Three reasons why YFI couldn’t hold $30K

Yearn.Finance’s YFI token has been in the news a lot lately, mostly due to its parabolic movement on the price charts. In fact, within a month of YFI trading at just over $7,500, the token hiked exponentially to touch the $30,000-mark on the 2nd of December. However, while YFI did hold the level for just under 48 hours, the token didn’t hold it for long, with YFI valued at just over $28,900, at press time.

In some quarters, the fact that the token was unable to hold on to the aforementioned level came as a surprise. After all, YFI’s recent movement was spurred by a host of organic developments in its own ecosystem. For starters, such movement came on the back of Yearn.Finance announcing a host of mergers and partnerships with the likes of C.R.E.A.M, Pickle, Akropolis, PowerPool, and SushiSwap. Secondly, the $20M debt ceiling for YFI on Maker was also approved recently.

And yet, YFI fell. Not only that but when YFI did climb over $30k, there wasn’t any associated euphoria. This was an odd anomaly, especially since all the aforementioned projects were quick to climb on the charts when these developments were made public.

A recent report by Santiment suggested that a few signals were at play when YFI crossed $30k, signals that may have eventually pulled YFI’s value below the $30k-level.

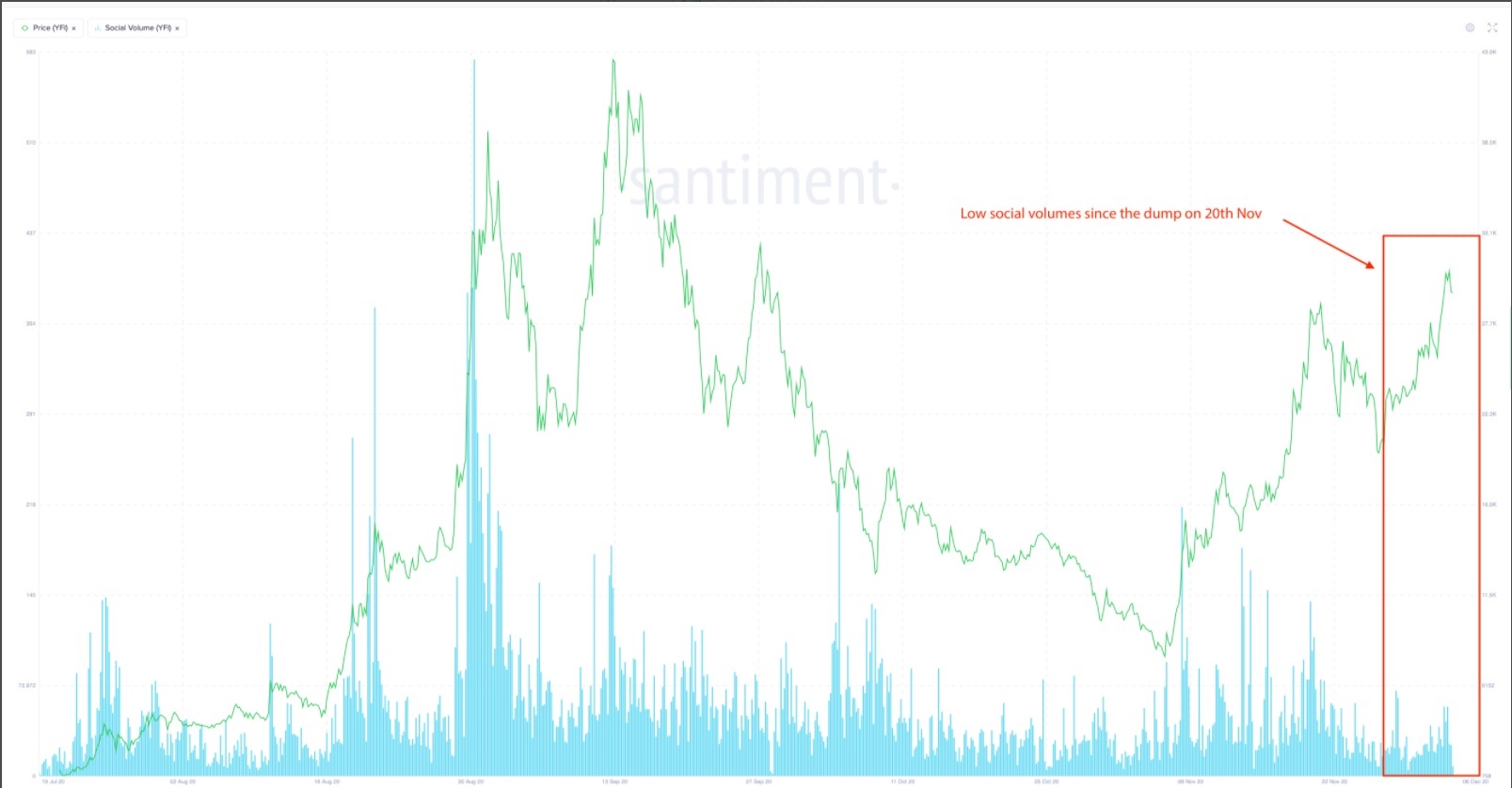

For starters, the Social Volumes associated with the latest hike weren’t as high as they were in the third week of November. According to Santiment, this was somewhat “surprising” since a little more excitement is usually the norm immediately before and after the breach of an important psychological level. However, it would seem that traders in the YFI market are being increasingly cautious, “leaving more room to move upwards.”

