Analysis

XRP’s 10% jump: A temporary bull run or a sign of growth?

The momentum and volume indicator of XRP on the 1-day chart showed signs of bearishness.

- The 1-week market structure was bullish but the 1-day chart was not.

- The Fibonacci golden pocket could see prices consolidate for a while.

Ripple [XRP] saw a 10.46% move higher in the past week, but the capital inflow was weak. The indicator signaled that these gains were temporary and bears were the dominant entity in the XRP market.

The rising market capitalization of XRP was encouraging for long-term holders. The on-chain metrics showed an increase in user activity that could drive demand upward.

The higher timeframe range was under no threat yet

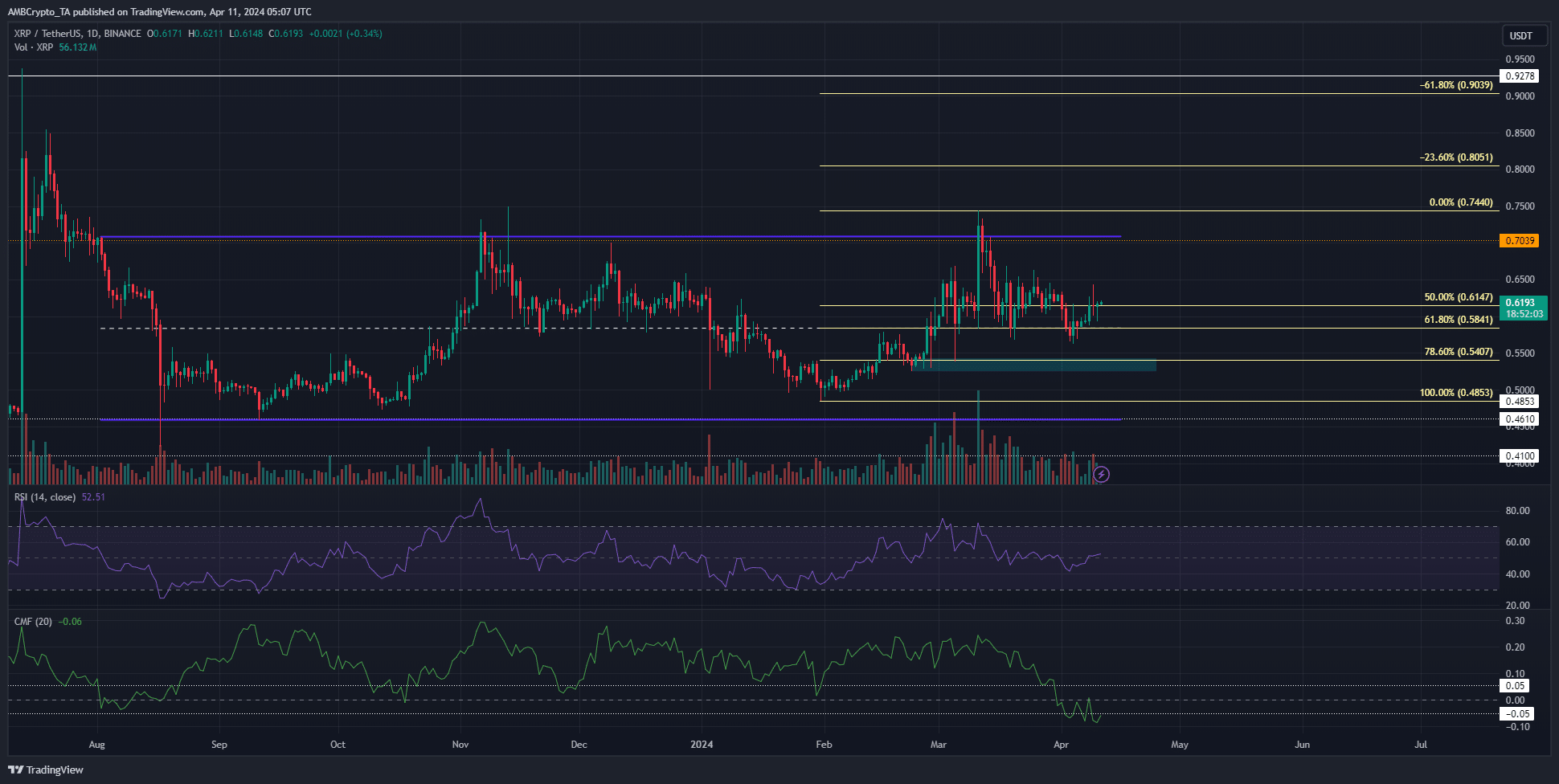

On the one-day timeframe, the market structure shifted bearishly when prices fell below the $0.568 level on the 3rd of April. In the week since, XRP has bounced just over 9% to reach $0.6193. Yet, the daily price action showed a bearish bias.

Therefore, it is possible that the downtrend could take XRP to the $0.54 level, which was also an area of demand from late February. This dip was more likely because the CMF has fallen below -0.05. This means significant capital is leaving the market and highlighted selling pressure.

The RSI was hovering near the neutral 50 mark. It was at 52.5 at press time but that does not mean much by itself. A drop below the 45 mark would be an early sign of strengthening bearish pressure.

Sentiment was weak and market conviction was low

Source: Coinalyze

The spot CVD has steadily declined for a month now. The spot market participants have been selling XRP and this trend has not slowed down. The funding rates were positive but very close to the zero mark, indicating neutrality.

Read Ripple’s [XRP] Price Prediction 2024-25

The Open Interest climbed higher over the past week as prices rallied from $0.568. However, it did not show strong bullish belief.

Speculators preferred to remain sidelined, sensing a lack of price trend behind XRP.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.