What can stop Bitcoin Cash from irrelevance?

Superlatives are oozing out for Bitcoin from every direction. The largest digital asset is currently surging towards its all-time high valuation, but a particular forked asset from 2017 isn’t’ doing that well. Bitcoin Cash is suffering at the hands of its own expectation, and its current price position was not pretty.

Bitcoin vs Bitcoin Cash: A change of fortune

Source: Trading View

While Bitcoin has been on a near-perfect run since May 2020, Bitcoin Cash has significantly struggled to attain any grip on the market. The misfortunes surrounding BCH are almost surprising because in it the past, BCH rallied behind Bitcoin’s positive market. It hasn’t been the same case in 2020 and it is down to many reasons.

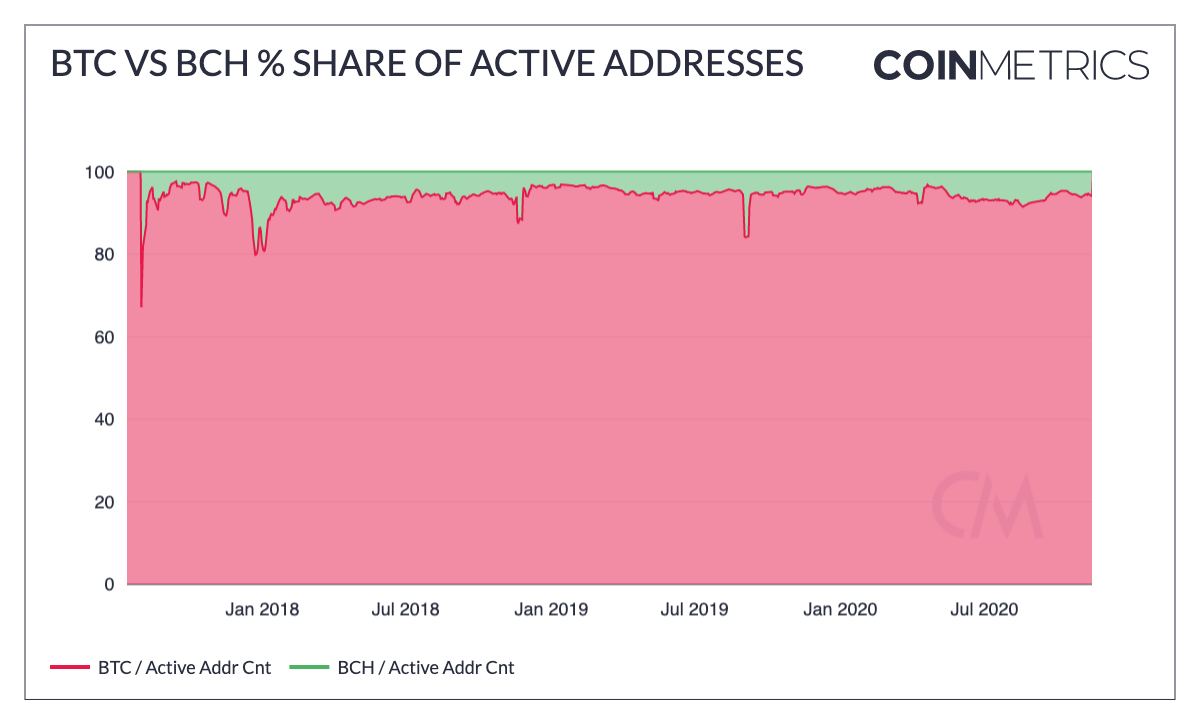

Source: Coinmetrics

According to Coinmetrics’s recent report, Only 6% of BCH’s total addresses were active at the moment. In comparison, Bitcoin had a 94% active address rate which has remained consistent over the past couple of years. It is quite clear that Bitcoin Cash was lagging its user’s support as well in the space. Its on-chain properties were as bad as off-chain price activity.

Additionally, the report also added that Bitcoin Cash’s adjusted transfer value in 2020 averaged less than $150 million per day. Bitcoin registered a whopping $4 billion in daily adjusted transfer value, and BCH was “supposedly” the better medium of exchange.

To add more problems to its existing mountains of catastrophes, Bitcoin ABC (i.e Bitcoin Cash) underwent a new chain split that gave rise to BCHA and BCHN. The aftermath hasn’t been pretty with only a handful of blocks being added to the BCHA chain since November 15th. The impact of hash rate has been significant as well.

