What is driving Wrapped Bitcoin’s growth this year?

2020 has turned out to be quite a year for the DeFi space. DeFi’s rapid growth over the course of the year saw it cross the $12 billion-mark in terms of total value locked, with the same bullishness positively impacting popular Bitcoin (BTC) tokenization protocol – Wrapped BTC (WBTC).

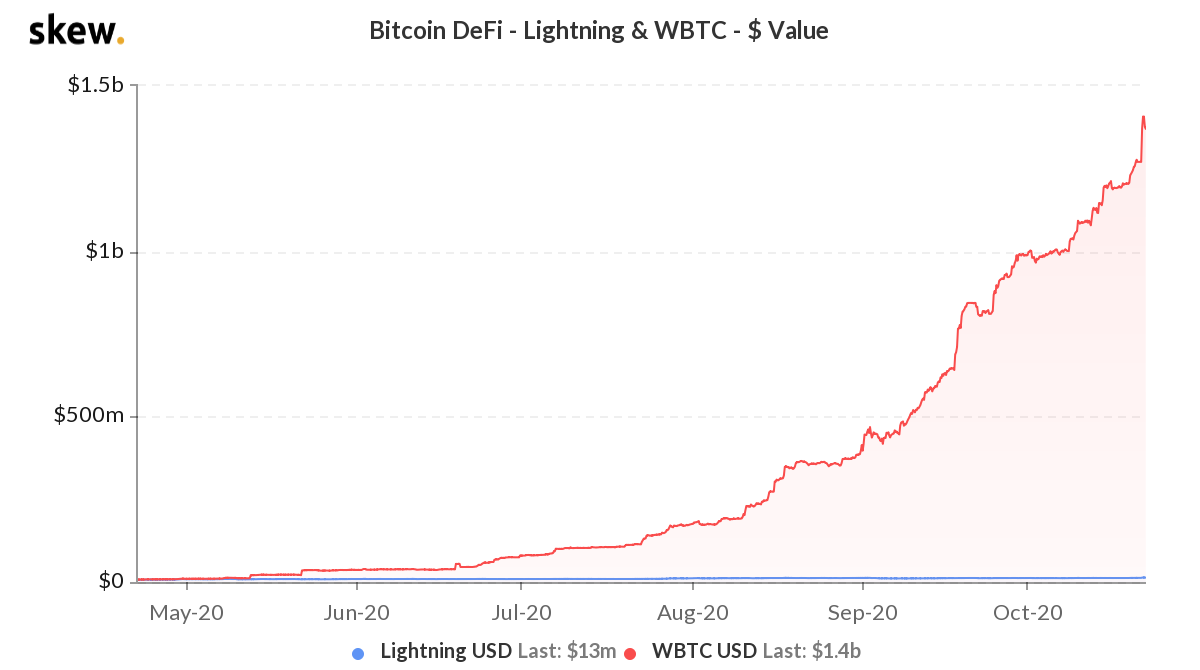

WBTC, the ERC-20 token on the Ethereum blockchain, was launched in January 2019 and at press time, as per data provided by Skew, had a market cap that was close to $1.5 billion. That’s not all, however, as WBTC also noted a staggering increase of 27,834% Year-to-Date.

A recent report published by LongHash highlighted the growth of WBTC in 2020, underlining the fact that at the start of the year, its market cap was around just $4 million. The report noted that as of 13 October, WBTC accounted for nearly 15% of the aggregated market cap of all DeFi tokens on Ethereum, while also elaborating on a few key reasons that could have contributed to this surge.

Elaborating on the demand for Bitcoin and the explosive growth of DeFi, the report argued,

“The demand for wBTC primarily comes from its compatibility with DeFi protocols on Ethereum. Since Bitcoin cannot be directly sent to the Ethereum blockchain, Bitcoin users have to convert BTC to wBTC to gain access to DeFi services running on Ethereum.”

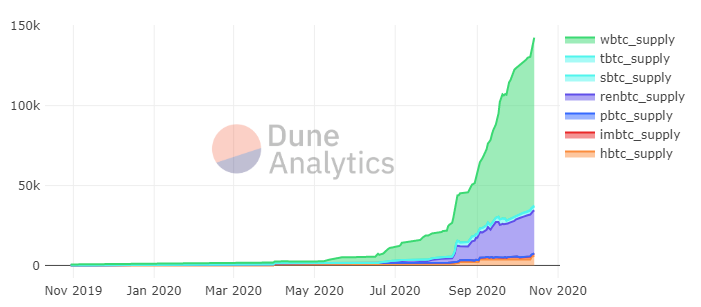

For Bitcoin and the cryptocurrency market in general, one of the key defining features of 2020 has been the rise in institutional interest over the past few months. The report highlighted a few of the key reasons behind WBTC’s popularity when it comes to tokenized forms of Bitcoin and Ethereum that can be used by DeFi.

“Three factors are likely behind the dominance of wBTC over other tokenized crypto assets. First, wBTC has long been the top tokenized Bitcoin, and it thus has a strong network effect. Second, top exchanges have started to support wBTC. Third, it is widely used across decentralized exchanges.”

While the DeFi hype may have come to a slight standstill at the moment, Longhash’s report suggested that the fact that WBTC is supported by many exchanges, while being increasingly used on decentralized exchanges, and the overall growth of DeFi, have all created the right environment for the token to dominate. It read,

“The confluence of the support from major exchanges, the overall growth of DeFi, the rising usage on decentralized exchanges, and its network effect are all likely behind wBTC’s dominance in the tokenized crypto asset space.”