Secondly, Daily Active Deposits revealed that some are taking the opportunity to offload their YFI bags whenever the token climbs to a local top on the charts. YFI’s short-lived breach of $30k was one such local top. While the volume of these deposits over the past few days wasn’t as high it was in mid-November, it should be noted that the aforementioned period saw YFI falling dramatically on the charts, not consolidating right under $30k.

This was supported by the Coin Supply on Exchanges metric that continued to trend downwards. According to Santiment,

“Coin supply on exchanges is showing that there’s no major deposit so DAD likely represents smaller YFI holders that wouldn’t make much dent to the price (unlike what we saw in Nov 20).”

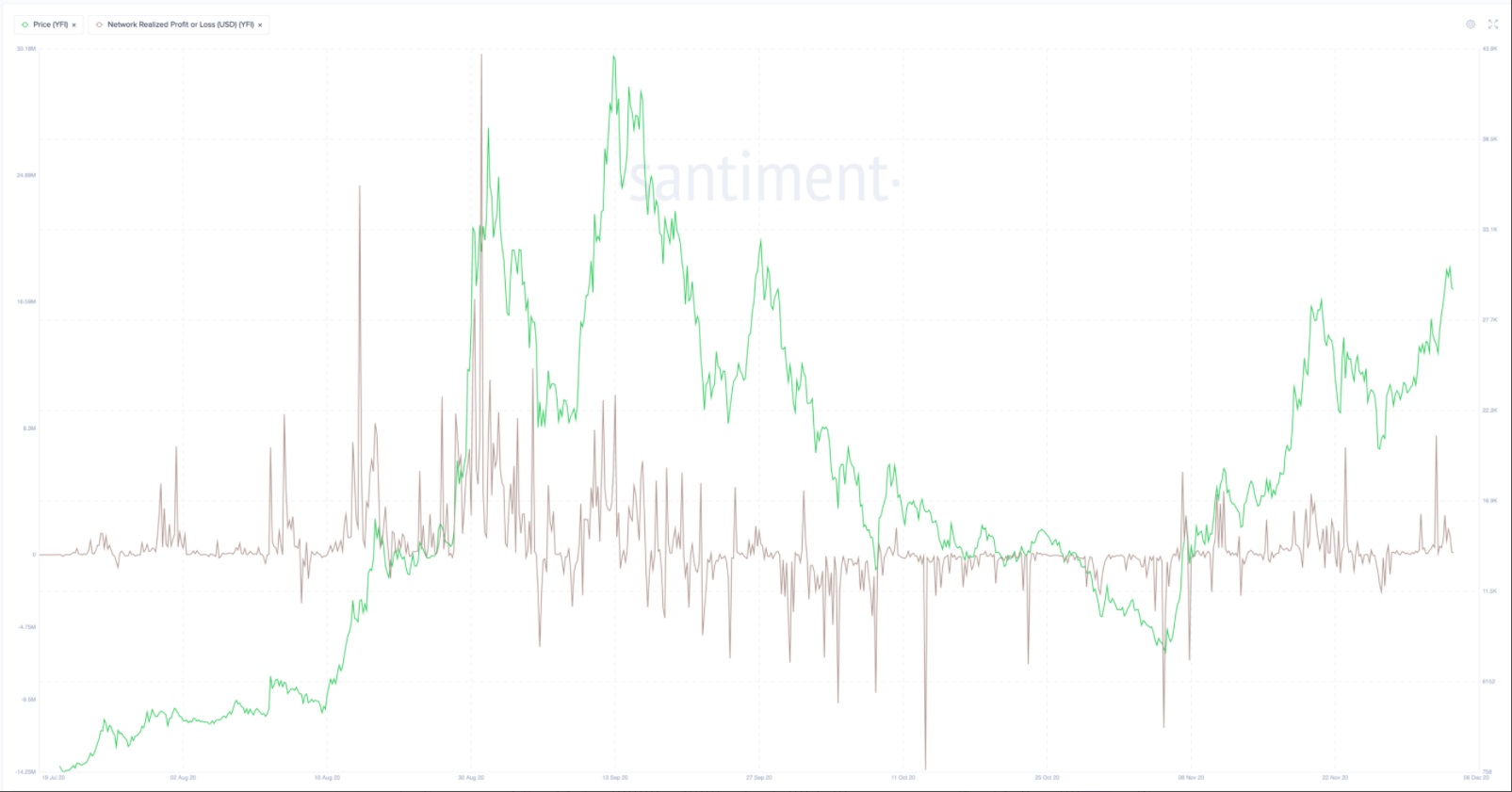

Finally, there was the matter of Network Proft/Loss. The said metric “computes the average profit or loss of all coins that change addresses daily.” According to Santiment,

“We continue to see profit-taking at each local top (as observed in DAD earlier), signaling a much more healthy rally.”

With YFI still trading just under $30k on the charts, it is unlikely that any of these signals will contribute to the token falling even more on the charts. In fact, it more or less looks like a healthy rally with corrections. However, these signals have stalled whatever momentum the token had until a few days ago.