What to expect from Bitcoin and Ethereum as the bull rally ends

- Bitcoin’s transaction volume has started to decline in the recent past.

- Ethereum was down by over 4%, and the meme coins were following a similar trend.

The entire crypto market, including top coins like Bitcoin [BTC] and Ethereum [ETH], enjoyed a comfortable rally during the last few weeks. Most cryptos managed to register promising gains, allowing the capitalization of the overall crypto market to rise.

Unfortunately, like all good things, this bull rally came to an end as well. Therefore, let’s take a look at the crypto market’s condition to see what the future holds as we enter the end of 2023.

Bitcoin’s performance looks robust

At the time of writing, the crypto market cap stood at $1.4 trillion. However, Santiment recently posted an analysis pointing out that the comfortable bull rally came to an end somewhere around the 12th of November.

? #Crypto market caps have temporarily run out of steam after the huge 4-week rallies. In our mid-month November market report, we take a look at #Bitcoin's supply moving off exchanges, and how the crowd will impact prices the rest of the year: https://t.co/jhUT3OPulx pic.twitter.com/Pd46PH2Npj

— Santiment (@santimentfeed) November 18, 2023

Santiment’s latest report also highlighted how the king coin performed during the bull rally. To begin with, BTC’s price surged by nearly 30% last month.

