XRP

XRP Futures Open Interest plunges 37% – Is an altcoin exodus underway?

XRP’s Futures market cools as traders cash out. Can strong fundamentals prevent a deeper correction?

- XRP’s Futures market is seeing a sharp decline in activity as traders close positions and signal profit-taking

- With speculation cooling off, can strong fundamentals prevent a deeper correction?

XRP has hit a rough patch, with the altcoin stuck around $2.50 on the price charts – Down 26% from its yearly high.

Profit-taking is sweeping through both Spot and Futures markets, with Open Interest plummeting by 37%. As momentum fades, is XRP heading for a dramatic drop back to $0.20?

Decoding the current market mood

Amid the uncertainty surrounding Trump’s heavy levy play, Bitcoin’s dominance remains impressive, staying well above 60%. This highlights its resilience, but also points to the struggle altcoins face in attracting capital.

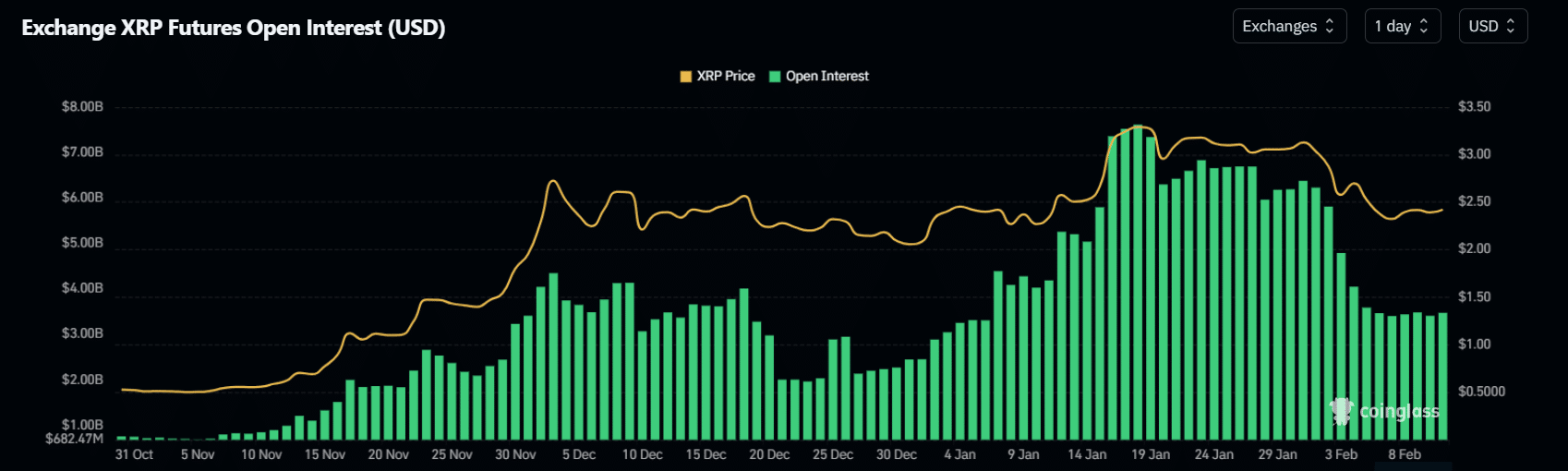

XRP’s Futures data tells the tale – Open Interest has fallen by 37% in less than 30 days. In fact, it has dropped from its peak of $7.86 billion when XRP hit $3.40.

De-risking is clearly underway, with traders cashing out, cutting down on high-leverage positions, and walking away with hefty profits.

With less speculative capital flowing into XRP’s Futures, it’s no wonder its price has been stuck in a tight range around $2.50, making any big swings hard to come by.

Now, XRP finds itself at a crossroads, with potential to move either up or down. However, given the internal and external pressures, could this 37% drop signal the start of a mass exodus? Especially as Bitcoin’s dominance continues to squeeze the altcoin market?

XRP Futures puts traders in a dilemma

Amid external volatility, consolidation can often signal a bullish breakout once the market rebounds.

But with XRP Futures traders locking in profits, can the altcoin’s fundamentals spark a strong recovery? XRP whales have been making moves, with significant exchange flows aligning with a 10% dip to $2.30.

AMBCrypto recently pointed out that XRP’s rise past $3 was largely fueled by big players stacking up. Alas, with XRP now down 26%, following a broader market crash, the question arises – Are these whales now shifting to distribution?

Realistic or not, here’s XRP market cap in BTC’s terms

With HODLing losing its charm, traders are quickly pulling back. Over $8 million in long positions vanished in just 24 hours, adding fuel to the uncertainty.

If the trend continues, we could see more capitulation from XRP Futures traders, pushing the Open Interest even lower. While a $3 rebound seems distant, if this momentum holds, $2.20 may become the next key support level.