VanEck predicts Bitcoin inflows of over $2B in 2024

- VanEck’s data showed that BTC’s price could further surge in the future.

- Fidelity’s ETF came one step closer to approval.

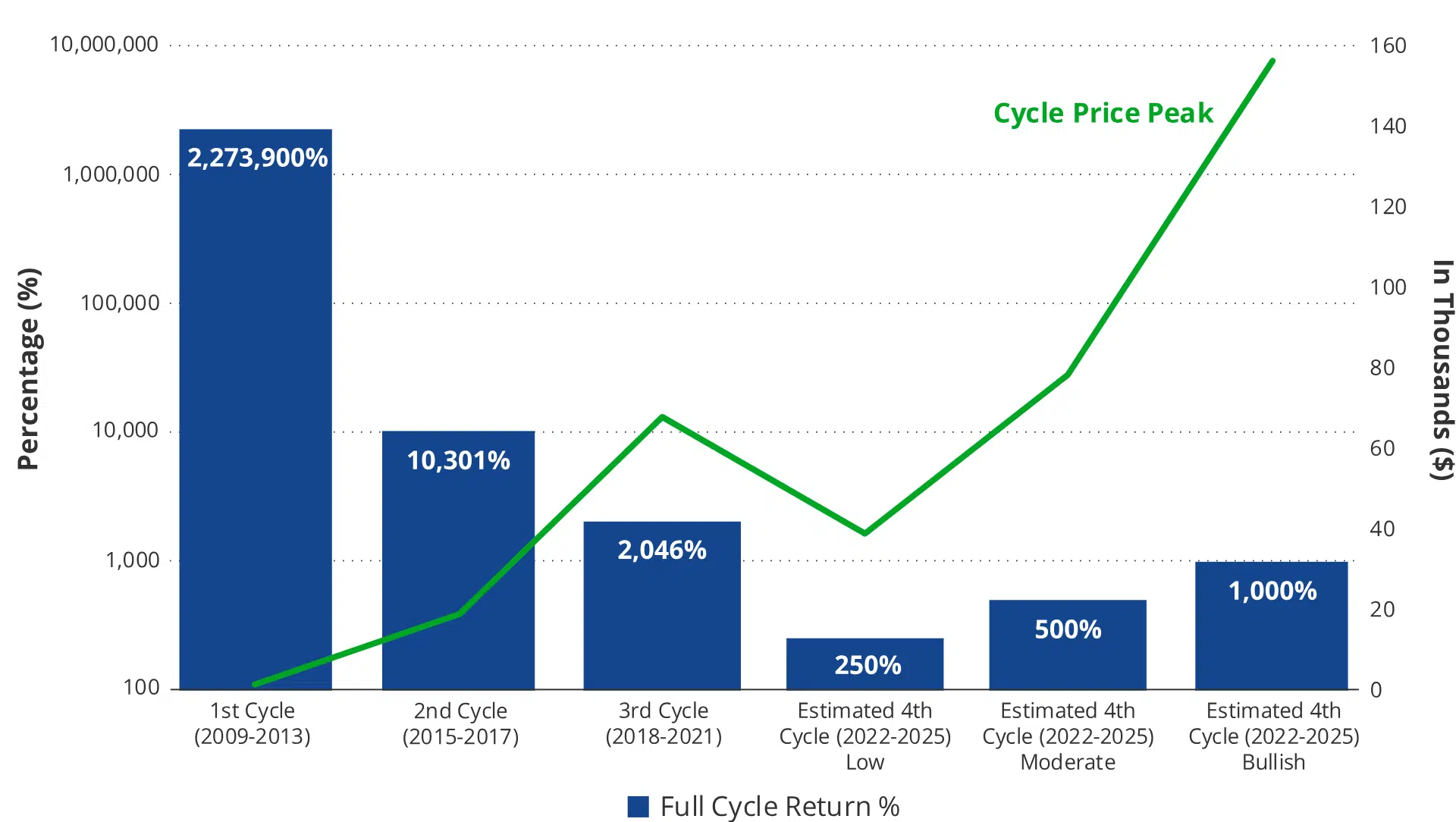

Bitcoin [BTC] has been inspiring optimism in the crypto sector for quite some time. However, institutional research suggested that BTC still had a long way to go.

More green for BTC?

According to VanEck’s research, the U.S. economy is anticipated to enter a recession in the first half of the new year. Several indicators, including slowing economic momentum, softening employment, and rising bankruptcy filings, point to late-cycle dynamics.

Bitcoin and gold experienced fluctuations during the previous recession, but Bitcoin is expected to remain resilient.

VanEck also pointed out Bitcoin’s performance during the 2020 recession. It initially dropped but rallied sharply after liquidity injections by the Federal Reserve. Gold also faced a decline in the early stages of the recession.

Due to these factors, anticipated inflows into newly approved U.S. spot Bitcoin ETFs in Q1 2024 are estimated to be more than $2.4 billion.

This projection is based on historical data related to the launch of the SPDR Gold Shares (GLD) ETF.

The analysis compares the potential inflows into Bitcoin ETFs with historical inflows into the GLD ETF. It also considers changes in money supply and interest rates.

The second half of 2024 is expected to bring significant volatility due to a high percentage of the global population participating as interest in BTC rises.

The possibility of regulatory changes and a favorable outcome for Bitcoin is possible, potentially leading to an all-time high.

ETF hype continued to grow

Additionally, Fidelity’s Bitcoin ETF is on the DTCC website as FBTC. When BlackRock listed their Bitcoin Trust on DTCC, a spokesperson clarified it doesn’t signal any pending regulatory issues.

The recent listing of Fidelity’s Bitcoin ETF on the DTCC website, known as FBTC, can bring good things for Bitcoin. When big companies like Fidelity show interest, it makes Bitcoin more popular and trusted.

The fact that it’s listed on a well-known platform suggests that there might be clear rules and regulations, making Bitcoin seem safer. This kind of confidence from big investors and companies could boost regular people’s trust in Bitcoin.

Additionally, when major players get involved, more people might start paying attention to Bitcoin.

Read Bitcoin’s [BTC] Price Prediction 2023-24

This increased interest can lead to the price going up. It also helps Bitcoin become more accepted in everyday life when big companies show they believe in it.

At press time, BTC was trading at $43,367.5 and its price had fallen by -1.3% in the last 24 hours.