Why DOGE remains bullish despite price drops

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Dogecoin saw sustained accumulation in holder addresses.

- The price action was bullish on the higher timeframe, but momentum has stalled over the past ten days.

Dogecoin [DOGE] recorded a major milestone recently, as the total number of DOGE holders crossed 5 million, an all-time high.

Earlier, AMBCrypto had reported that a crucial weekly resistance level was yet to be surmounted despite the recent bullishness.

This upward momentum has slowed down considerably over the past two weeks as Bitcoin [BTC] bulls struggled hard to drive a move past the $37.5k level and flip it to support.

The breakout past the eleven-month trendline resistance was a strong sign of intent

The trendline in question was plotted in yellow and was retested as support on the 9th of November. The three-day timeframe showed a strong bullish structure, and the RSI showed bullish momentum as well.

On the daily and lower timeframe charts, the bullish momentum had waned.

The move above July’s high in mid-November was another encouraging sign that buyers had strength in the market.

The Chaikin Money Flow (CMF) agreed with this finding, as its reading of +0.17 indicated heavy capital inflow to the Dogecoin markets. The On-Balance Volume (OBV) has not lost its uptrend either.

The $0.072 and $0.0765 levels of support were likely to be important in the coming days. A move below both these levels would signal a shift toward bearish bias.

DOGE showed evidence of accumulation on-chain

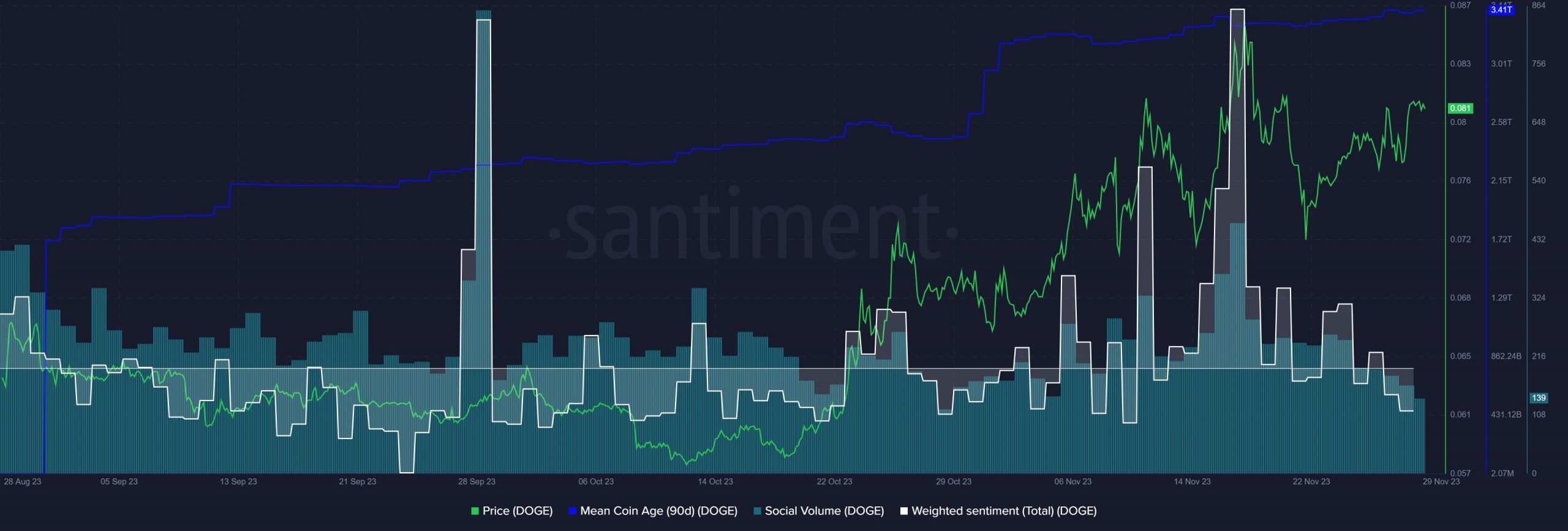

Source: Santiment

The mean coin age metric of DOGE has trended upward since September. Notably, despite the price drop a couple of weeks ago, the metric saw hardly a dent. This suggested that holders retained their confidence in the meme coin.

The Weighted Sentiment began to drop lower over the past ten days, as did the Social Volume. This suggested more negative social media engagements as prices began to hover indecisively in the lower timeframe price charts.

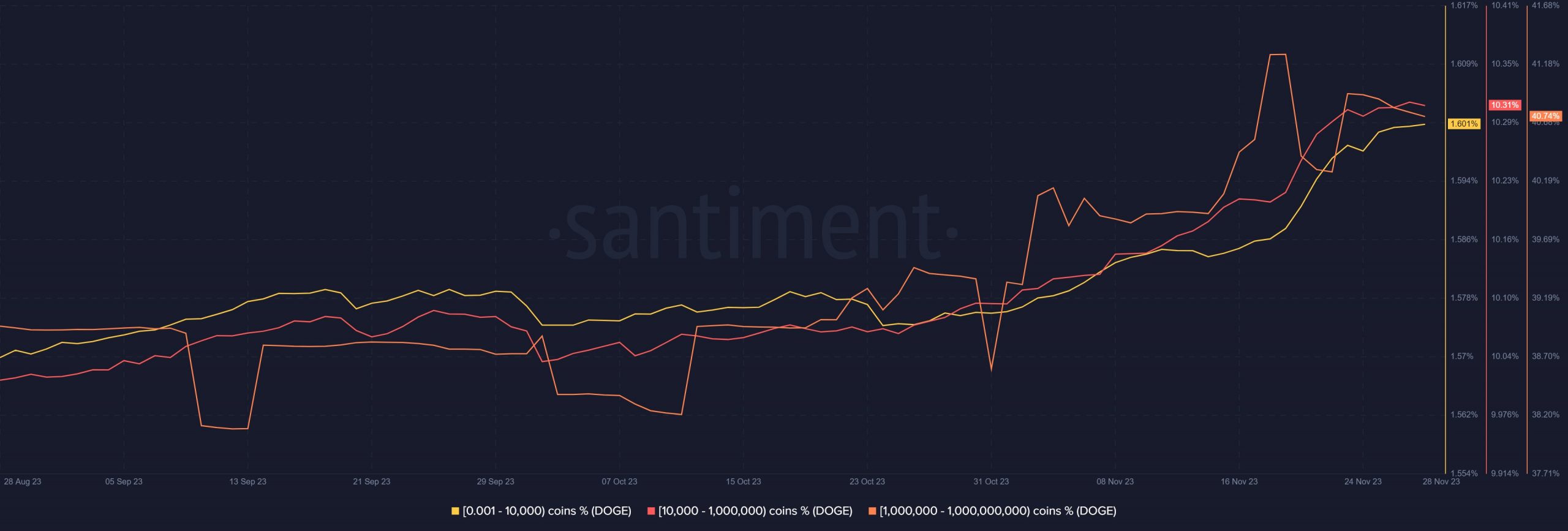

Source: Santiment

AMBCrypto also looked at the balance of addresses to check whether accumulation was still in progress. And the evidence showed that it was.

Across the spectrum from shrimp to whales, the balance of DOGE addresses has steadily trended higher in recent months.

Is your portfolio green? Check out the DOGE Profit Calculator

Hence, both the mean coin age and address balance showed that holders continued to accumulate Dogecoin at press time.

This hinted that more gains were likely, but it remains to be seen if sentiment would be as strongly bullish toward the year-end as it had been over the past month.