Bitcoin Futures’ Open Interest on Bakkt touches new ATH – again

Though this year has recorded some very positive price movements across the board, it still isn’t entirely clear how institutional investors have positioned themselves about Bitcoin. While volumes and volume profiles on derivative exchanges do provide a lot of information regarding how much trading is taking place, a far more insightful metric is its ‘Open Interest’. The OI represents the value of all outstanding contracts of a certain type on the exchange and provides a better context to how much capital is entering the space.

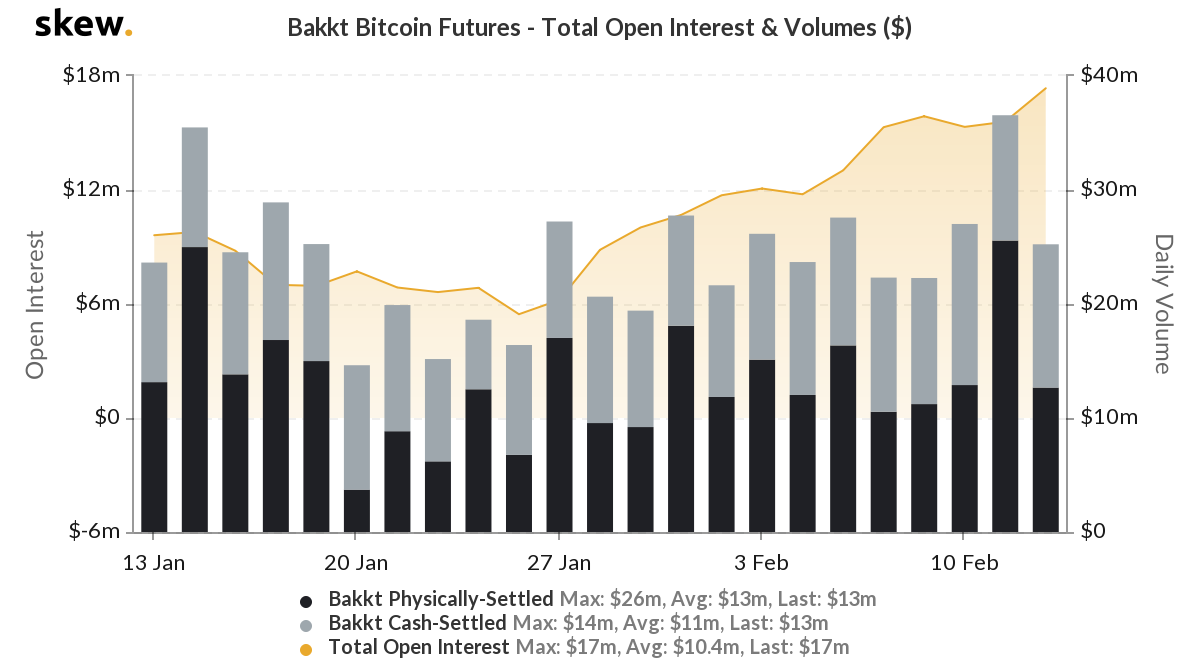

Source: Skew

According to data from crypto-derivatives analytics firm Skew, Open Interest on the Intercontinental Exchange-backed Bakkt exchange touched a new all-time high, $17 million, for their Bitcoin futures contracts yesterday. The last all-time high had been just a week earlier, with Open Interest on the contract reaching $13 million on 6 February.

This new record followed Bitcoin’s recent return above the $10,000 level in a two-hour-long 4% upward move. This may have reinvigorated institutional investors — the primary participants on the Bakkt exchange — facilitating the entry of more capital in the space.

Further, institutional investors are far more likely to trade derivatives as it allows them to invest without being directly exposed to the crypto-asset. It also enables them to hedge any bets they may have made on the spot market. With Open Interest increasing, not only are contracts being traded, but new positions are being opened.

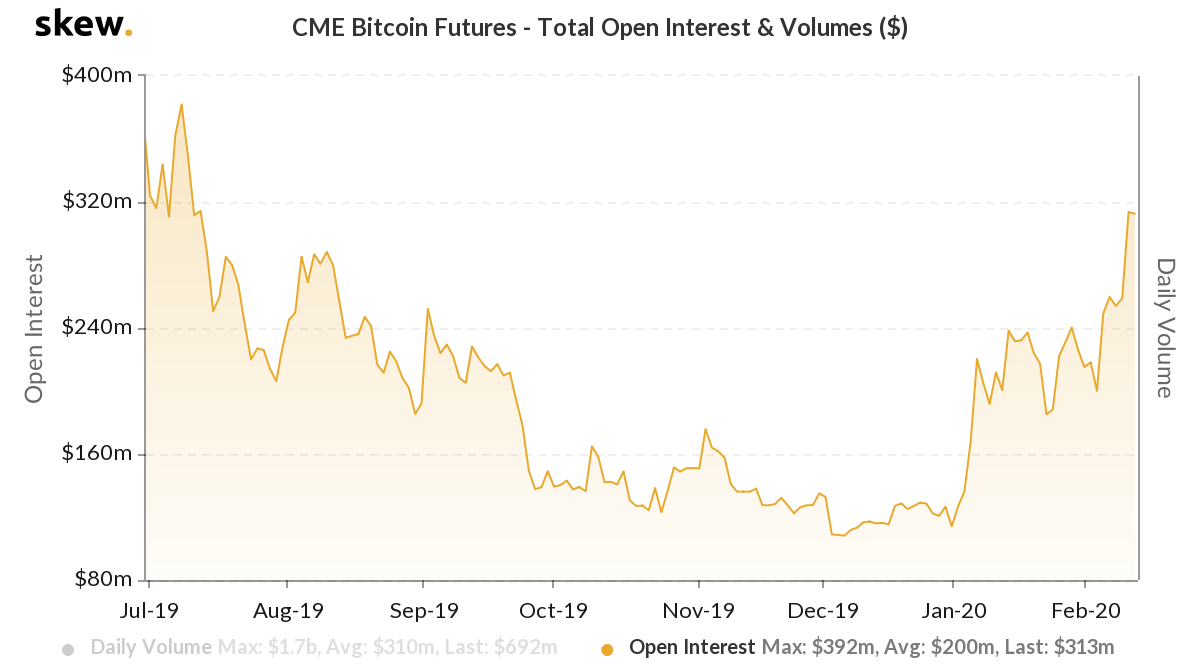

Source: Skew

Open Interest for Bitcoin Futures contracts on the Chicago Mercantile Exchange (CME) also touched a 7-month high, crossing $313 million for the first time since July 2019. While a rising OI isn’t a sure-shot sign of positive price action, it does signify more institutional confidence in the space and could facilitate greater price discovery as the contracts’ expiry date approaches this quarter, especially considering the lowering volatility of Bitcoin this year.