Worldcoin jumps 25% amid rumors of Altman’s return to OpenAI

- WLD tapped a new high, increasing by 25% in 24 hours.

- The Worldcoin network has become overheated, indicating a likely drawdown for the token.

Things have turned around for Worldcoin [WLD] since reports emerged that OpenAI was mulling a possible return for Sam Altman. As a result, WLD exchanged hands at $2.57 after the price increased by 25.23%. But at press time, the price had slightly reduced to $2.40.

However, the jump may not be surprising to AMBCrypto analysts. This is because, in the last article published, where Altman’s firing was mentioned, we predicted that WLD may rally off the bottom. But the intriguing part is that it came to a bit sooner than expected.

Sentiment changes as OpenAI calls Sam

The discussion surrounding Altman’s potential return was because the staff and investors of OpenAI were not satisfied with the board’s initial decision. In a number of posts, many of these employees have shown public support for Altman.

For instance, Altman, who co-founded Tools for Humanity (the firm behind Worldcoin) admitted his love for the OpenAI team. In response, interim CEO Mira Murati commented on the post with a heart.

?

— Mira Murati (@miramurati) November 19, 2023

Like the firm’s staff, investors in the project, led by Microsoft, showed their outrage at the decision. In the intervening period, Worldcoin’s price was not the only metric affected.

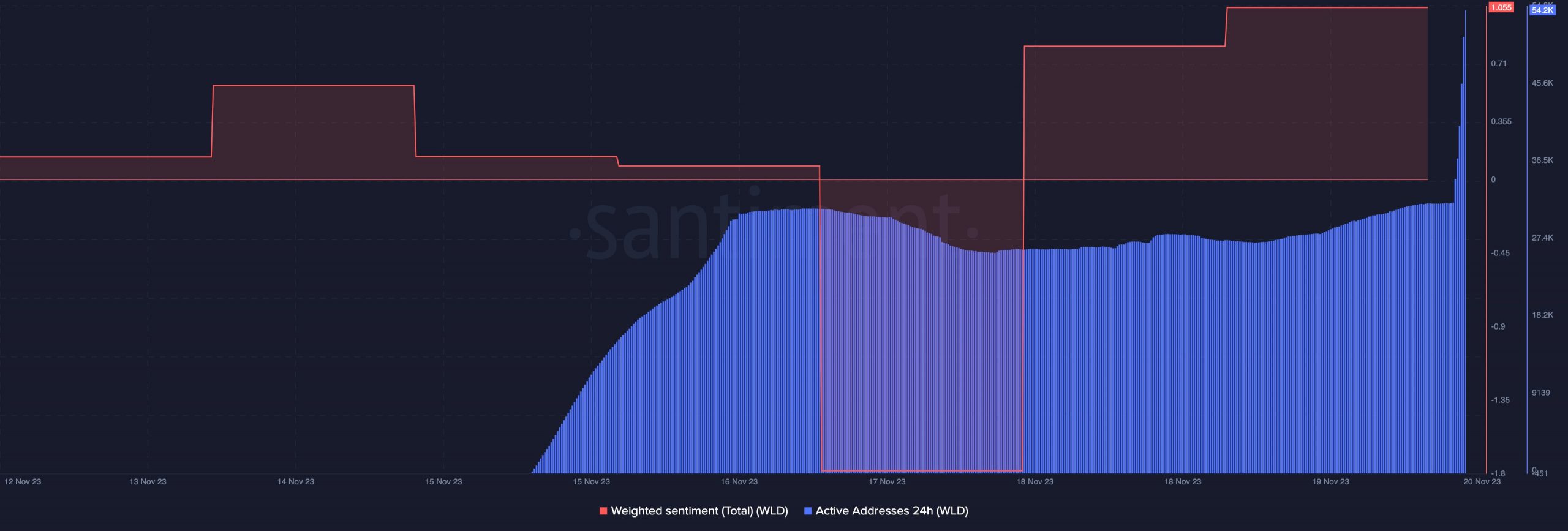

A look at the on-chain data from Santiment showed that the Weighted Sentiment, which was -1.77 on the 18th of November, had increased to 1.055.

The jump in the Weighted Sentiment implied that WLD holders have switched from doubt to confidence in the project. Another metric positively impacted by the development was the Active Addresses.

As shown above, Active Addresses on the Worldcoin network increased by 22,000 between the 18th and the 19th of November. This rise in Active Addresses was confirmation of growing interest in WLD. Also, the positive sentiment could lead to increased price volatility.

So, if buying momentum continues to increase for WLD, the token has the tendency to surpass its All-Time High (ATH). But this may also depend on external factors like the outcome of the reconsideration referenced earlier.

As of this writing, the discussions seem to be moving in the right direction. Altman posted a picture on his X (formerly Twitter) page, in which he was wearing the guest tag at OpenAI with the caption:

“First and last time I ever wear one of these.”

first and last time i ever wear one of these pic.twitter.com/u3iKwyWj0a

— Sam Altman (@sama) November 19, 2023

Take a look before aping

Comments under his page took the post as a confirmation of his return. Should the ex-CEO return, then the effect on WLD might be greater than what it has done in the last 24 hours.

AMBCrypto also checked out WLD’s Network Value to Transaction (NVT) Ratio. The NVT Ratio answers one question— has the market cap of a project proven to be reasonable, judging by its transaction activity?

Read Worldcoin’s [WLD] Price Prediction 2023-2024

High values of the metric indicate that market cap has outpaced transaction volume. Periods like these are associated with market tops. Furthermore, it acts as a bearish sign. The low values of the NVT Ratio are linked with market bottoms, suggesting a bullish network.

The chart above showed that Worldcoin’s NVT ratio had increased to 301 at press time. This implied that the network was a bit overheated. For now, it could be reasonable to overlook buying WLD for short-term gains.