Bitcoin

Why Bitcoin should technically hit $28K before November 1?

Although this article isn’t different from a lot of bitcoin price prediction articles out there, this is a different article. The underlying reason for Bitcoin hitting $28,000 by November 1, 2020, is based on historical data and not just an analyst’s prediction.

Bitcoin’s volatility is a well-known aspect of the asset and the fact that this aspect is high is what’s preventing it from becoming an everyday unit of exchange/account or in simple terms – money. Arguing the soundness of bitcoin is for another day, however, what’s important is this historical data that suggests an average bitcoin return of 196% after a certain condition has been met.

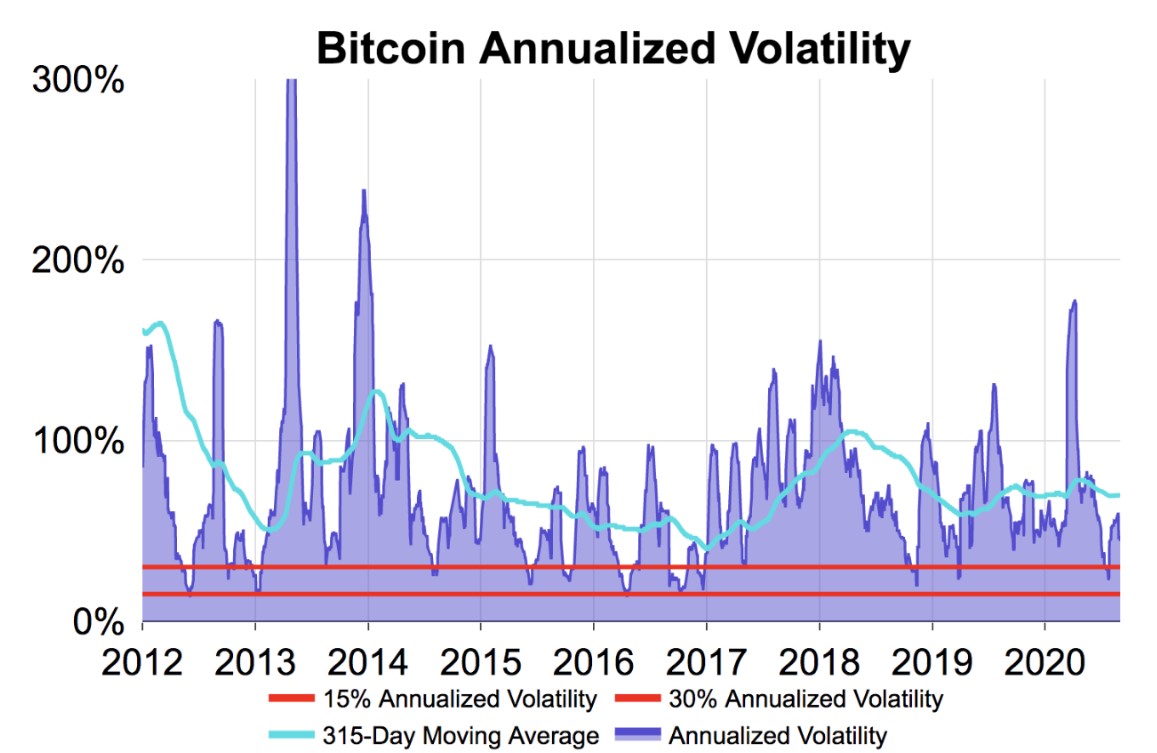

According to Kraken’s August volatility report, there are “suppressed pockets” which represent bitcoin volatility slump between 15% to 30%. As seen below, the pocket extends between the red lines.

Source: Kraken Volatility Report

To date, bitcoin has only every hit these pockets 12 times, and every time bitcoin slides into these pockets, it reverses to the mean, which happens to be a 315-day moving average. In other words, after sliding into these pockets, volatility has seen an average surge of 140%.

What’s interesting is the price implication of this volatility suppression and eventual expansion. It was observed that the price saw an average surge of 196% over the next 90 days.

On two separate occasions – 2014 and 2018, the returns were -60% and -45%., hence, there is an 83% chance of price surging 196%. Considering the last dip in the pocket was July 24, 2020, and the surge as of writing was only 4.36%, there is a lot of upside for bitcoin.

196% surge from July 24, over the next 90 days should put bitcoin between the $28,000 and $30,000 range and on October 22, 2020. This would mean bitcoin has to surge a 4.2% surge every day to hit the target of ~$30,000.

Is it a realistic target?

Although an uncorrelated asset, Bitcoin is being affected due to what’s happening in the US. BTC is inversely correlated with the Dollar index and in-line with the Dow Jones. As long as this connection/correlation exists, it is potentially bad for bitcoin. Apart from this, bitcoin would have no trouble doing an average daily return of 4.26%.

Although times are bleak in September as the price is now closer to $9,000 than $12,000, it seems to be realistic, especially considering the hype around DeFi.