USDT, USDC on track to record another successful month in January

- USDT solidified its position with more than 70% market share.

- USDC’s market cap rose for second consecutive month.

Stablecoins continue to be an important barometer of the digital asset market’s health.

An increase in stablecoin supply typically suggests increasing capital inflows into the crypto market. This is because most traders from traditional markets would use stablecoins to enter and exit trades on crypto exchanges.

Stablecoins continue their winning streak in 2024

According to the latest report by digital assets market data provider CCData, the stablecoin sector extended its winning streak into the new year.

The total stablecoin marketcap rose 2.45% to $134 billion as of the 16th of January, marking the fourth straight month of growth. This was also the highest market value of stablecoins in nearly an year.

The first month of 2o24 proved to be historic for cryptocurrencies as the long-awaited spot Bitcoin [BTC] ETFs were officially cleared for trading in the U.S. market.

The positive sentiment prompted investors to give space to cryptos in their portfolios, in turn creating demand for stablecoins.

As of the 10th of January, $579 billion in stablecoins had been exchanged, with the figure anticipated to surpass December’s total of $995 billion.

USDT hits fresh ATH, USDC sees hope

Being the largest stablecoin, Tether is considered a bellwether for stablecoin sentiment in the market.

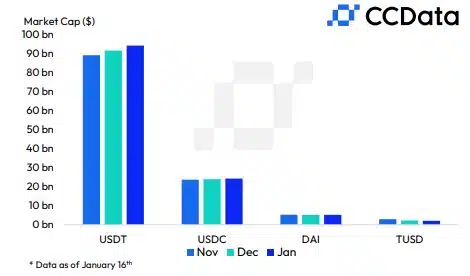

USDT’s market cap jumped 3.61% to $95 billion in January, setting a new all-time high (ATH). With the latest move up, the king of the stablecoins recorded its fourth straight month of market value growth.

USDT solidified its position with more than 70% market share of the stablecoin landscape, the highest since December 2020.

There was also a ray of sunshine for the second-largest stablecoin USD Coin [USDC].

The market cap rose 2.02% to $24.5 billion in January, marking the second consecutive month of growth following eleven months of decline.

Recall that last year’s banking crisis brought about a slump in USDC’s supply. The stablecoin failed to recover from the blows inflicted during this time and ended up losing 45% of its market capitalization in 2023.

TUSD depegging hogs limelight

Another key stablecoin-related event which grabbed the headlines thus far in 2o24 was the depegging of True USD [TUSD]. The stablecoin dropped to as low as 98 cents on the 15th of January amidst massive redemptions in favor of USDT.

What followed was a sharp decline, with TUSD falling behind First Digital USD [FDUSD] as the fifth-largest stablecoin by market cap.

The report also noted a steady decline in TUSD trading volumes in recent months, tumbling to $6.96 billion in December when compared to the yearly peak of $60 billion in June.

The rise of FDUSD

To the contrary, FDUSD continued to ascend. The Binance [BNB]-backed stablecoin increased 16.6% to $2.10 billion in January, recording a 7-month winning streak since its launch in July 2023.

Also unlike TUSD, FDUSD trading pairs have clocked high volumes over the last few months. Moreover, the stablecoin pair was on track to register a higher volume in January, compared to December’s ATH of $81 billion.