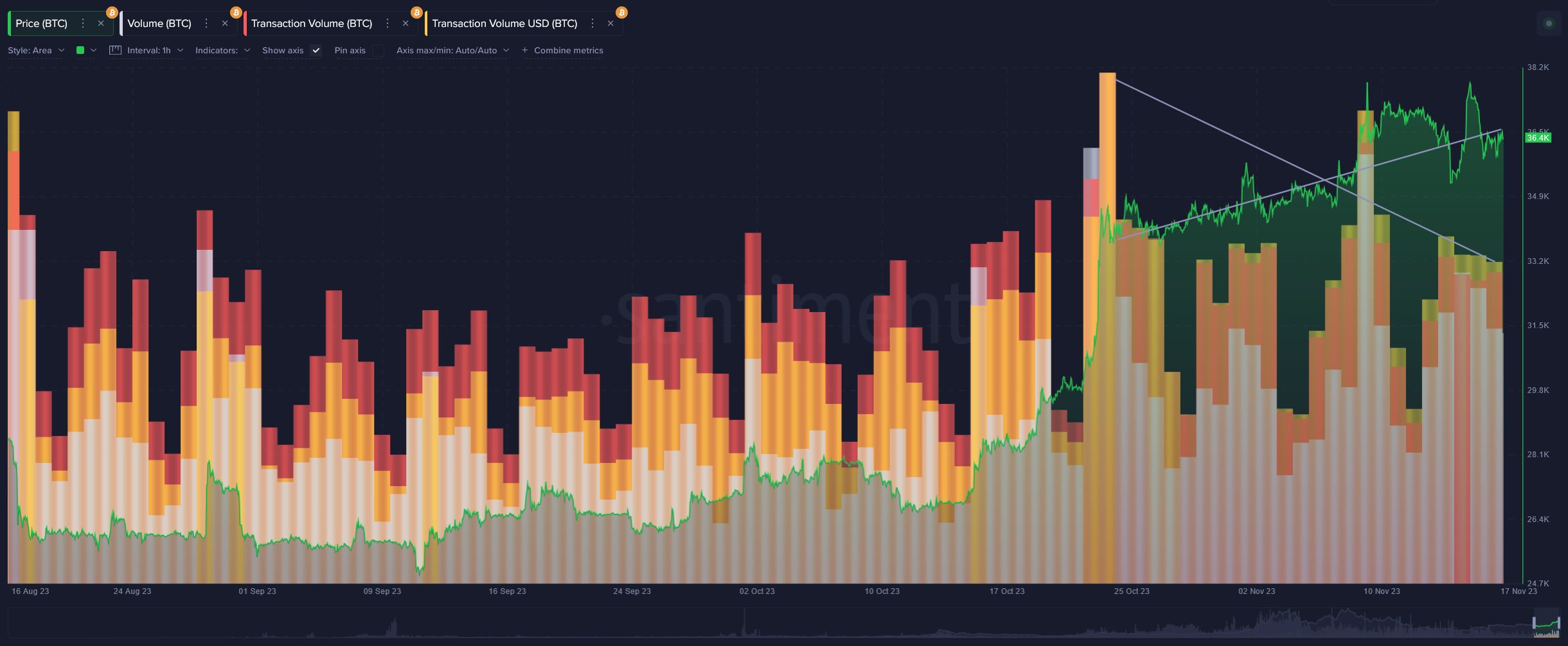

As per Santiment’s report, over the last 30 days, key wallets holding between 10 – 10k BTC shed 50,882 bitcoins. Interestingly, after a comfortable rise in transaction volume, the metric started to decline at a time when BTC’s value continued to rise.

