XRP, Ripple ODL’s popularity in Australia triggers double-digit growth for BTC Markets

The world of remittances blew right open to adopt unique, technologically-driven solutions like the one provided by Ripple. Ripple’s on-demand liquidity [ODL] platform connected various remittance-heavy nations to serve as a cheap and swift alternative to facilitate remittances. According to Caroline Bowler, CEO of Australia-based BTCMarkets, there is a growing interest in the country about the platform and the world’s third-largest digital asset, XRP.

Bowler, in a recent interview, provided insights into the Australian ODL market. BTCMarket, one of the oldest crypto-exchanges in the country, became a RippleNet member just recently, with the platform facilitating remittances across the U.S and the Philippines. According to Bowler, the exchange has been noting 5% in growth week-over-week.

“…what we’re seeing with ODL, just to give you this as context, I think we’re averaging about a 5% week-over-week growth since January in terms of volume coming through our exchange on XRP.”

This is an interesting development since this corresponds with the high volumes across the Australian corridor. According to Utility Scan, the volume on the AUD-USD corridor has been high. On 21 May, the corridor was reporting a 24-hour volume of $3.946 million. This growth was driven by ODL traffic and people’s inclination towards XRP. The exchange also noted high traffic in the month of April.

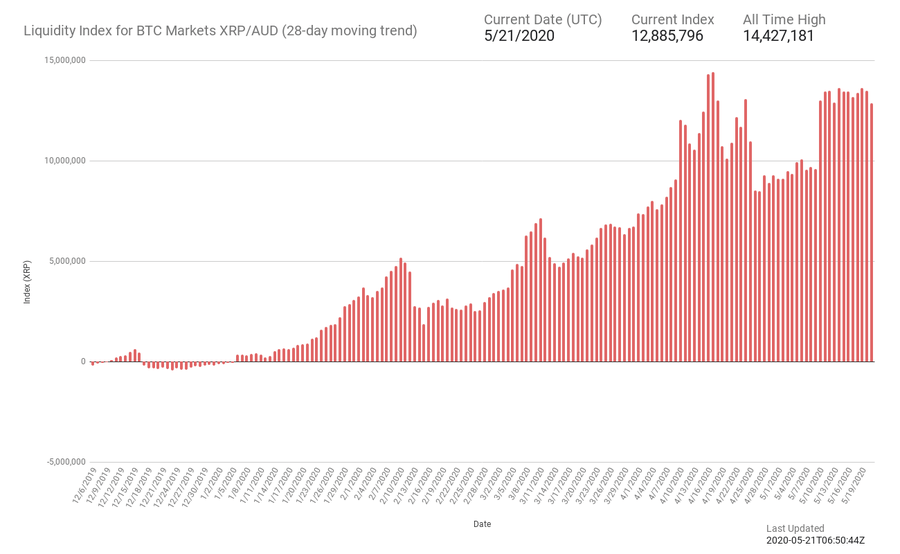

The Liquidity Index Bot, which provides data about the liquidity across different OLD indices, charted great liquidity in April on the XRP-AUD index.

Source: Liquidity Index Bot

The index recorded an all-time high [ATH] in terms of liquidity on 17 April, with 14.427 million, and recently, has been noting liquidity of at least 13 million. Bowler noted that the exchange has been averaging “84% growth since January.”

Bowler added that from a price-point perspective, the exchange also noted a 15% increase in volume since January 2020. She claimed that the volume had an impact on the price.

“…and it’s a positive relationship.”

Even though the past few years have seen increasing use of technology and crypto-education among the masses, Australian users might take some more time to adopt crypto. Quoting a survey from the Reserve Bank of Australia, Bowler claimed that 80% of Australians have heard of Bitcoin, but only 1% hold BTC. Despite the trading being limited to 4%, the CEO believes that in the coming ten years, BTC shall be a part of investors’ portfolio.