BCH Hashrate reeks of Security Threat

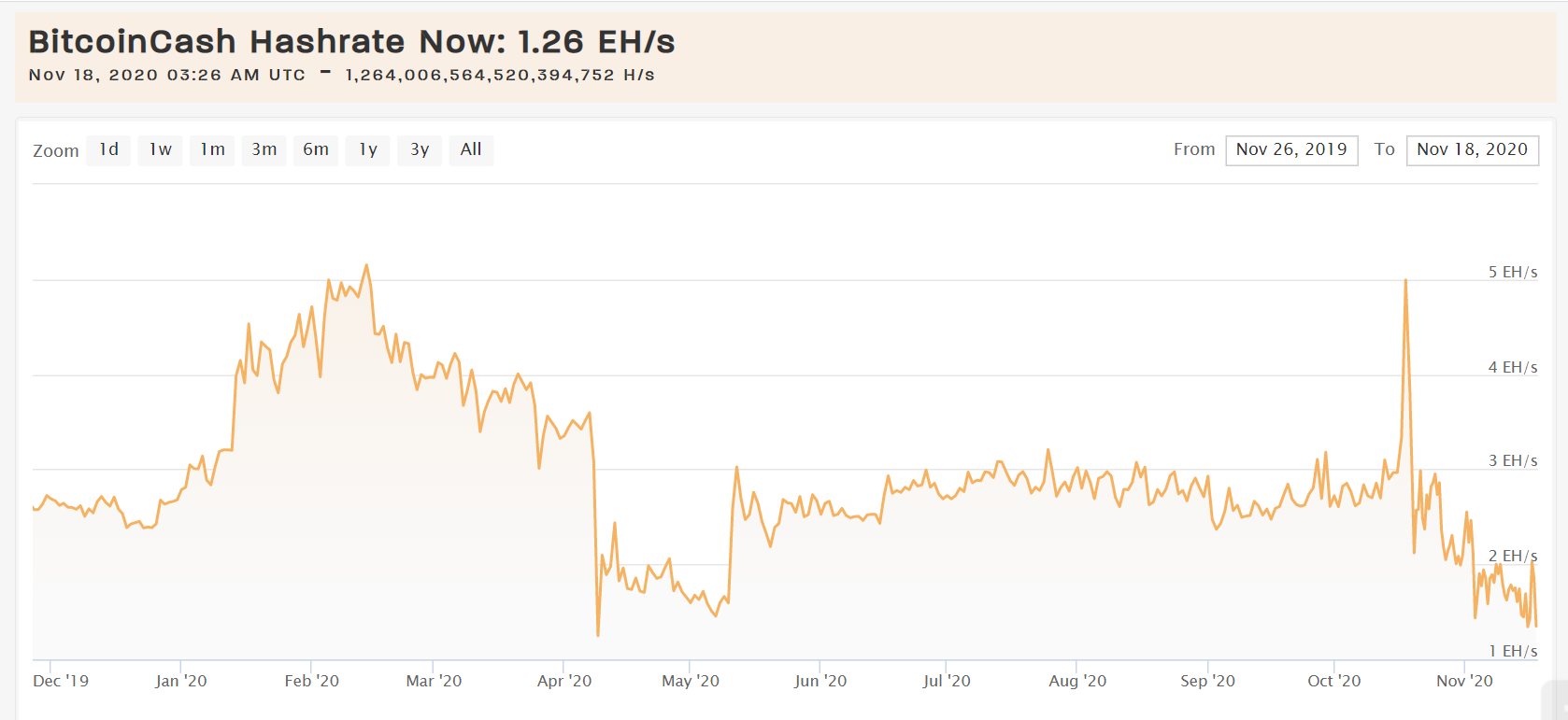

Source: Coinwarz

In light of the recent chain split, BCH’s hash rate dropped down to 1.26 EH/s as illustrated in the chart. The hash rate dropped down to post halving levels of April 2020, which was considered to be a major security issue.

Under such an uncertain and vulnerable state, attacking BCH is even more simple. According to data, conducting a 51% PoW attack on BCH will cost $8,749 per hour at the moment. In comparison, it will cost $816,867 to attack Bitcoin.

Bitcoin Cash is slowly heading towards irrelevance

Bitcoin Cash had a market cap of $4.6 billion, which will possibly allow the asset to stick around in the top 20 for the next few months. However, BCH’s reality seems inevitable.

It is quite difficult to see a future where Bitcoin Cash sticks around in the top-10 in the next 12-18 months. The sentiments were similar at the start of 2020. Now, Bitcoin Cash is just listing out more reasons.