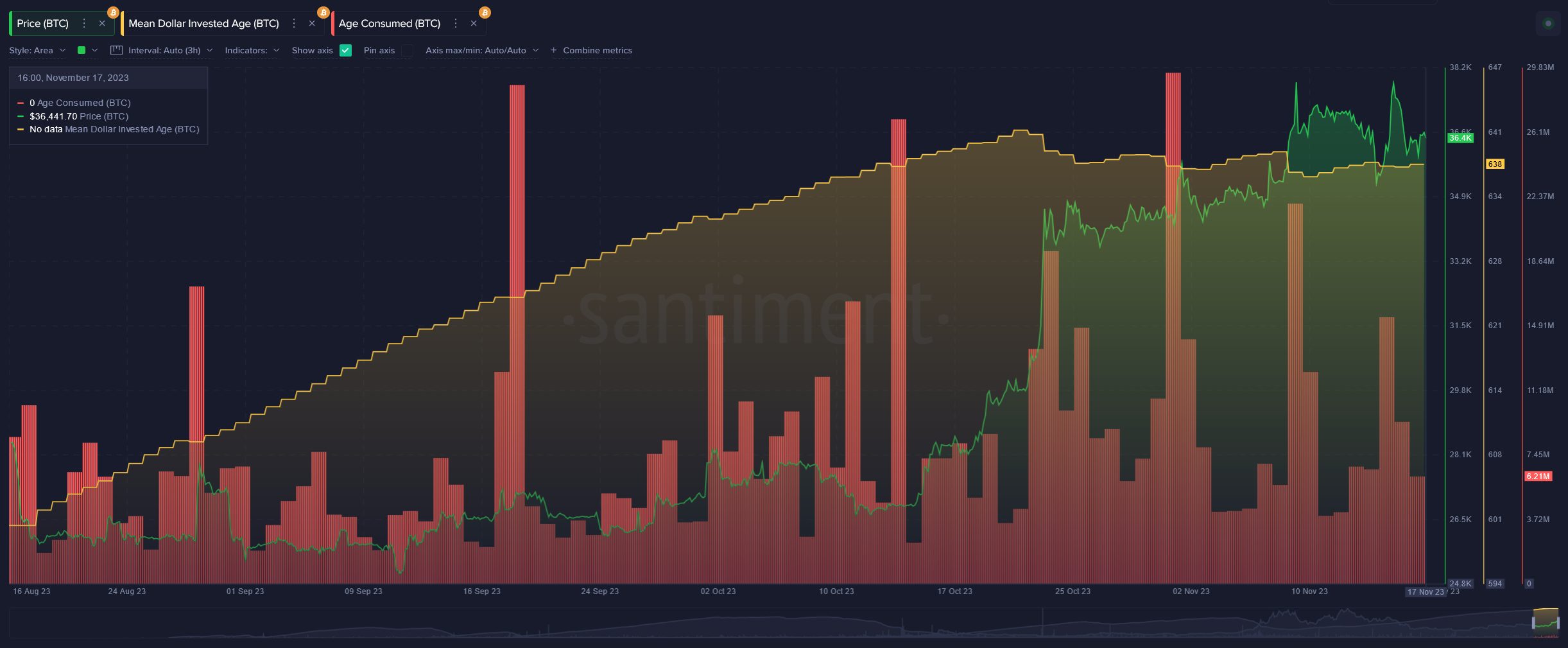

Like transfer volume, Bitcoin’s MVRV ratio also increased over the past few weeks. Santiment’s report mentioned that the average trading returns for 365 days were still at +32%, implying that they may need to even out too close to 0% before another takeoff can happen.

Nonetheless, the fact that the dormant token movement has been quite active in the first part of November is encouraging.

This can be expected from Bitcoin

Like Santiment’s report, AMBCrypto’s analysis also found that the possibility of Bitcoin’s price action slowing down was high. As per CoinMarketCap, BTC was already down by more than 15 in the last seven days.

At the time of writing, it was trading at $36,656.75 with a market cap of over $716 billion.

