Bitcoin

Why Bitcoin’s hashrate has left the door open for bears

CryptoQuant analyst Gigisulivan has noted that BTC may be on the verge of dropping to $31,500.

- Bitcoin’s hashrate tapped a seven-day high, putting BTC at risk of another decline.

- Shorts may be liquidated if the CLLD spikes.

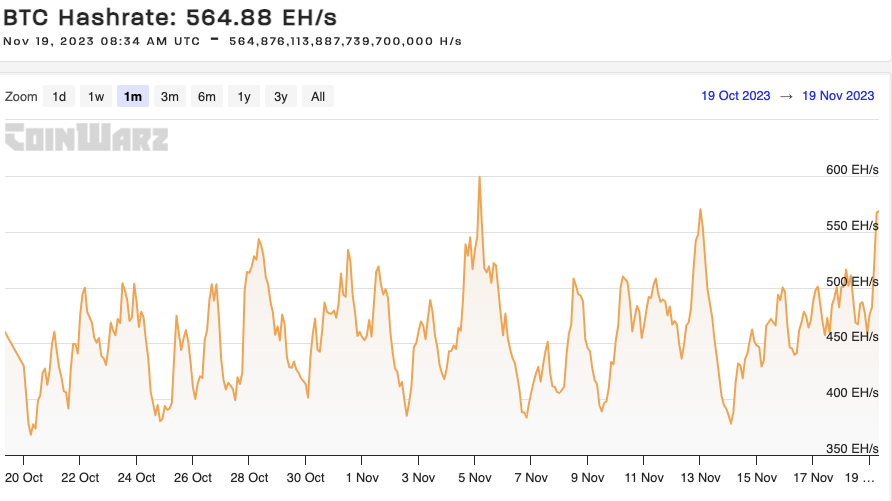

Bitcoin’s [BTC] hashrate has reached its highest point in the last seven days, according to the data AMBCrypto observed from CoinWarz. At the time of writing, the king coin’s hashrate stood at 564.88 Exahash per second (EH/s).

Bitcoin’s hashrate gives an estimate of the computational power used by miners to process transactions on the blockchain. This process is sometimes complex, but miners ensure that they confirm the legitimacy of a transaction before adding it to the blockchain.

A high hashrate is risky for BTC

Gigisulivan, an author on CryptoQuant, commented on the hike in the hashrate and how it might affect BTC’s price. According to Gigisulivan, who also doubles as an on-chain analyst, BTC may be on the verge of dropping to $31,500 because of the surge in hashrate.

The analyst, in backing up his point, compared the current situation with BTC’s condition around the 15th of September. It was also around this period that the hashrate tapped a new high. During that period, Bitcoin jumped to $26,700.

With respect to the press time situation, Gigisulivan noted:

“Important to note is that we had another new high on hashrate 2 weeks ago, that is sitting still within the usual time-frame and usual pump before dump range.Most likely pullback target between 30-31.5k.”

At press time, BTC’s price was $36.643. This value, when compared with altcoin prices in the last 24 hours, showed that Bitcoin’s dominance was decreasing. To ascertain how the king coin may perform, AMBCrypto evaluated the liquidation levels data provided by HyblockCapital.

By definition, liquidation levels are potential price levels that could lead to the wipeout of a trader’s position. A look at the data showed that BTC may decline sharply at some point.

Short-term holders should watch out

However, if the Cumulative Liq Level Delta (CLLD) spikes, shorts may be liquidated. This is because the trend may reverse to the bullish side. But as of this writing, traders were opening short positions for BTC with an average leverage of 25x.

Furthermore, mining-related metrics like the Market Cap to Thermocap ratio gave some information about BTC’s value. The Market Cap to Thermocap Ratio can be used to assess if the asset’s price is currently trading at a premium.

To get this value, Glassnode also considers the total security spent by miners. Historically, a high Market cap to Thermocap ratio has signaled that Bitcoin is near the top of a market cycle.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

When the ratio is low, it means that it is a relatively good time to buy. As of this writing, the Market cap to Thermocap ratio was 0.00000065.

For short-term holders, BTC’s value above $36,000 indicated that it could be risky to buy and profit from the coin at press time. Meanwhile, long-term holders had the chance to accumulate BTC at a discount irrespective of the current direction.