Analysis

XRP, EOS, and DigiByte’s positive returns undercut by declining market trend

Over the past 24-hours, many of the market’s major altcoins have registered significant gains. Alas, a larger change in trend was yet to be observed, at the time of writing. While XRP, EOS, and DigiByte collectively noted a period of growth, the market’s bears continued to sustain a strong grip on the market.

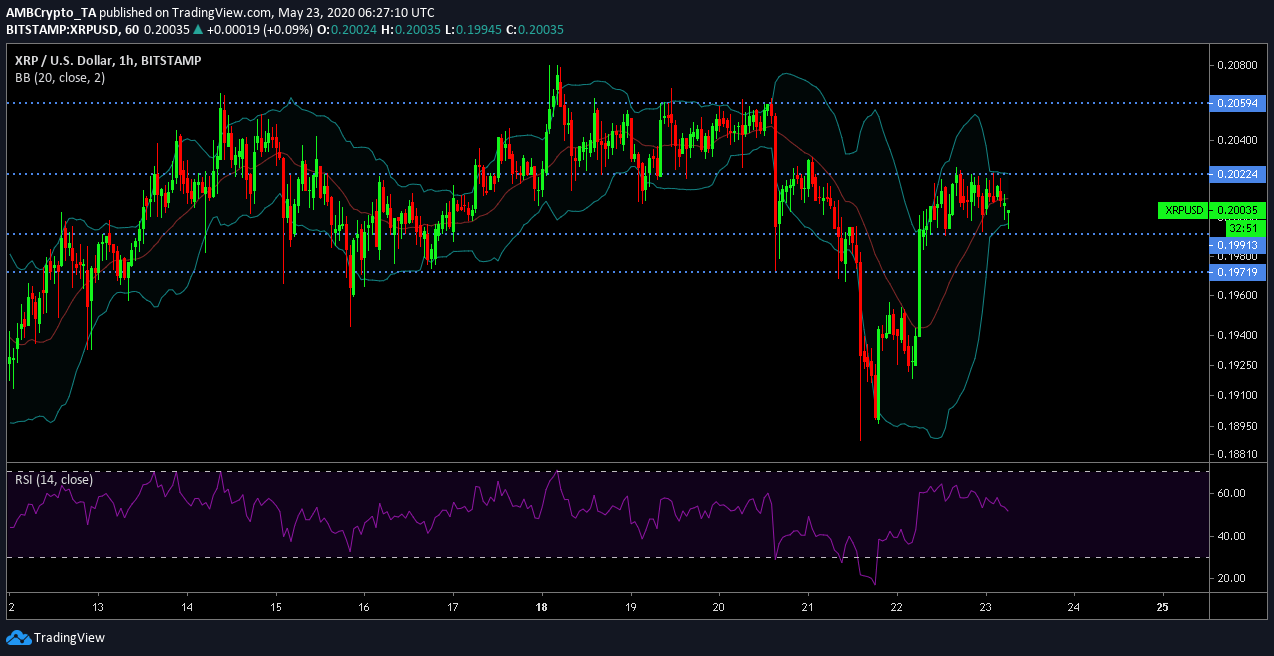

XRP

Source: XRP/USD on TradingView

A hike of 2 percent on the charts continued to help XRP maintain its position above the support at $0.199. With a market cap of $8.83 billion, its 24-hour trading volume of $1.77 billion continued to suggest an average activity. However, market indicators suggested a period of reduced volatility as the Bollinger Bands were converging on the charts.

The Relative Strength Index or RSI also registered a decline, indicative of the fact that selling pressure was on the rise.

Data from the XRPL Monitor suggested that Ripple carried forward 94.3 million XRP over the past 24-hours. 10 million, 23.3 million, and 10.24 million XRP were sent to the crypto-service BitGo and South Korea’s Bithumb exchange. However, 50 million XRP were also sent from Ripple’s Financing Wallet to an anonymous address.

EOS

Source: EOS/USD on Trading View

EOS has had a decent run lately, with the crypto recording a 4.35 percent hike, while maintaining its position at a higher range. The market cap of the token remained around $2.4 billion, backed by a high trading volume of $2.42 billion.

The Bollinger Bands suggested that a period of volatility might remain active in the near-term as the bands remained parallel to each other. Further, the Chaikin Money Flow or CMF implied that capital inflows dominated capital outflows, at the moment.

According to an announcement last Friday, Block.One, the company controlling 100 million EOS tokens, just under 10% of the current total supply, revealed the guidelines that would be used to decide which block producer (BP) candidates to support and vote for. Out of the three requirements, numbers two and three were, the BP candidates’ node has to be running version 2 or higher EOS software and has to be independently operating as a publicly queryable node.

DigiByte [DGB]

Source: DGB/USD on TradingView

Finally, 37th ranked DigiByte registered the most profitable returns over a 24-hour period with a hike of 7.53 percent. However, the overall trend remained significantly bearish. According to the Parabolic SAR, the bearish trend loomed large as the dotted markers were observed to be well over the price candles.

Further, the MACD implied a similar sentiment as the signal line hovered over the MACD line on the charts. The token had a market cap of $240 million, backed by a trading volume of $28 million, at the time of writing.