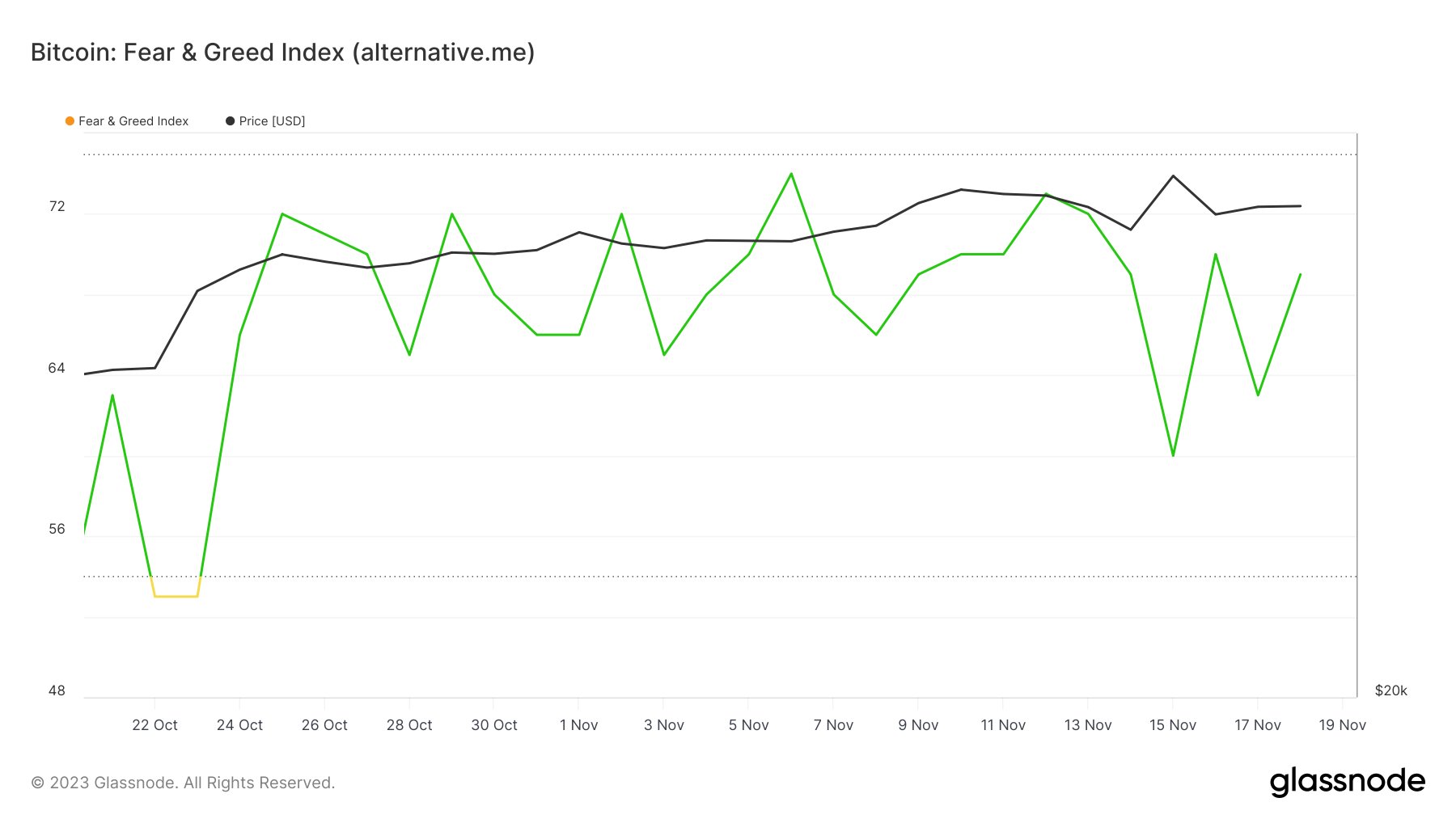

Its trading volume also plummeted by 40%, suggesting a lower willingness of investors to trade the coin. BTC’s fear and greed index had a value of 69, meaning that the market was in a ‘greed’ position at press time. When this happens, it brings about the possibility of a price drop.

AMBCrypto’s analysis of BTC’s daily chart pointed out that the MACD displayed a bearish crossover. The Relative Strength Index (RSI) also registered a downtick over the past few days.

Bitcoin’s Bollinger Bands suggested that the coin’s price entered a less volatile zone, minimizing the chances of an unprecedented surge. Nonetheless, the Chaikin Money Flow (CMF) rested above the neutral mark of zero — a hopeful sign.

Altcoins also rallied substantially

Ethereum was not left out of last month’s rally. As per CoinMarketCap’s data, ETH’s price went up by more than 25% in the last 24 hours, allowing it to go above the $2,000 mark.

