Bitcoin longs worth $56 million liquidated on BitMEX as market fills CME gap

Bitcoin recently surged past its crucial resistance at $9.9k and held on above $10k for some time. However, as sellers’ pressure increased, the coin could not hold on to $10k and its price slumped by 4.55% within a few hours. Bitcoin was valued at $10,195 before it experienced a downward force and was pulled back under the $9,731, causing a flurry of liquidation on BitMEX Bitcoin longs.

Source: BTC/USD on TradingView

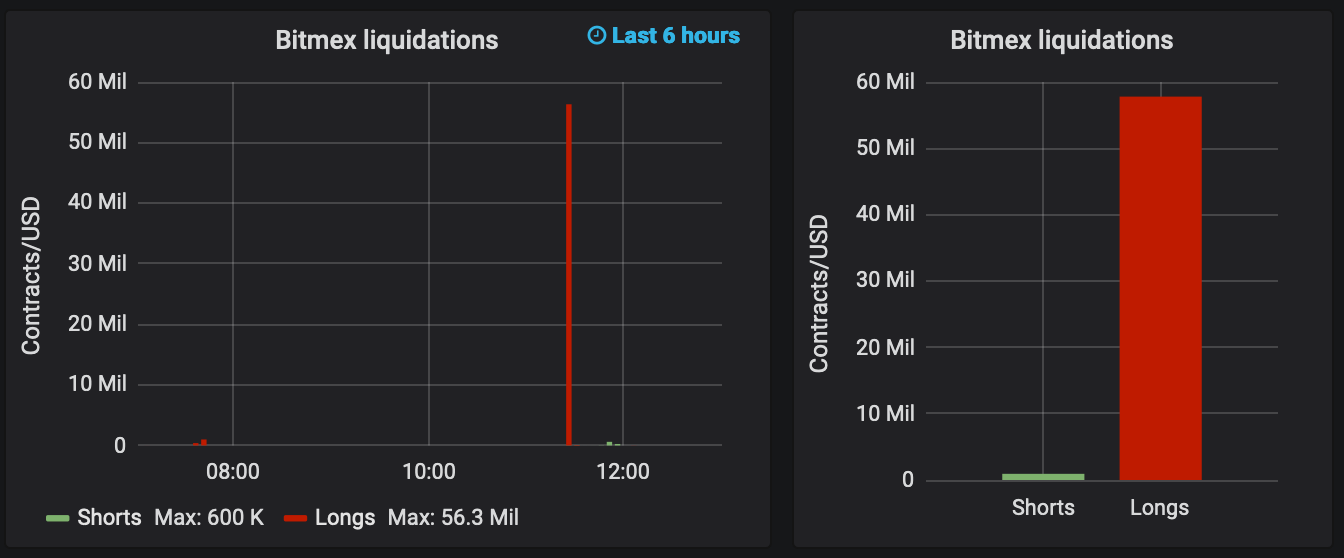

The hourly chart BTC/USD showed the price drop of bitcoin within four hours, following the liquidation of nearly $56 million of BTC longs on BitMEX.

Source: Datamish

According to data provided by Datamish, a total of $56.3 million longs were liquidated in the last 6 hours, with $600k worth short contracts expiring.

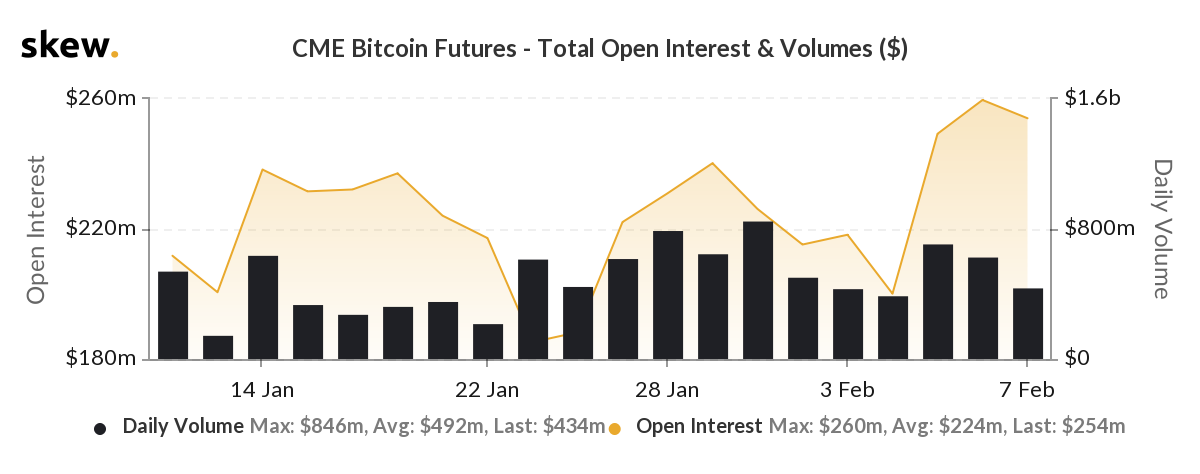

This decline in price also helped to fill a gap left at the end of trading on Friday on the CME futures. The Futures on CME group ended last week at $9,850 and on 10 February, the drop in price brought BTC back to the $9.8k range.

