What Bitcoin’s future holds as STH, LTH continue to tussle

- Bitcoin’s holders continued to show faith in the king coin.

- Miners turned hopeful as well, as exemplified by Bitfarm’s investment.

Bitcoin [BTC] has steadily stayed around the $37,000-$38,000 mark despite rising hopes about a move to $40k. However, this has not dulled the optimism of BTC enthusiasts in the slightest.

High on momentum

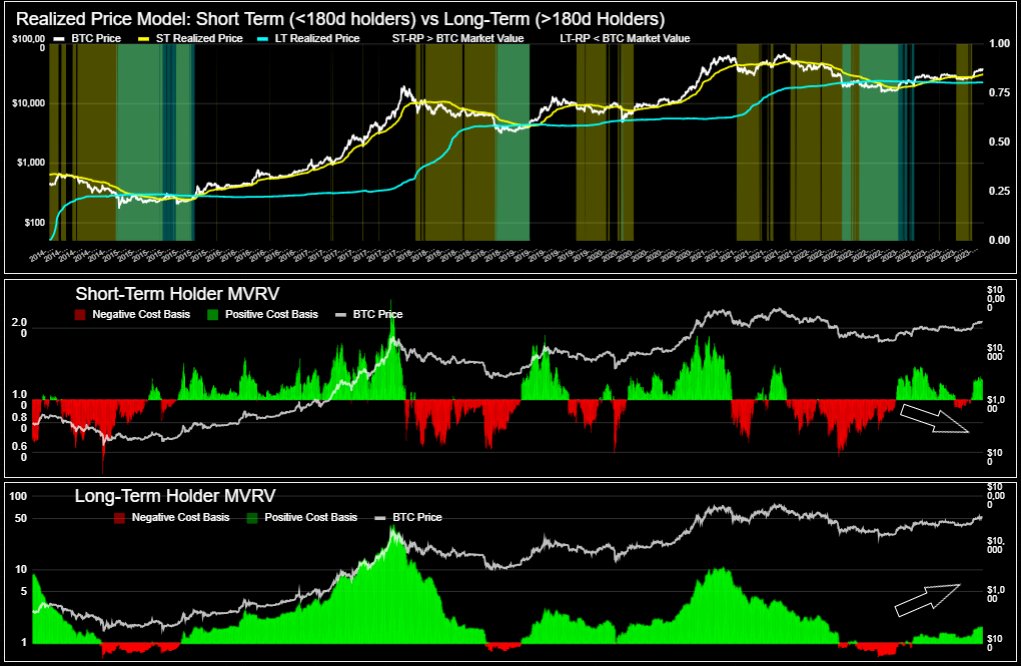

Bitcoin is experiencing strong momentum, coinciding with substantial holder positions. Signs of profit-taking are emerging, particularly among Short-Term Holders (STH), who historically impact prices despite being marginal liquidity holders.

Long-Term Holders (LTH) are holding firm as well, implying potential shallow price falls but indicating realized profits.

Weekly $BTC Onchain Notice!

Strong momentum coincides w/ strong holder positions

Signs of profit taking is becoming clear (from STH cohort). Despite STH's being the marginal liquidity holder, their decisions have historically impacted price

Key signs to? @santimentfeed pic.twitter.com/mT0S0HXw0n

— NeuroInvest Research (@Neuro__Invest) November 27, 2023

These observed trends, with their strong momentum and significant profit-taking among STH, suggest a nuanced impact on Bitcoin.

Long-term vs. short-term holders

If LTH continues to maintain its position, BTC may experience price stability, which could potentially limit the depth of price falls. This could act as a buffer against large market downturns.

However, the signs of realized profit, particularly among STH, showed a degree of market caution. This doesn’t massively alter the Long-Term (LT) thesis for Bitcoin. However, it does suggest that profit-taking activities might influence short-term price moves.

This trend mainly affects ST positions, not altering the LT thesis. An increase in the ratio implies that, on average, coins are becoming less dormant in the short term as compared to the long term.

Another model assessed how long coins remain unspent in wallets, measuring the ‘age’ of coins since their last movement. Another metric, Mean Coin Age, gauged “aggregate temporal structure,” highlighting a preference for movement over holding in the last 30 days.

The Coin Days Destroyed (CDD) indicator offers a subtle view by multiplying the number of coins in a transaction by the days since their last spend.

This provided insight into both the volume and age of coin movements. Notably, there has been a decreasing amount of available BTC as the king coin has shifted on-chain over the years.

This ongoing supply imbalance, alongside anticipation of the halving and ETF approval, may result in only minor price dips.

Bitcoin miners go all in

AMBCrypto noted that mining companies were getting hopeful around BTC as well. According to recent data, Bitfarms, a global Bitcoin mining company, has locked in an order for 35,888 Bitmain T21 miners at $2,660 each.

This move aligns with the firm’s strategy to secure hardware for 17 EH/s by H2 2024, and 21 EH/s by the end of 2024. Expected improvements include lower unit production costs, increased efficiency, and substantial hashrate growth.

Moreover, in H1 2024, the Paso Pe, Paraguay facility plans to increase production, expanding from 50 MW to 70 MW. This expansion, along with upgrades across other farms, targets a rapid growth in hashrate to 12 EH/s, a 90% increase from the 27th of November.

Is your portfolio green? Check out the BTC Profit Calculator

Another development in Yguazu, Paraguay, is set to contribute significantly to its organic growth in H2 2024, aiming for an initial 80 MW capacity with the deployment of 70 MW of new high-performance miners.

The large amount of money being put into mining rigs shows the high level of hope shown by the mining companies. Only time will tell whether their bets will pay off. At press time, BTC was trading at $37,335.79 and its price had fallen by -1.15% in the last 24 hours.