Will Worldcoin snap its 5-month range? $1.42 is the level to watch

Key Takeaways

WLD consolidates in a triangle as range resistance near $1.42 limits breakout potential. Rising scarcity, persistent outflows, and short-term speculation build pressure for a decisive move.

Worldcoin [WLD] has entered a critical phase of consolidation within a symmetrical triangle, compressing between converging trendlines as price volatility narrows.

The ongoing squeeze reflects a tug-of-war between buyers and sellers, with both sides preparing for a decisive move.

Notably, if the price breaks above $1.45 with volume confirmation, the projected target sits near the $3 mark—according to Fibonacci extensions.

This structure highlights rising anticipation among bulls, but confirmation remains key for sustained upside.

Can WLD break free from its range?

WLD successfully broke above a long-standing descending trendline stretching from December 2024. However, the token continued to trade within a well-defined horizontal range between $0.81 and $1.42.

This range has constrained price action for over five months, and the recent rejection at the upper boundary reinforces its significance.

Despite the bullish breakout, buyers must overcome the $1.42 barrier for the trend reversal to gain credibility.

While structural momentum is improving, the price must escape this consolidation zone to establish a stronger uptrend.

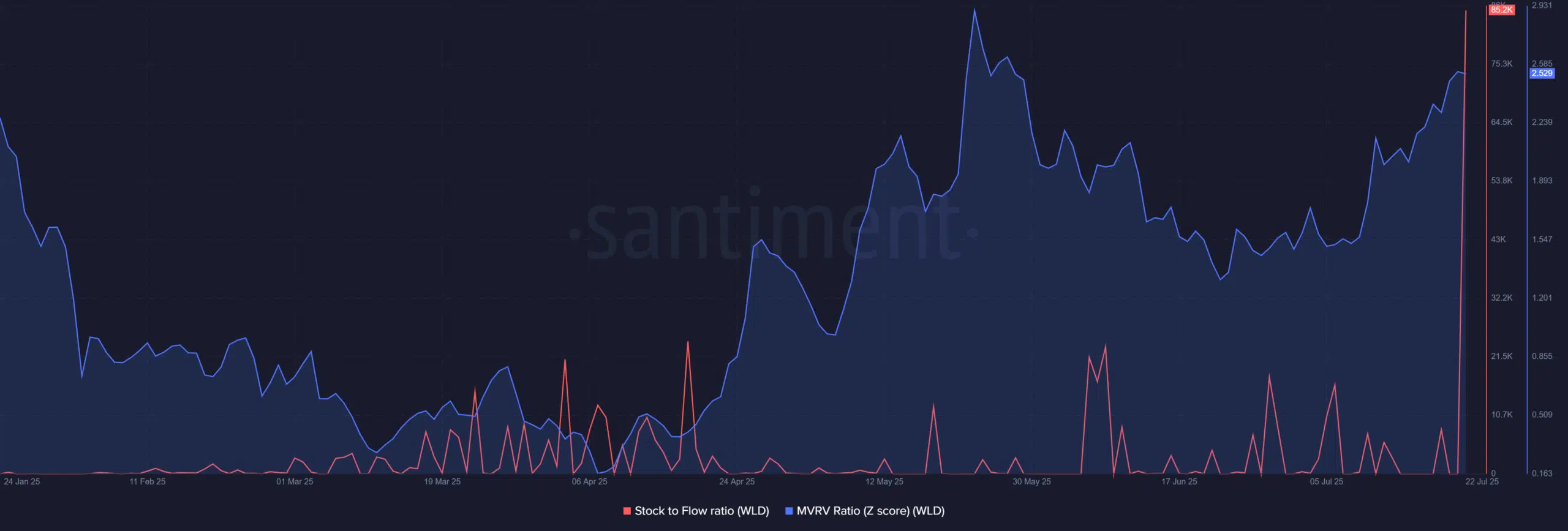

Scarcity and profitability

WLD’s Stock-to-Flow ratio has spiked to 85.2K, signaling extreme scarcity as token issuance dwindles.

