Bitcoin’s Q1 lows fail to outshine its strong market fundamentals

The digital asset industry is such that it takes only one wrong move in the market for critics to react and shower the industry with their unsolicited opinions.

A similar scenario played out in the case of Bitcoin in 2020. The world’s largest digital asset rallied for 6-weeks straight before registering a correction on 14 February. After the pullback, the coin sustained another bullish run in the first week of March, following which the market went south, really south.

While many were writing off Bitcoin after the crash, it is not inaccurate to state that the situation was a little overblown.

Bitcoin’s fundamentals remain strong

Bitcoin’s crash on 12 March was admittedly horrible, but certain long-term fundamentals were not affected by it.

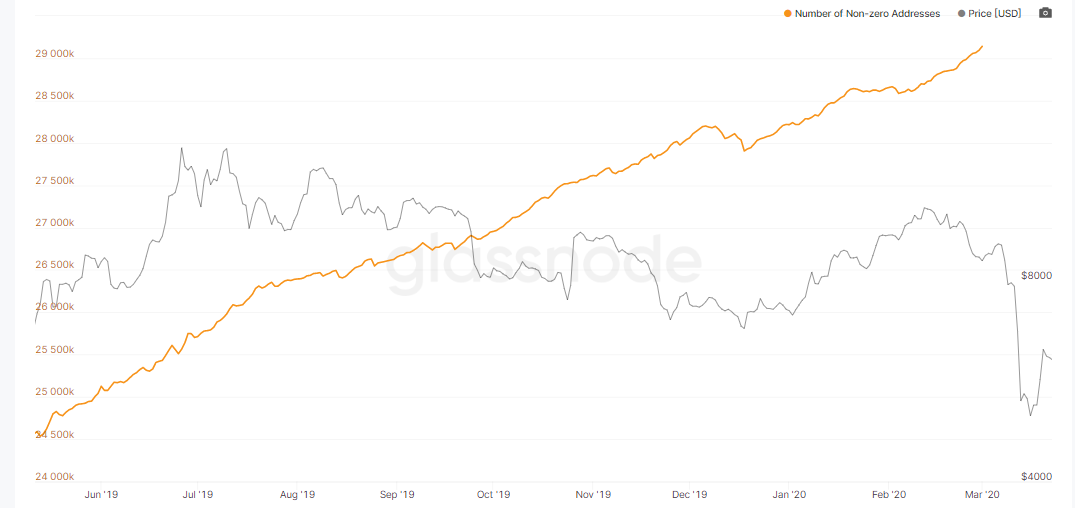

Source: Glassnode

According to Glassnode, the number of non-zero Bitcoin addresses has been on an incline since the turn of the year. During the end of December, the number of non-zero addresses was around 26.5 million and at the end of March, the number had surpassed the 30 million range.

The number of BTC addresses with 1 BTC also reached an all-time high of 795,630 on 14 march. The addresses were 795,200 at press time, but were relatively higher over the course of 2020.

Bitcoin’s average trading volume also continued to increase throughout the year and during the 3rd week of March, trading volume was as high as mid-2019. The consistently high trading volume suggested that BTC’s network had consistent activity, in spite of the price fall.

Difficulty adjustment and miners conundrum

Many speculated that miners would be most affected during this bearish turnaround as a third halving is only 6 weeks away.

Bitcoin’s network underwent a difficulty adjustment as well, but many failed to recognize the positive side of it. An adjustment of Bitcoin difficulty often takes the pressure off miners and establishes a sense of stability.

Such a reset of the system allows the mining industry to re-assess its production efficiency as the price consolidates and users turn their attention to the spot markets.

Previously, it had been reported that a majority of the miners would be affected if Bitcoin remained below the break-even price post-halving. Considering the break-even valuation is between $10k-$15k, a period of contango would take over the mining industry when acquiring BTC on the spot markets would be more efficient than mining.

Miners with weak hands would change their course to acquire Bitcoin, and network congestion won’t be an issue between strong miners.

Bitcoin may break the ‘financial crisis’ deadlock sooner than later

A state of chaos is evident in the traditional market as well, with various governments soon releasing their stimulus bills to combat economic adversity.

Bitcoin is already on a path to recovery and considering the current backwardation cycle in the traditional asset class, Bitcoin may break the bearish chains before the stocks or bonds market.

Historically, Bitcoin’s Q2 has been largely lucrative, but nothing is certain in the digital asset industry. However, it can be assumed that the lows of Q1 may not play a part since Bitcoin’s ecosystem already has a stable base for 2020.