Bitcoin Futures spreads on BitMEX, Binance now on a rise

The sudden fall in Bitcoin‘s price has resulted in various developments across its Futures market. While Bitcoin’s value has been on a decline for the past three days, the cumulative loss in its price has been worth at least 9% of its value. However, despite the bearish market, some of the Futures exchanges are reporting lower liquidity on their platforms.

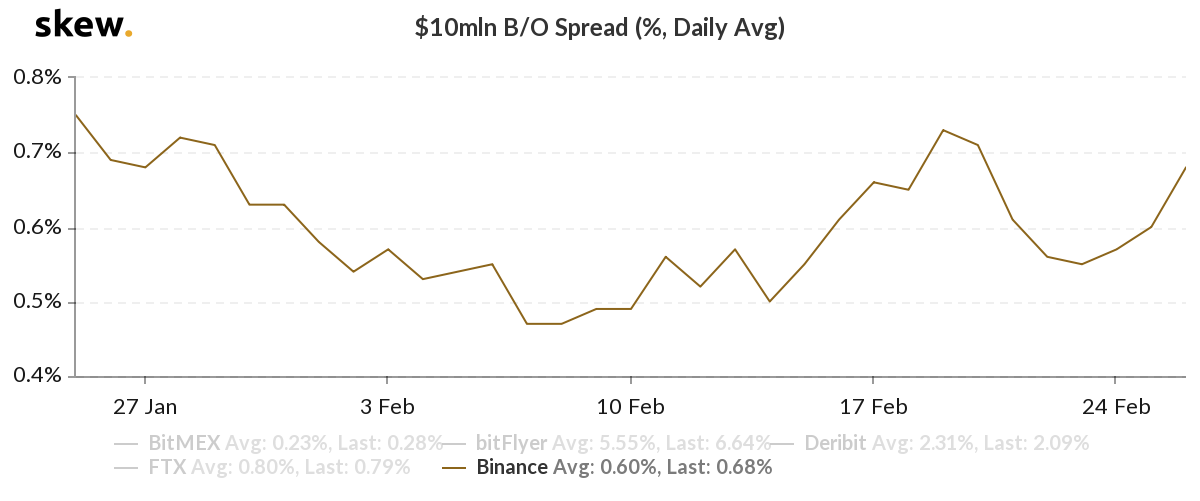

As per the data provided by the analytics firm, Skew, the $10 million daily average bid-ask spread on cryptocurrency exchanges like Binance and BitMEX has been noting a gradual rise. The “difference between the highest price that a buyer is willing to pay for an asset and the lowest price that a seller is willing to accept,” is the bid-ask spread, where the spread is the transaction cost.

Data also suggested that Binance was reporting a spread of 0.61% on 26 February.

Source: Skew

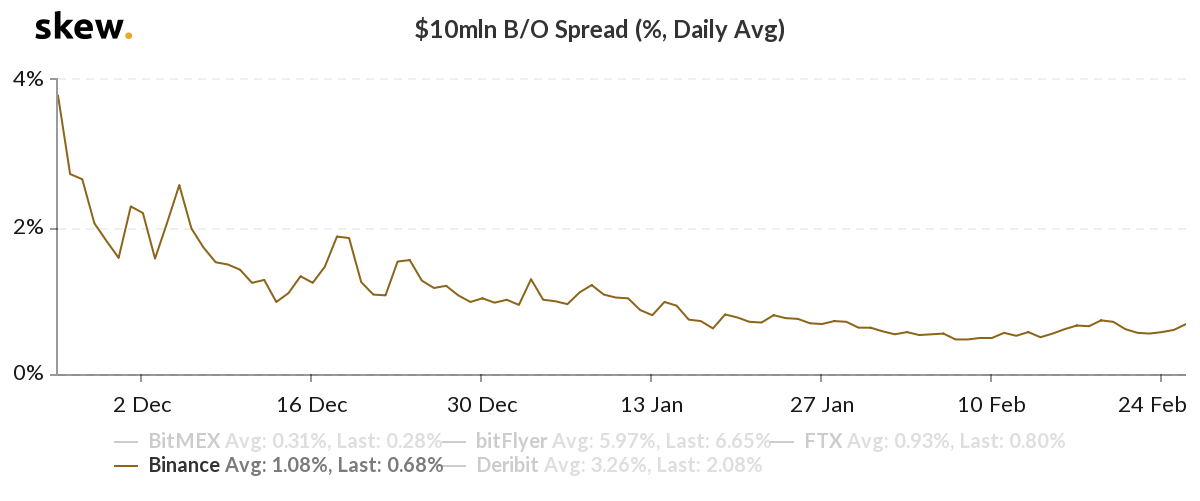

As the chart suggested, liquidity on the exchange, while high in November 2019 at 3.79%, soon noted a slight decrease, implying that the liquidity in the market has been catching up.

