Ripple

Why XRP must hold THIS level to evade BTC’s downturn

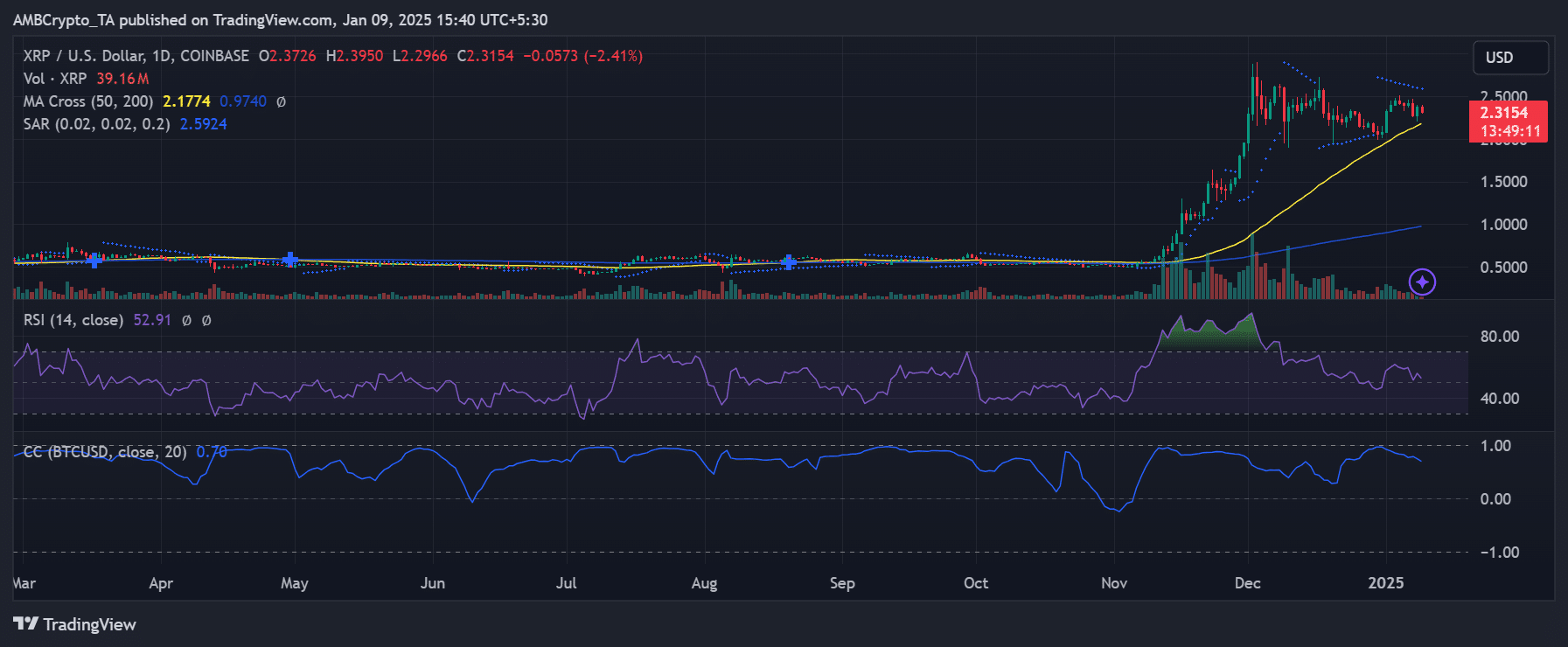

XRP faces critical support at $2.18 amidst Bitcoin’s dip to $93,594. With market sentiment turning cautious, can XRP maintain its resilience?

- XRP’s correlation with Bitcoin at 0.76 highlights its vulnerability to BTC’s bearish moves as it struggles to hold key support.

- With XRP trading below $2.50, market watchers eye $2.18 as a critical level to avoid a deeper sell-off.

As the cryptocurrency market faces renewed selling pressure, Ripple[XRP] is in the spotlight, grappling with external influences from Bitcoin’s[BTC] price fluctuations.

With XRP recently retreating to $2.31, questions arise about whether it can withstand the broader market’s bearish momentum driven by BTC’s downturn to $93,594. A detailed analysis of the charts reveals the critical dynamics at play.

XRP price analysis: Struggling to maintain momentum

XRP’s price chart highlights a significant pullback, with the asset trading below key psychological levels.

Currently, XRP finds support at $2.18, marked by the 50-day Moving Average(MA). However, the recent breach of the Parabolic SAR dots, which have flipped above the price, suggests a bearish trend may be taking hold.

Additionally, the Relative Strength Index (RSI) hovers around 52.91, signaling a neutral zone but showing signs of declining momentum.

Volume has dwindled to 39.16M, indicating weaker participation from bulls. Despite the short-term bearish pressure, XRP still trades significantly above its 200-day MA of $0.97, providing some reassurance of its long-term uptrend.

However, XRP must hold above its immediate support and regain momentum toward resistance at $2.50 to maintain this position.

BTC price analysis: Downward pressure intensifies

Bitcoin, often viewed as the market’s bellwether, has faced notable selling pressure, dipping to $93,594, well below its 50-day MA of $97,659.

The BTC price chart indicates a weakening momentum as the Parabolic SAR dots also suggest a bearish bias. The RSI stands at 43.72, reflecting oversold conditions but not yet signaling a strong reversal.

With Bitcoin struggling to reclaim key support levels, its bearish sentiment is cascading into altcoin markets, including XRP.

The declining BTC dominance and volume of 2.79K further point to a lack of bullish conviction, creating additional headwinds for XRP and other assets.

XRP vs. BTC: The key battle

XRP’s performance relative to BTC remains crucial in determining its stability. The correlation coefficient between XRP and BTC stands at 0.76, indicating a strong positive relationship.

This means BTC’s price trends heavily influence XRP’s movement. Unless Bitcoin stabilizes, XRP may find it challenging to break free from its bearish trajectory.

However, XRP’s resilience lies in maintaining key support levels. A consolidation phase around $2.20 could set the stage for a potential recovery, provided Bitcoin stabilizes above $93,000.

What’s next for XRP?

To withstand BTC’s pressure, XRP must defend its immediate support levels and regain buyer interest at higher volumes. On the flip side, a breach below $2.18 could see XRP testing the psychological barrier at $2.00, which may accelerate selling pressure.

– Read Ripple (XRP) Price Prediction 2025-26

For now, XRP’s ability to weather Bitcoin’s influence hinges on broader market sentiment. Investors will closely watch key support and resistance levels, as well as any macroeconomic developments that could impact risk-on assets like crypto.