Source: Trading View

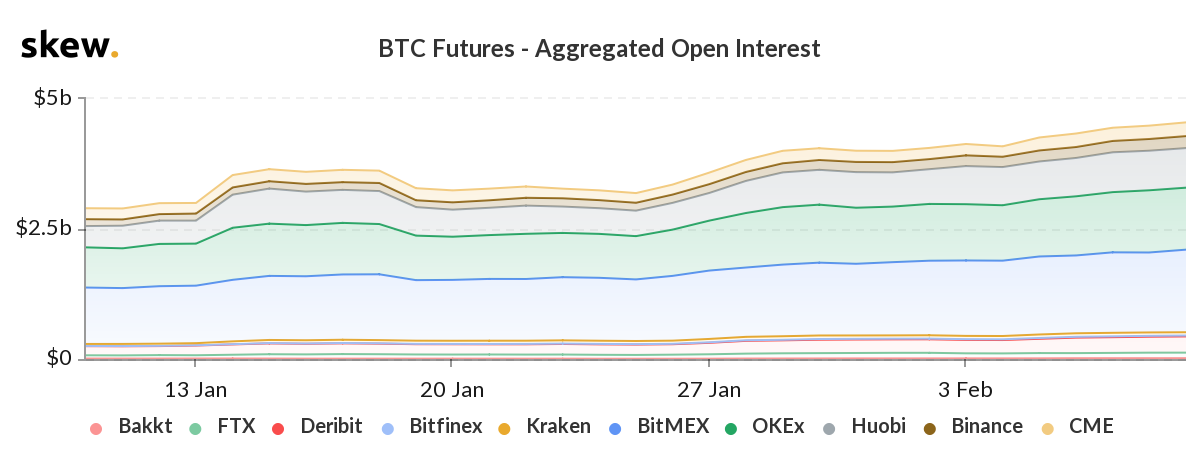

AMBCrypto had previously reported of Bitcoin Futures’ open interest climbing high. According to data provider Skew, Bitcoin Futures reflected an Open Interest of $4 billion with BitMEX and OKEx leading the charge. At press time, the aggregated open interest of Bitcoin futures was highest on BitMEX exchange noting a value of $1.6 billion and was closely followed by OKEx with $1.2 billion.

Source: Skew

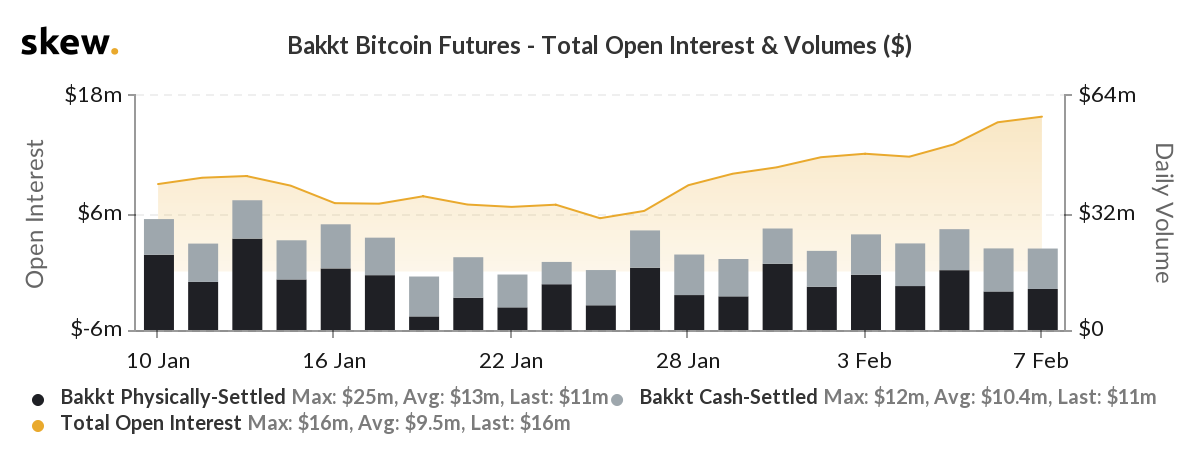

Whereas, the open interest for Bitcoin Futures on Bakkt reported an all-time high $16 million with volume hitting $22 million.

Source: Skew

Meanwhile, the open interest on CME was also rising in anticipation of future gains.

Source: Skew