Why PEPE’s sell-off is not easy on the eyes

- PEPE sold in the last seven days was about 12x the tokens kept.

- PEPE’s price increased, but a retracement seemed likely.

Reaching a $1 billion market cap in a few weeks was one event that spurred Pepe [PEPE] to become one of the most talked about cryptocurrencies. But since it fell from that height, PEPE has been a shadow of its former self.

While PEPE has gotten back into the top 100, it does not seem like a solid ground supporting its recovery. This is because market players seem not to believe in its long-term potential.

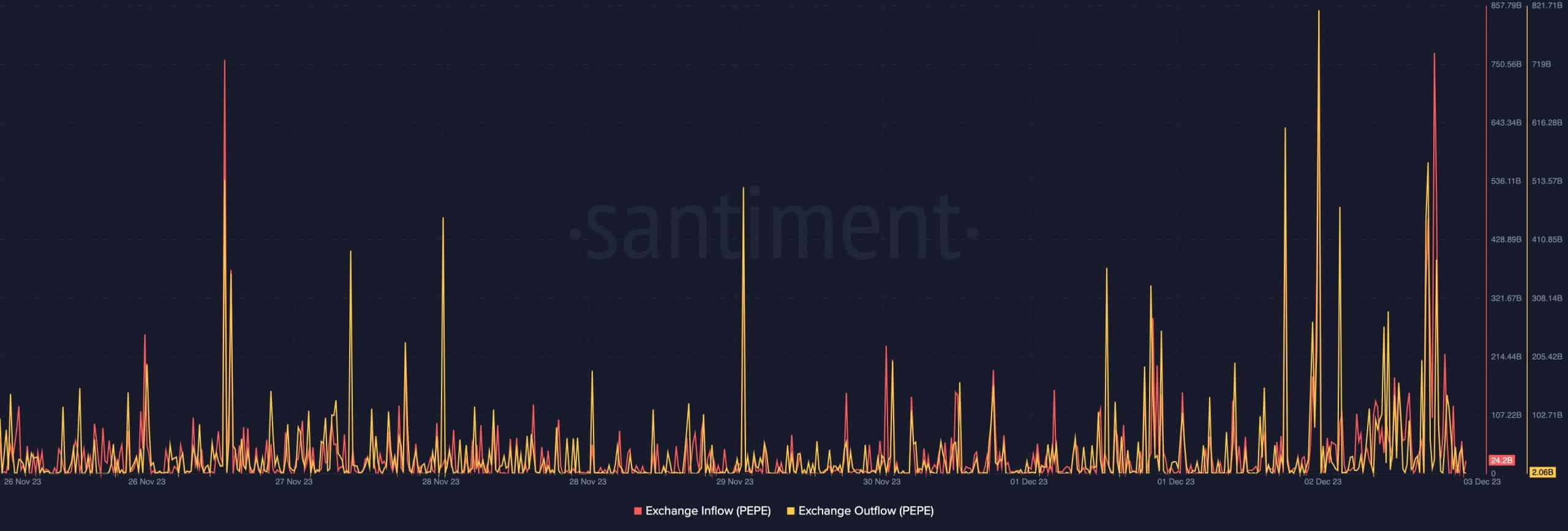

The exchange inflow and outflow are two metrics backing up this point.

No longer the meme for the future

AMBCrypto examined on-chain data from Santiment. From the evaluation, we found out that PEPE’s exchange outflow was 2.06 billion in the last seven days. The exchange inflow, on the other hand, was almost 12x the outflow.

An increase in exchange outflow is a sign that the market is convinced that a cryptocurrency has good long-term prospects. So, the “right” thing to do is to send it into non-exchange wallets.

But when the exchange inflow increases, it implies that market participants are selling. The sell-off in PEPE’s case is not one normal to any cryptocurrency. At the same time, it was surprising considering the token’s performance in the last 24 hours.

At the time of writing, PEPE changed hands at $0.000001186. This value represents a 6.50% increase within the stated period. CoinMarketCap also showed that PEPE’s trading volume increased by 130%.

This increase indicated that there had been a surge in transactions involving the meme coin.

PEPE’s time to shine again?

The technical side of PEPE was, however, a little optimistic. AMBCrypto discovered that the recent surge in price could be linked to buying pressure.

As shown by the Money Flow Index (MFI), the buying momentum began around the 1st of December.

At that time, the MFI was 30.19, indicating that PEPE was oversold. But at press time, the MFI reading had hit 82.20, meaning that the meme was overbought. Therefore, PEPE has the potential to drop from $0.0000001186.

If the value drops, there is a chance that it will recover in a short period. This was indicated by the Awesome Oscillator (AO). As of this writing, the AO was 0.000000074, forming higher high green bars.

An AO reading like this suggests solid buying momentum. Should PEPE retrace, the support at $0.000001087 could be vital in avoiding a significant nosedive.

Read Pepe’s [PEPE] Price Prediction 2024-2025

Regardless of the price action, it could remain challenging for PEPE to get the support it once got from the broader market. One reason for this could be linked to the project’s team members withdrawing and selling without consent.

Though this incident happened as far back as August, market players still have doubts about the team’s transparency. This has also affected the growth in the number of holders, which only moved from 148,000 to 149,000 in the last 30 days.