Analysis

XRP price prediction: Technicals favor buyers, but can patience pay off?

Traders can bid at $1.9-$2 but need to exit the trade upon a drop below $1.73

- XRP traded within a short-term range

- A drop below $2 was possible in the coming days, especially if BTC fell below $92.7k

Ripple [XRP] has flashed an overvalued signal with a high NVT ratio, but the technical findings supported a move higher in the coming weeks. This could change if Bitcoin [BTC] experienced volatility.

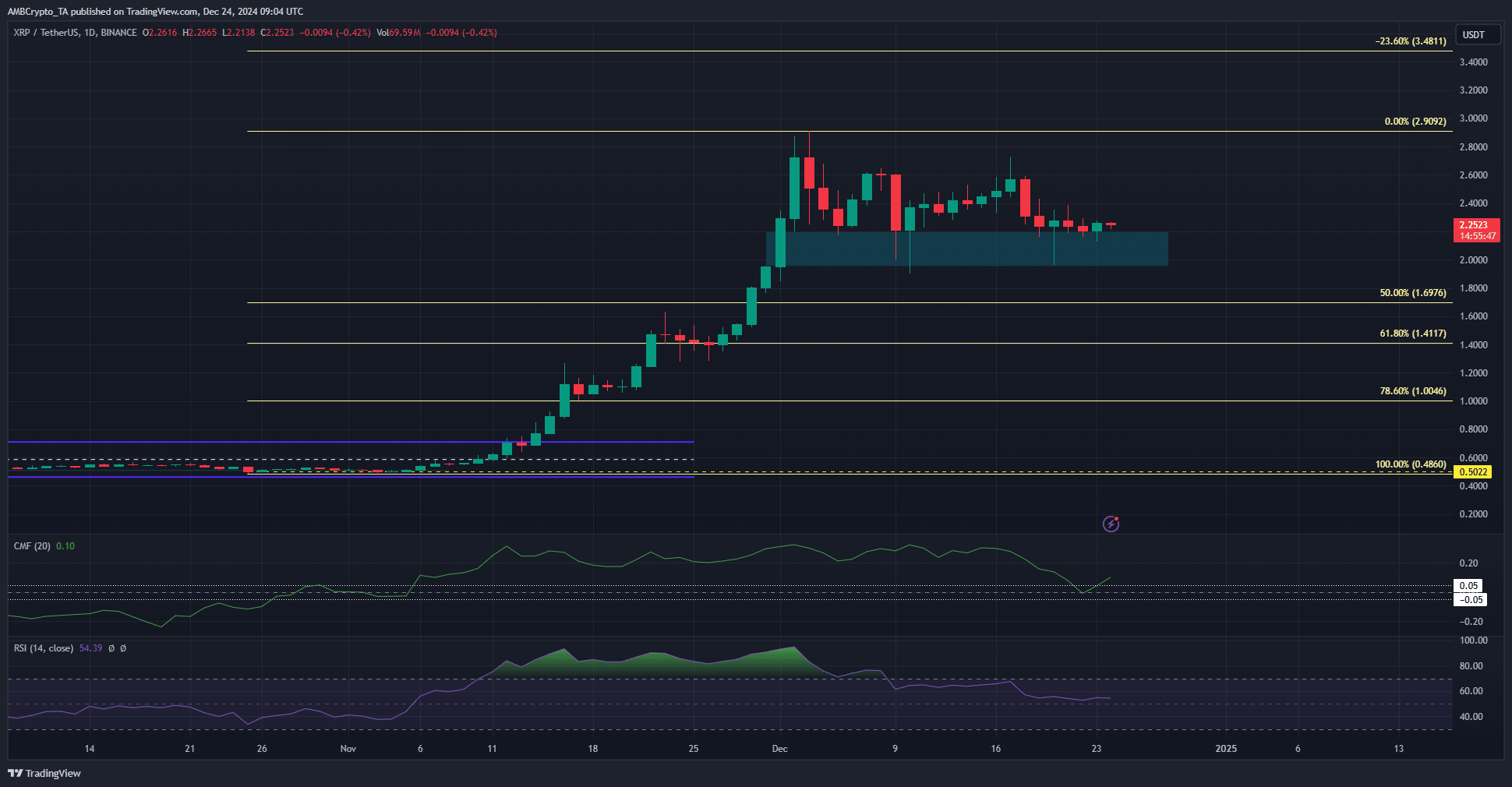

XRP has traded between a range that extended from $2.17 to $2.72. The range lows were tested once again on Monday, but XRP has bounced nearly 5% since then.

XRP price prediction- deeper retracement or recovery, which would be first?

XRP bulls have valiantly defended the fair value gap from early December, but momentum has been falling. Selling pressure increased, though it did not dominate. This was reflected in the CMF’s downtrend in December, but it has risen above +0.05 in recent days.

This indicates significant capital inflows, giving buyers an advantage. The RSI is at 54, showing neutral momentum but a bullish bias on the daily timeframe.

The Fibonacci levels plotted based on the Q3 2024 XRP rally show that the 50% level at $1.69 has not been tested yet. Generally, strong rallies are followed by a deep retracement to the 61.8% or 78.6% levels.

Therefore, even though XRP appears to recover from the $2 demand zone, long-term investors might want to wait for a price drop to $1.7 or $1.4 before buying.

Next targets are at $1.82 or $2.76

These are the levels that the 1-month liquidation heatmap highlighted. The $1.82 region is closer to current market prices, but a Bitcoin recovery could give XRP bulls a reason to continue bidding.

A surge in positive sentiment across the market could push XRP toward $2.76.

Source: Coinalyze

In the short-term, the spot demand was down, but the Open Interest(OI) has climbed slightly over the past two days.

By itself, the OI rise was not a good signal for incoming gains. Yet, the spot CVD was a fairly reliable warning of a lack of demand.

Read Ripple’s [XRP] Price Prediction 2024-25

This contradicts the CMF findings, but they are based on different timeframes. Currently, evidence points toward a higher price move. Traders can bid at $1.9-$2 but should exit if it drops below $1.73.

Investors with a long-term perspective can wait for a deeper retracement or a breakout past $2.72.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion