Will Bitcoin crash in 2025? Some major signs emerge

- Bitcoin’s future has got market makers on edge, with the king coin caught in a volatile loop.

- With every dip, the uncertainty grows, and the endgame might be just around the corner.

The New Year is here, but Bitcoin [BTC] is still stuck in a high-FUD zone, dropping nearly 5% in the last week.

Despite an impressive 140% surge in 2024, making many investors wildly wealthy, the surge in liquidity is raising red flags about a potential Bitcoin ‘crash.’

Bitcoin crash despite HODLing?

Typically, a Bitcoin top is often signaled by a convergence of key indicators, pointing to an overextended phase.

During these euphoric highs, the market braces for corrections. But December took an unexpected turn.

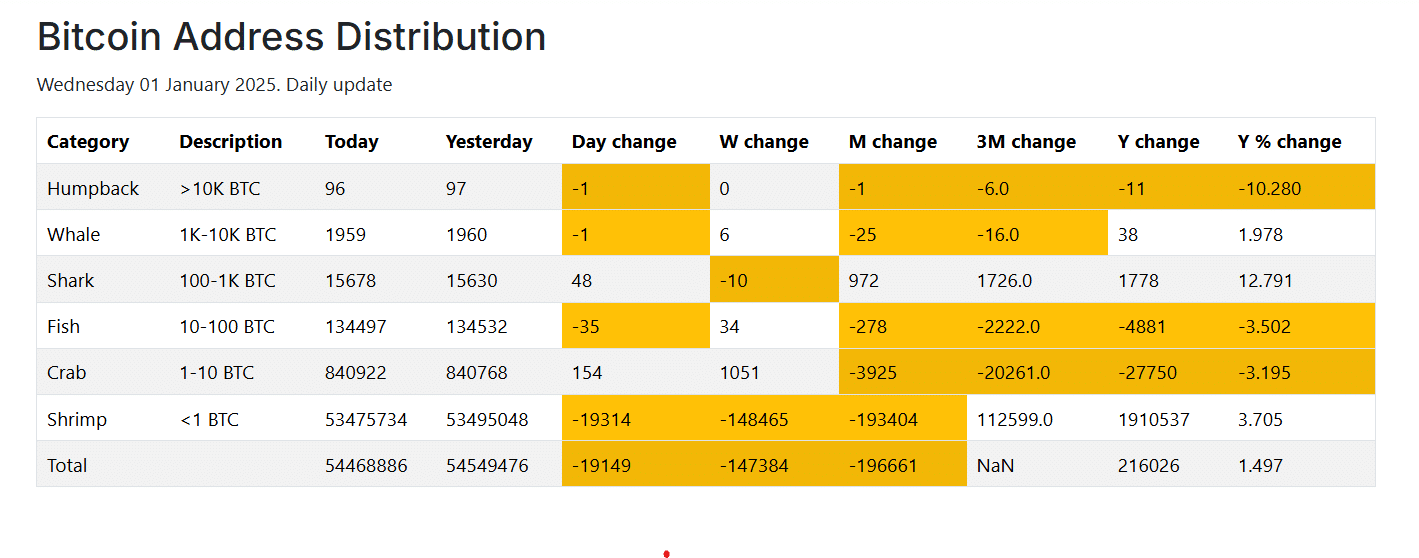

Even with the RSI in a moderate zone and greed levels below 90, around 194K shrimp wallets (holding <1 BTC) exited as BTC hit its $108K ATH.

It’s clear—these small holders took their profits off the table.

The silver lining? Shark wallets (holding 100-1K BTC) saw a 12.791% rise year-over-year, with whales holding strong and new addresses emerging.

However, unlike the last cycle when capital flowed into altcoins during Bitcoin’s consolidation, this time the entire market has dipped into the red.

Some coins are even posting double-digit losses within a week.

This shift has investors on edge, as concerns mount over the lack of fresh capital entering the market while weak hands shake out.

It’s becoming clear: HODLing may not be enough to weather this storm.

Low trading signals economic imbalance

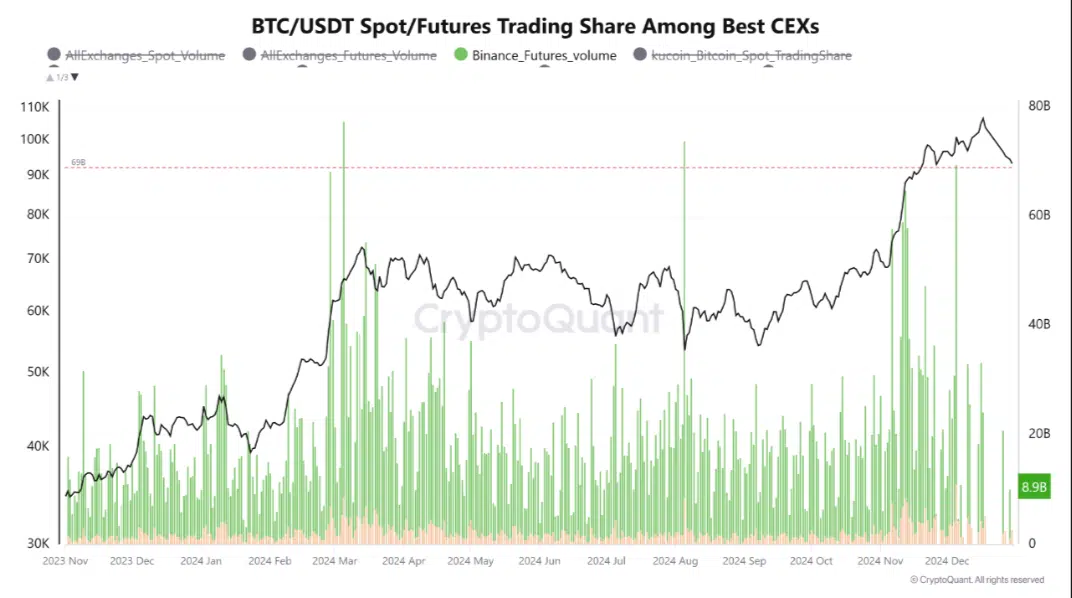

Meanwhile, over the past week, the trading volume of the BTC/USDT pair has plummeted, particularly in both the spot and futures markets, with Binance seeing the steepest decline.

Historically, such drops in volume are often seen at market tops, accompanied by high selling pressure.

With two consecutive weeks of BTC price declines, it suggests that investors may be realizing profits while fearing a further crash, with little “dip” buying taking place.

The key to turning this around? Accumulation. If demand doesn’t pick up soon, HODLers might lose their confidence to hold.

In addition, weak hands could keep selling off on every small uptick, pushing BTC further into a volatile loop. This is further reflected by consecutive outflows from BTC ETFs.

The market is nearing a tipping point, and Q1 could set the tone for the rest of the year.

Read Bitcoin’s [BTC] Price Prediction 2025-26

If institutional demand doesn’t step up to create a supply shock and restore balance, this could mark the beginning of the end of the current BTC cycle.

Time is running out, and each passing day is a test for Bitcoin’s future.