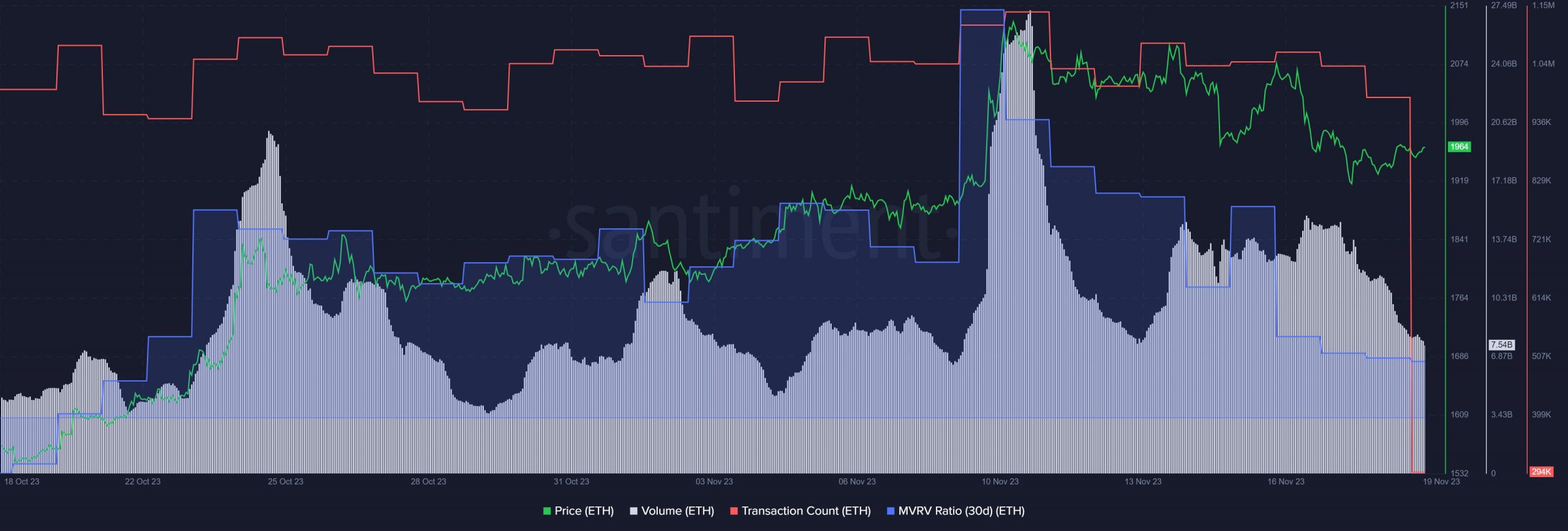

AMBCrypto’s analysis of Santiment’s data revealed that ETH’s trading volume spiked each time its price went up. A positive signal for Ethereum was that its transaction count remained consistently up. When the token’s price crossed $2,000, its MVRV ratio also peaked.

However, like BTC, ETH’s bull run also shows signs of ending, as its price dropped by more than 4% in just the last seven days. At the time of writing, it was trading at $1,959.51 with a market cap of over $235 billion.

When AMBCrypto checked CryptoQuant’s data, it was revealed that selling sentiment in the market was dominant.

Both Ethereum’s Korea Premium and Funds Premium were red, meaning that Korean retail investors and investors in funds and trusts, including Grayscale, have relatively weak buying sentiment.

Ethereum’s number of transactions and transfer volume dropped as well — a worrying sign.

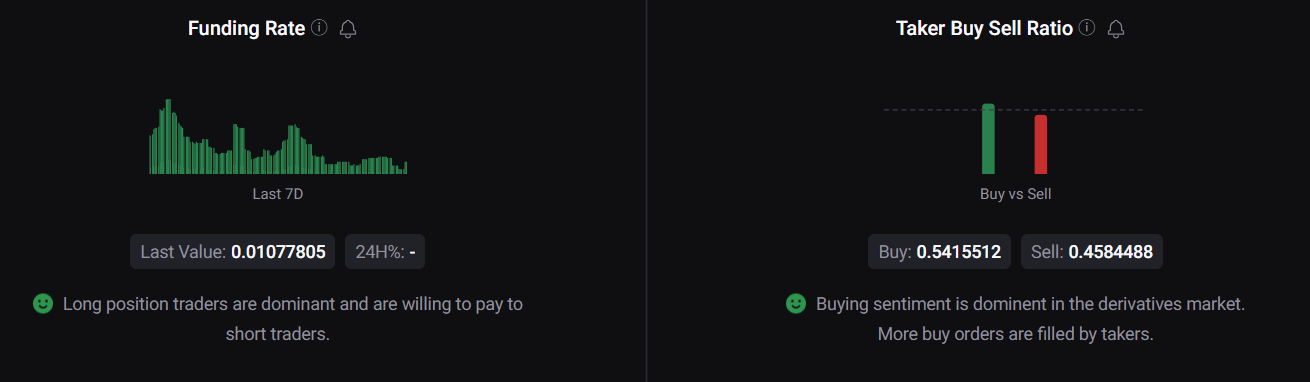

Interestingly, while the token’s price dropped, its demand in the derivatives market increased. ETH’s Funding Rate was green, suggesting that investors were buying the token at a lower price at press time.

Additionally, its Taker Buy Sell Ratio was green as well, further showing that buying sentiment in the futures market was high. Therefore, the possibility of ETH continuing its downtrend seems likely in the days to come.

How are the meme coins faring?

The meme coin pack followed the king of altcoins as their values also plummeted in the recent past. For instance, Dogecoin [DOGE], the world’s largest meme coin, registered a value drop of nearly 7% in just the last 24 hours.

Is your portfolio green? Check out the BTC Profit Calculator

Shiba Inu [SHIB] had a similar fate, as the token’s price also sank by more than 5% over the last seven days.

Considering all the aforementioned metrics and market conditions, one can conclude that the market might remain a little slow in the coming days.