Which investors will drive the Bitcoin market?

Bitcoin has new blood. With the cryptocurrency reaching a high not seen since December 2017, following which it endured a 15-month long bear market, new and unfamiliar investors are entering the Bitcoin markets.

For starters, these newbies are rushing in to buy Bitcoin, creating fresh demand. This demand has to be catered to by Bitcoin’s supply, which cannot be increased. Currently, the Bitcoin supply is 18.5 million out of a total of 21 million. However, much of this 18.5 million is locked up, either as a consequence of companies like Grayscale, Square, Coinbase, etc warehousing it, or lost in wallets which are untouched for years.

The ‘free float’ or tradeable supply of Bitcoin is around 3.4 million. So, the new demand can only be satisfied with this limited amount.

According to a report by Chainalysis, of the 3.5 million free float Bitcoins in supply, 0.25 million or 7.1 percent were sent to exchanges in the past two weeks. These 0.25 million BTC had accrued a profit of 25 percent and were sent with the intention of being sold so that the investors could take their profits, so to speak.

Hence, the demand from these new investors was satisfied by a flow of 7 percent from the supply, however, that isn’t enough. The report notes,

” Each week this liquid supply keeps decreasing, showing that new investors are currently absorbing the bitcoin of previous investors who are cashing out.”

As the simple economic principle of when demand exceeds supply, prices rise, this is a ‘bullish’ case for Bitcoin.

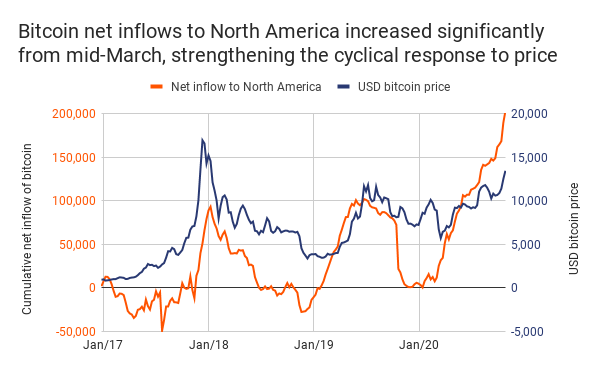

Onto where these new investors are coming from. The report identifies that the net inflows from North America “have increased significantly since mid-March,” as 200,000 more Bitcoins moved into the continent than out of it. North American investors are those who buy during a bull run, and hence once the price began improving, they stepped in.

Bitcoin net inflows | Source: Chainalysis

Going forward, if the prices are as high, or higher, than they are, the market will be driven by North American investors. The report concluded,

“Since mid-March, flows into North America have been high, and increasing faster than in past periods of price appreciation. This suggests North American demand is a more important driver in the current market than it has been in past markets.”