What Ethereum’s price drop means for you

- ETH fell below $2,077, a level at which the TWAP trading strategy ended.

- About $91 million in longs were liquidated in the last 24 hours.

Ethereum [ETH] retreated as the weekend came to a close, but the second-largest crypto by market cap was still clinging to the $2,000 mark.

As of this writing, ETH was exchanging hands at $2,045, having recorded double-digit gains over the last month, AMBCrypto discovered via CoinMarketCap’s data.

However, the asset could witness a spike in volatility in the days ahead, possibly culminating in a fall in price.

The happenings in ETH’s derivatives market

Popular crypto market researcher and author at CryptoQuant, Maartunn, took to social platform X (formerly Twitter) to call attention to his analysis supporting the above claim.

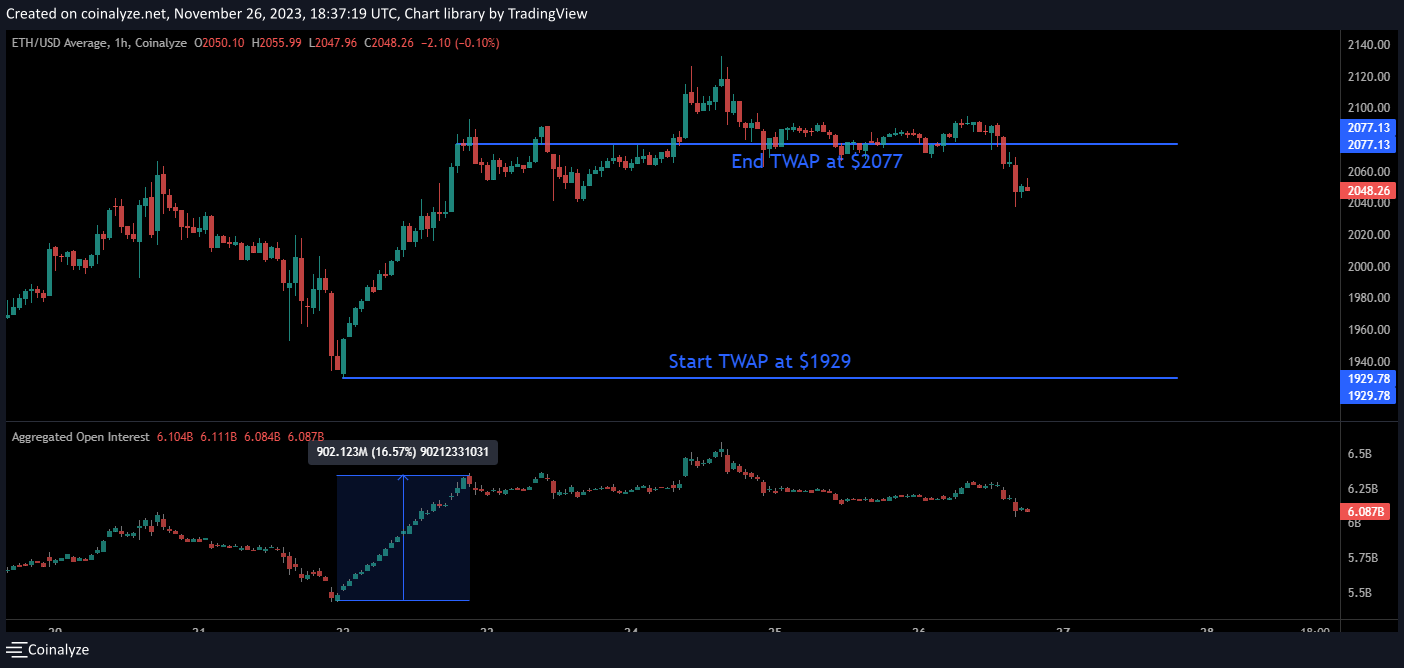

A few days ago, the analyst spotted a buying trend in ETH driven by the Time Weighted Average Price (TWAP) strategy. For the uninitiated, TWAP involves distributing a large single order into smaller quantities, each executed at regular intervals.

By doing so, the impact of a large trade is reduced, preventing sudden fluctuations.

The systematic buying resulted in a linear growth in ETH futures contracts’ open interest, Maartunn had stated in a post dated the 22nd of November.

Cut to the 27th of November, and the CryptoQuant analyst predicted “significant volatility” for ETH in the days to come.

As per the research, the TWAP buying commenced at $1929 and ended at $2077, during which ETH added more than $900 million to its Open Interest.

However, ETH’s dip below $2,077 in the last 24 hours started exerting pressure on the positions. When the market moves against one’s leveraged position, the risk of liquidation increases substantially.

In this case, the long-position traders who bought using the TWAP strategy were at risk of forced liquidations. The knock-on effect would pull ETH’s price further lower, Maartunn argued.

Realistic or not, here’s ETH’s market cap in BTC’s terms

Traders turn bearish on ETH

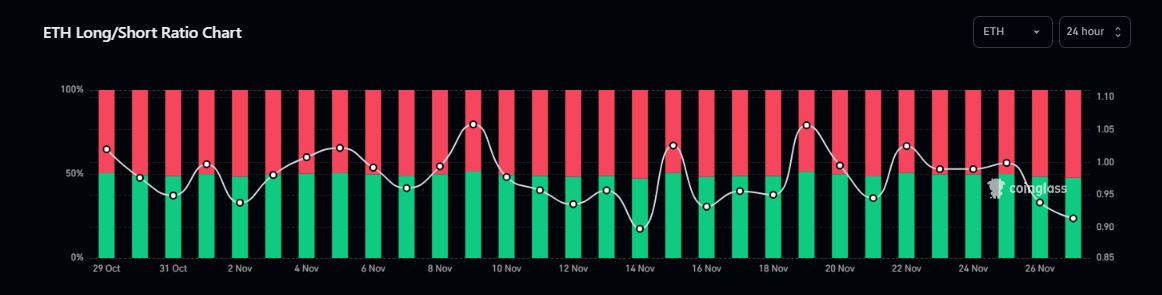

The consequences were making their presence known at press time. Notably, about $91 million worth of long positions in ETH futures were liquidated in the last 24 hours, AMBCrypto noticed through Coinglass‘ data.

The liquidations led to a shift in market sentiment. The number of traders holding long positions dipped sharply when compared to those on the short side.