind portfolio allocations, arguing,

“The value in these ecosystems is going to be dominated by the currencies and Bitcoin being the reserve currency would be where I’d allocate most of our assets in this space. Although I could see over time, there are other currencies that evolve.”

Ethereum, the second-largest cryptocurrency, isn’t always in the spotlight in such use cases as it has chosen a different developmental route, in comparison to Bitcoin. Elmandjra highlighted this difference by classifying it as the divergence between “innovation maximalists and monetary maximalists.” He added,

“When you look at it from a kind of a money first mindset, then you start and kind of end with Bitcoin. In which case, kind of the investor focus is really around kind of that assurance theory of money and looking at this really from a monetary view.”

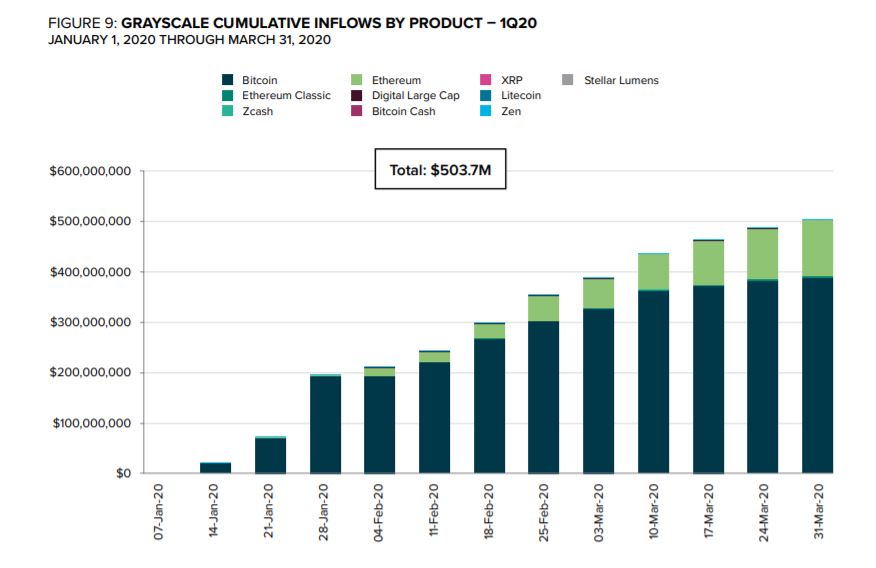

Interestingly, according to the Q1 2020 report released by Grayscale, Bitcoin is continuing to dominate crypto-investment portfolios, with Ethereum enjoying a really small share.

Source: Digital Asset Investment Report, Grayscale

It’s not all bad news, however, as product-wise cumulative inflow data from 2020 shows that Ethereum’s network upgrades and developmental work within its ecosystem are paying off.

Elmandjra also noted that for Bitcoin, even though it does have a reliable mechanism of transferring and verifying data transactions, the investors’ priorities ought to be around network scalability and “creating these expressive upgradeable base layer protocols with these large feature sets.”