This dynamic typically favors long-term appreciation. However, the bullish setup is complicated by the MVRV Z-score, which has climbed to 2.52—indicating that many holders are in profit. Historically, such levels increase the risk of profit-taking.

Therefore, while rising scarcity supports bullish sentiment, elevated profitability may trigger short-term corrections if buyers fail to drive a breakout above key resistance. This tension could define WLD’s next move.

Worldcoin: Short-term speculation

The Realized Cap HODL Waves for the 1-day to 7-day range have spiked to 0.854, marking the highest level in over six months.

This trend reflects renewed speculative interest from short-term holders entering the market.

Typically, such behavior leads to increased price swings, as newer participants often react quickly to changes in sentiment.

Consequently, while the rise suggests strengthening interest, it may also signal vulnerability to abrupt corrections—especially if bullish momentum stalls below the range high.

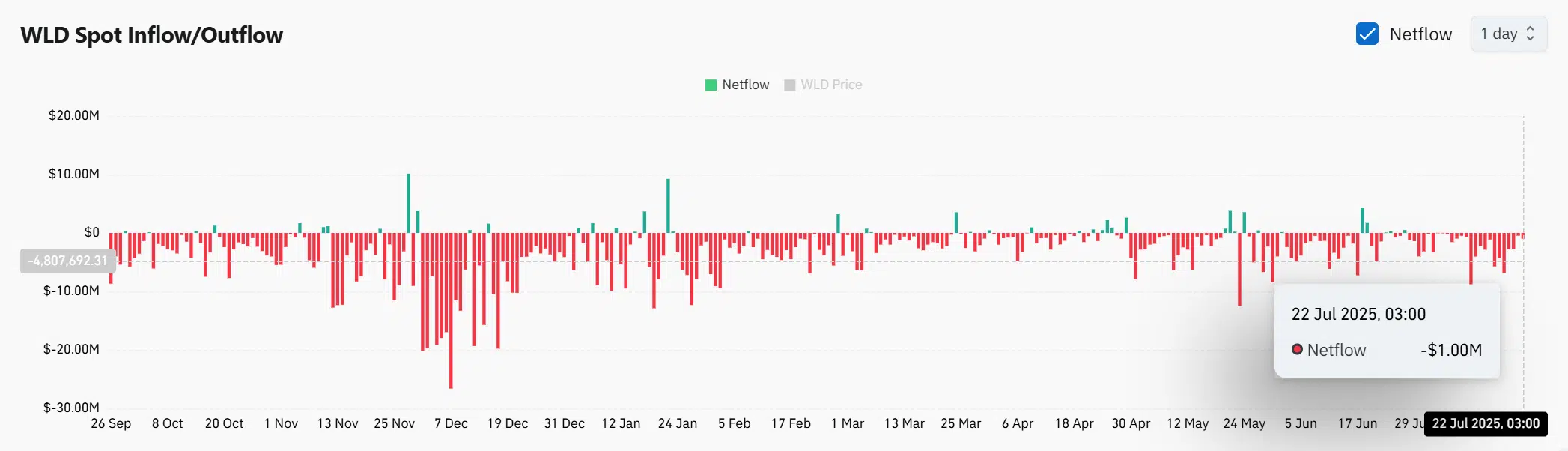

Growing holder conviction

Worldcoin continues to experience persistent negative spot netflows, with another $1 million in outflows recorded at press time.

This sustained trend reflects a shift in investor behavior, with tokens increasingly moving off exchanges—typically a bullish signal of long-term holding intentions.

As fewer tokens remain available for immediate sale, the reduced sell pressure may aid any upcoming breakout attempt.

However, while outflows suggest confidence, price movement still depends on buyers stepping in with volume to challenge and flip key resistance levels into support.

Can bulls overcome resistance?

Worldcoin shows signs of bullish strength, supported by tightening consolidation, rising scarcity, and renewed short-term interest.

However, the $1.42 resistance remains a critical barrier. Until bulls push beyond this range with conviction, the breakout potential toward $3 remains speculative.

Therefore, WLD’s next move hinges on strong buyer engagement and volume-driven momentum to escape the long-standing range.