Source: Skew

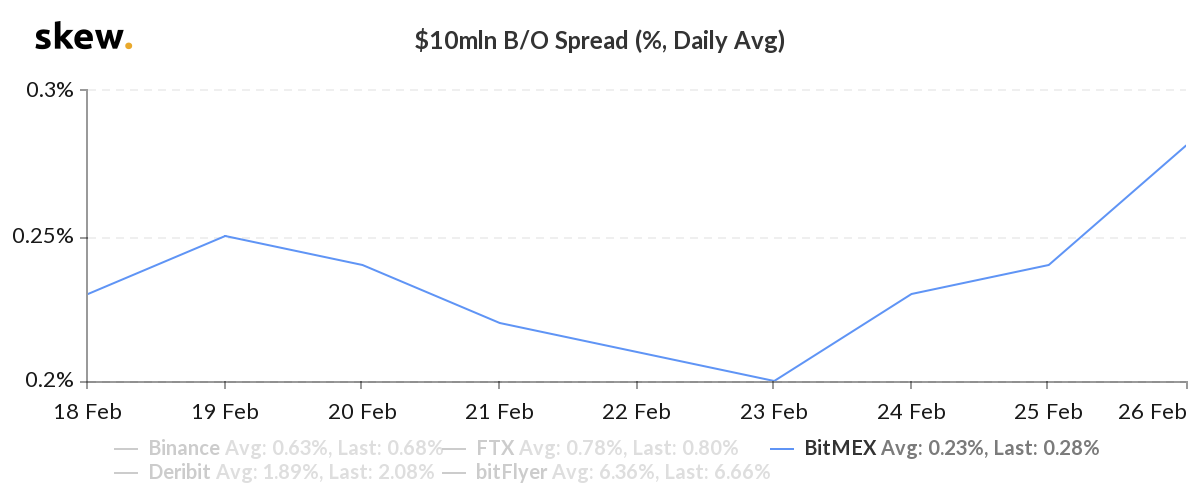

BitMEX, a prominent Bitcoin derivatives platform, also recorded a slight rise in its spread at 0.28% on 26 February. This implied that the liquidity on the exchange could be dropping a little because as the difference between the bid price and offer price increases, fewer and fewer traders are met with their demands. As indicated by the chart below, the spread saw a spike emerging on 23 February and it has been on the rise since.

Source: Skew

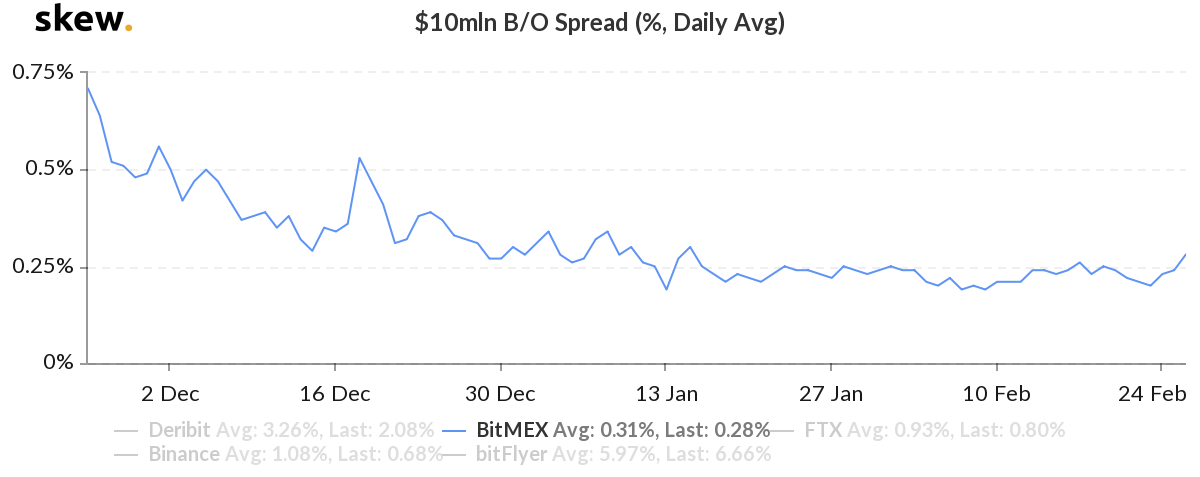

However, BitMEX also marked a similar trend as its spread was reported to be around 0.71% on 25 November 2019, which was still low, when compared to Binance.

Source: Skew

The spreads of Binance and BitMEX can still be considered to be lower when compared to other exchanges in the $10 million daily average bid-ask spread. The spread on bitFlyer was reported to be 7.88%, highest among all the other mentioned exchanges, implying it to be the most illiquid of the lot.