Why Dogecoin traders aren’t bothered by market shenanigans

- Contrary to the broader market direction, DOGE’s price jumped to $0.08.

- Large volumes of Dogecoin are hitting the breakeven point and may continue to do so.

After a period of significant uptrend, the crypto market finally went through a widespread correction on 16th November. This drawdown affected the top performers including Bitcoin [BTC] and Solana [SOL]. However, one notable cryptocurrency did not follow the trend and that was Dogecoin [DOGE].

From AMBCrypto’s experience, the market movement is a sign that market players are turning their unrealized gains into booked profits. But at press time, DOGE exchanged hands at $0.08. This value indicates a 5% surge within the last 24 hours.

DOGE moves in contrast

On-chain analytic platform Santiment weighed in on the cryptocurrency’s performance. According to the post on X, the surge in on-chain transactions was a major factor that came to the aid of DOGE.

? #Dogecoin has had a modest +5% surge on a mostly flat #crypto market day. It has been aided by $665M in #onchain transaction volume, its highest level in 3 months. There is also a notable amount of $DOGE longs opening as traders bet on prices rising. https://t.co/uFgCCIxih0 pic.twitter.com/DussxIPJN2

— Santiment (@santimentfeed) November 16, 2023

Due to the volume, traders are taking the bullish side, and expecting the Dogecoin price to increase. This projection was indicated by the funding rate. Typically, a positive funding rate suggests that traders are bullish on a cryptocurrency.

On the other hand, a negative reading of the metric indicates traders’ gloomy position in relation to a coin’s price action. An in-depth analysis of the funding rate showed that traders have a strong conviction in a DOGE uptick.

This was because the finding rate was 0.079– one of the highest readings it has hit all year long. Interestingly, AMBCrypto was able to track some of the notable on-chain transactions, thanks to a post by Whale Alert.

The whale tracking handle, in a 16 November post, disclosed how $8.23 million worth of DOGE moved from one wallet to another.

? 103,280,221 #DOGE (8,239,746 USD) transferred from #Robinhood to unknown wallethttps://t.co/DYaj5nSiiU

— Whale Alert (@whale_alert) November 16, 2023

It’s a healthy season for the meme

Furthermore, we considered it necessary to find out other reasons why traders are bullish on Dogecoin’s short-term movement. One metric that helps out in this case is the adjusted Realized Value to Transaction Volume (RVT) ratio.

The higher values of the RVT indicate a large degree of profit-taking in a bull cycle. In bear periods, a high RVT suggests capitulation as market participants may be taking a large volume of realized losses.

Read Dogecoin’s [DOGE] Price Prediction 2024-2025

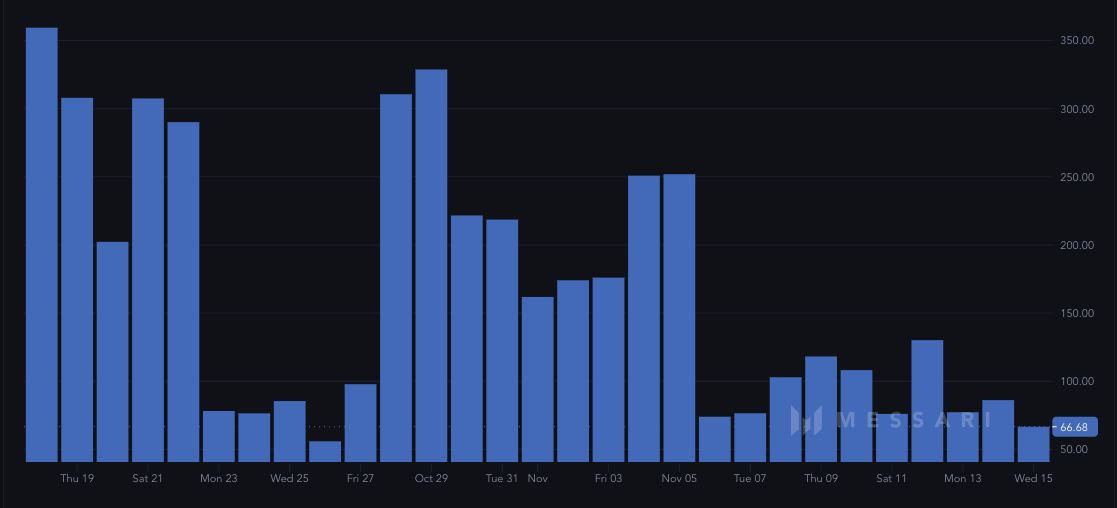

Low NVT values are usually associated with a healthy coin performance. In this case, there is a high active supply, and holders are hitting the break-even point. At press time, Dogecoin’s 30-day adjusted NVT was -66.68.

Apart from the holders moving above the original acquisition price, the metric is also a sign of an early bull market. So, it could be safe to say that a Dogecoin rally may not be far away.