With more than 80% earned for its investors since 2018, the Templar Fund dazzles

The rapid growth of Bitcoin and the collective digital asset industry has taken the financial markets by storm over the past few years and the lucrative nature of cryptocurrencies has given consumers a direction in investment.

However, it is difficult to identify to right apples in a sea of bad ones. Various platforms based around the world provide services that allow users to invest in BTC and various crypto-related trading instruments, but the reliability is still a major question amidst these entities.

After the market crash in March 2020, the allure of investing in Bitcoin has surged to new levels as the digital asset class was the first of its kind to register recovery in the financial markets. Investors around the world were more eager to experiment with Bitcoin at the moment, as the largest digital had all the momentum on its side.

In a highly competitive market, the Templar Fund is one of the most efficient and transparent hedge funds currently providing investment services in Bitcoin. The organization adheres to its principles of total transparency and since its launch in 2018, the hedge fund has openly shared its trading activities with the world.

In order to keep their users engaged, the Templar Fund also facilitates active trade information to its customers at a consistent rate so that its investors are up-to-date with the market at times, making the most appropriate trade selection.

Major Benefits of Templar Fund

1. Transparency

As mentioned earlier, Transparency is one of the Templar Fund’s key objectives as a hedge fund and the organization has done well to justify its standards. Every trade made by the fund since its public launch in 2018 has been made public, as well as a huge public live trade library that users can view on YouTube.

2. NO KYC

For its U.S based customers, there is no requirement to comply under the regulations of FATCA or KYC reporting standards, which is a common occurrence with fiat-to-Bitcoin hedge funds. Because the Templar Fund is a bitcoin-to-bitcoin cross-chain hedge fund, KYC can be avoided (similar to BitMEX, for example). Protecting the privacy of its users, no KYC indirectly means the trading activity of a user remains protected and not reported.

3. Accounting in FIAT and No Counterparty Risk

Every trade transacted by the Templar Fund is made on DEX known as DyDX(DeFi), i.e the Ethereum Blockchain hence the functionality of a decentralized network allows the hedge fund to avoid counterparty risk. The funds are stored in an offline cold hardware wallet which eliminates headaches such as loss of funds or hacks. The organization also preserves users’ U.S dollars with the exposure to the bull market, while being hedged against the bear market.

4. Freedom of Trade

Templar Fund’s major feature is the absence of a discrepancy amongst its traders. From retail to institutional investors, clients of diverse backgrounds are able to take advantage of their services. A particular age bracket or income status is not a pre-requisite for the hedge fund, with people of different backgrounds who can incur the services of the institute.

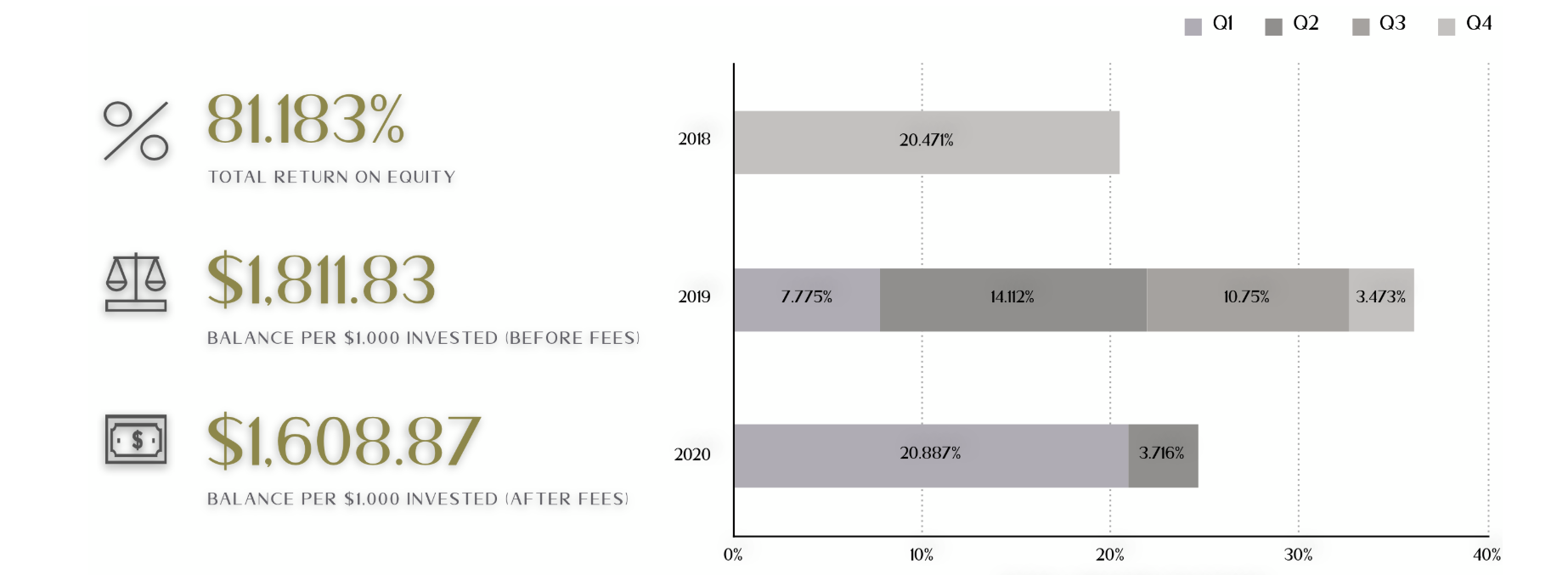

Earnings Summary (November 21, 2018-June 30, 2020)

Source: Templar Fund

The success of the Templar Fund is fairly evident from its total returns of Equity registered over the course of its inception. The entity has witnessed 81.183% of the total returns of equity on its investments since its launch in 2018.

In 2020 alone, the Return of Investment has been more than close to 24 percent, which is very impressive considering the current year has been financially on the downside for the greater economical market during the pandemic.

Liquidity provided by the hedge fund to its customers is also extremely top-notch and it all comes down to the utilization of the custom-built automated trade technology to earn market-making profits, irrespective of the valuation of Bitcoin.

Conclusion

A lack of experience might in the industry is a fact but Templar Fund has ticked all the right boxes since its trading operations began in late 2018. For a user that is trying to enter the Bitcoin investment business, Investments via Templar Fund is a decision that has been profitable to a plethora of customers, and the hedge fund is possibly one of the best options available in the current industry.

With only a small minimum deposit of $100 required, investors can easily get a taste of the action before making a substantial investment, so that they can understand the efficiency of the hedge and then completely bestow their trust on it.

For more information, check the Templar fund’s official website.

Disclaimer: This is a paid post and should be considered as news/advice.

![Arbitrum [ARB] - 50% hike after ETH's rally, but can it hold on for token unlock?](https://engamb.b-cdn.net/wp-content/uploads/2025/08/Ritika8-400x240.webp)