Don’t believe the hype; Litecoin’s price may stay grounded for a while

Litecoin’s halving is just five days away. Litecoin’s mining reward will be effectively cut in half and each miner will receive 12.5 LTC to find a new block, from the current reward of 25 LTC. The final block reward halving will occur in 2140.

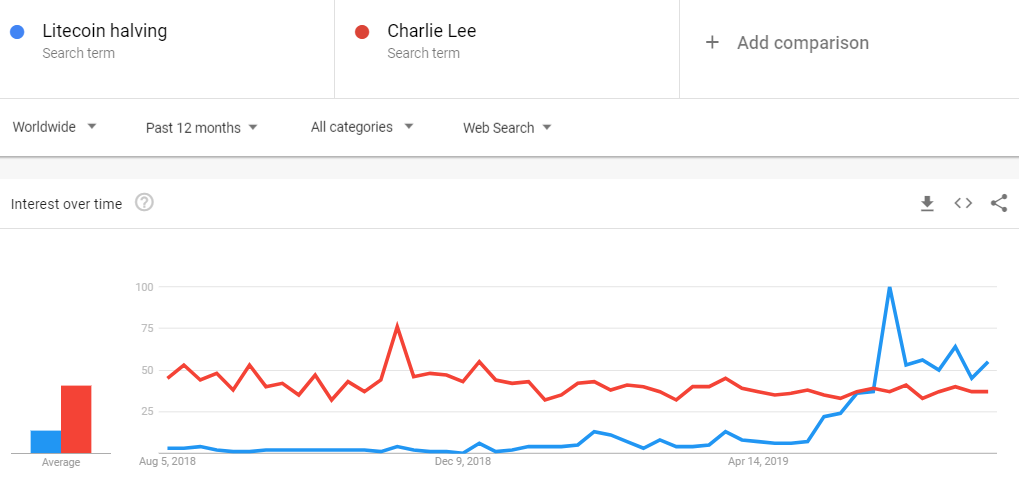

Halving remains a popular topic of discussion among cryptocurrency enthusiasts. If Google Trends data are taken into consideration, the term ‘Litecoin halving’ managed to garner more attention than the creator of Litecoin, ‘Charlie Lee.’ A hype that gained traction in mid-June was occasioned by the massive spike in Litecoin’s price, surpassing the coin’s $140 resistance.

Litecoin exited the crypto-winter well before the halving and as it draws closer, many speculations have cropped up regarding its possible divergence. Despite the fact that many in the crypto-community had predicted a bearish market for the silver coin after the recent market dip, LTC was up by 196.8% since the start of the year, surging from $30.46 to $90.42, at the time of writing.

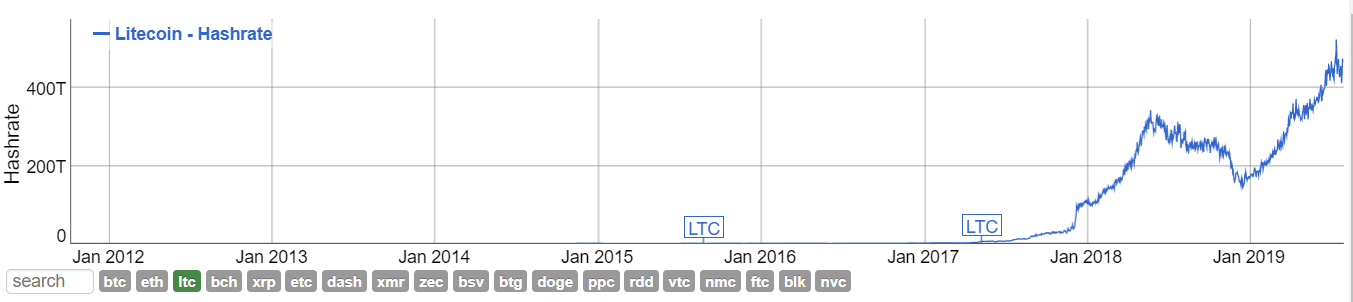

Cutting through all the noise, the increase in price was coincidentally met with an increase in hash rate, which peaked to reach an all-time high of 523.81T on 14 July, 2019. A growing hash rate showed impressive mining fundamentals as the halving neared and the community anticipated the subsequent decline in mining rewards.

Source: BitInfoChart

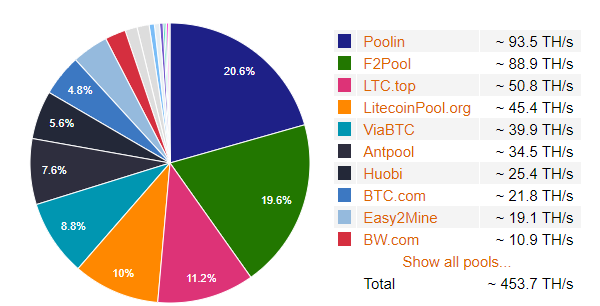

At press time, Poolin had contributed 91.7 TH/s, while F2Pool accounted for 86.3 TH/s of the total hash rate. This was followed by LTC.top and LitecoinPool.org contributing 50.8 TH/s and 45.4 TH/s, respectively.

Source: Hash Rate Distribution [last 21 hours]|litecoinpool.org

Bitcoin, Litecoin, and many other cryptocurrencies have very important sound money properties, which are scarcity and limited supply of the currency. Satoshi Nakamoto made sure this would be a factor that would allow his brainchild to flourish. Due to this particular property, the rise in price a year before the halving is seen in both Litecoin and Bitcoin.

Coupling the sound money properties with the sentiment of the people, especially miners, a rise in price makes a lot more sense. Humans are creatures of habit. Everything in this universe is mathematics; right from the basic building blocks of life, DNA, to the solar system and the galaxies. They all follow the fractals; fractals that repeat over a different time frame. The same can be seen in the price cycles of Litecoin and other cryptocurrencies.

Hence, it can be concluded that while Litecoin will not post any major rallies right after the halving, prices are bound to soar eventually as demand increases when supply decreases.