Turning to Traditional Assets: COVID-19 and the Impact on Bitcoin Traders

Short Description: The COVID-19 pandemic has caused traders to turn away from risky cryptocurrencies like Bitcoin to traditional assets like stocks, oil, and more. With a recession on the way, and the COVID-19 outbreak spiraling out of control, traditional markets are exploding with volatility – the perfect environment for traders to profit from.

The record-breaking volatility across the stock market, commodities, and more, has prompted traders to ditch high-risk cryptocurrencies like Bitcoin, and toward testing their skills and strategies on other, more currently interesting assets. For traders who don’t want to sit idly by and let profit opportunities pass, they can sign up for the PrimeXBT trading platform and utilize advanced trading tools designed to profit from whichever direction the market turns, and better manage risk during the explosive volatility.

Introduction to the Changing Financial Landscape

The novel coronavirus that originated in Wuhan, China, in just four months went from discovery to widespread outbreak and a global pandemic, unlike the world, has ever seen. The sheer disruption alone caused by the state of lockdown impacting all industries has in just a few short weeks crippled the economy and caused a historic soar in initial jobless claims across the world.

The virus affects the respiratory system of those with weakened immune systems and causes flu-like symptoms, even death. The pandemic has now infected over one million people and each day the number is climbing. Lockdowns are proving to do little to flatten the curve and slow the spread of the deadly outbreak.

Beyond the risk to human life, the economy faces its biggest challenge yet, and governments scramble to maintain order and prevent a total collapse by printing trillions of dollars at whim. However, even that has had a little positive effect on picking up the economy.

The shakeup is affecting all areas of life, from simple tasks like grocery shopping to how consumers spend, save, and invest.

Reevaluating Risk Exposure Ahead of Post-Pandemic Recession

In the week that ended March 28th, 2020, a record-breaking 6.6 million Americans filed jobless claims. The number brings the first two weeks of the coronavirus quarantine-related jobless claims to over 10 million.

All major nations show similar numbers of record job loss, and the impact of the pandemic is only just beginning to be felt.

Governments have had to step in and issue relief and stimulus packages to save corporations, small businesses, and individual taxpayers from falling into bankruptcy. With people beginning to worry about losing their jobs and how they’re going to continue to put

food on their plates, they’re taking a step back to review budgets to penny pinch and find ways to get the most mileage out of their money.

It’s caused the world at large to reconsider many things, including their regular spending habits, how much they have saved away for a rainy day, and if it is time to cash out existing investments or make new ones.

The very real fear is that a recession – potentially the worst the world has seen in decades – is likely just around the corner, is prompting these changes in behaviors. As panic first set in, a massive, historic selloff swept all financial markets, from stocks to precious metals, to commodities, to forex and cryptocurrencies and everything in between. Those first to sell are happy they did consider markets have since suffered some of the worst losses on record. Those who held through it are now left wondering if the worst is yet to come,

or if a relief rally is just around the corner and selling now is a waste.

As investors consider their risk exposure, they may rethink some of the riskier assets within their portfolio and seek to liquidate them to de-risk, reallocate capital, or cash out completely. Others, sick of paper losses may move their capital to trading platforms to trade their way back to profitability.

FOMO No More: Cryptocurrencies Become Less Interesting During Crisis

With investors reconsidering and reevaluating their risk exposure, the asset class taking the biggest hit are cryptocurrencies like Bitcoin, Ethereum, Ripple, Litecoin, and EOS. These digital assets are based on emerging technologies that offer much promise and potential,

but are years, or perhaps decades away from finding a regular use-case and reason to exist beyond proof-of-concept.

Because these assets are so new and untested, their valuations are based on hype and speculation rather than fundamentals and financial figures. Bitcoin was created during the last recession, in 2008. The cryptocurrency’s creator sought to design a completely decentralized digital replacement for cash, removing the need for a third- party mediator such as a bank or government entity.

The asset is considered among the best-performing assets of all time, growing from virtually worthless at its inception, to over $20,000 at its all-time high in late December 2017.

During that time, the stock market was surging, and wealth was in abundance. The coronavirus was the furthest thing from people’s minds. Investors FOMOed into the cryptocurrency market over the promise of the new tech, forming a bubble. The bubble later popped, and the asset class collapsed in value by as much as 90% or more in many cases. Many cryptocurrencies are still down by as much as 90% or more in many instances, showing just how risky these assets can be.

After two years of a bear market, these assets looked to be ready to thrive once again, but the coronavirus selloff that swept the stock market spilled over into cryptocurrencies and Bitcoin as well. Bitcoin has been showing its strongest correlation with the stock market since it first was released. The correlation, however, is likely due to the human behavior impact of the coronavirus, as the same-minded investors are selling off both stocks and cryptocurrencies to prepare for the worst.

Crypto Traders Turn To Traditional Asset’s Amidst Coronavirus Market Chaos

It was Bitcoin’s correlation with another asset that first started the crypto trader’s love affair with traditional assets. In 2019, as tensions between the United States and China began to mount and grow into a trade war. Fears over what this may do to the economy, investors began moving their money into gold – the original safe-haven asset.

Gold has been used in trade for thousands of years, has been utilized as a currency, and has been the go-to store of wealth for ages. When a crisis hits the economy, investors over their money into precious metals. Bitcoin is said to share many of the same attributes as gold, earning it a “digital gold” nickname and a reputation as an asset that should, in theory, behave like a haven like gold, due to the

assets having a very limited supply.

Bitcoin and the cryptocurrency bear market also turned many investors into traders, as eventually those who bought into the hype bubble of 2017 got fed up with paper losses, and instead began trading on Bitcoin-based margin trading platforms to earn back their money. These platforms have surged in popularity ever since, as the profits possible through these platforms are undeniable.

Between crypto investors turning into traders to prevent losses and a growing interest in traditional assets as time goes by, the current record-breaking volatility across traditional equities markets, precious metals, forex, commodities, and more, are just too attractive of profit opportunities to crypto traders to pass up.

More and more traders are ditching cryptocurrencies to take advantage of the opportunities around every corner in traditional markets.

Record-Breaking Volatility Rocks Oil, Gold, Stocks, and More

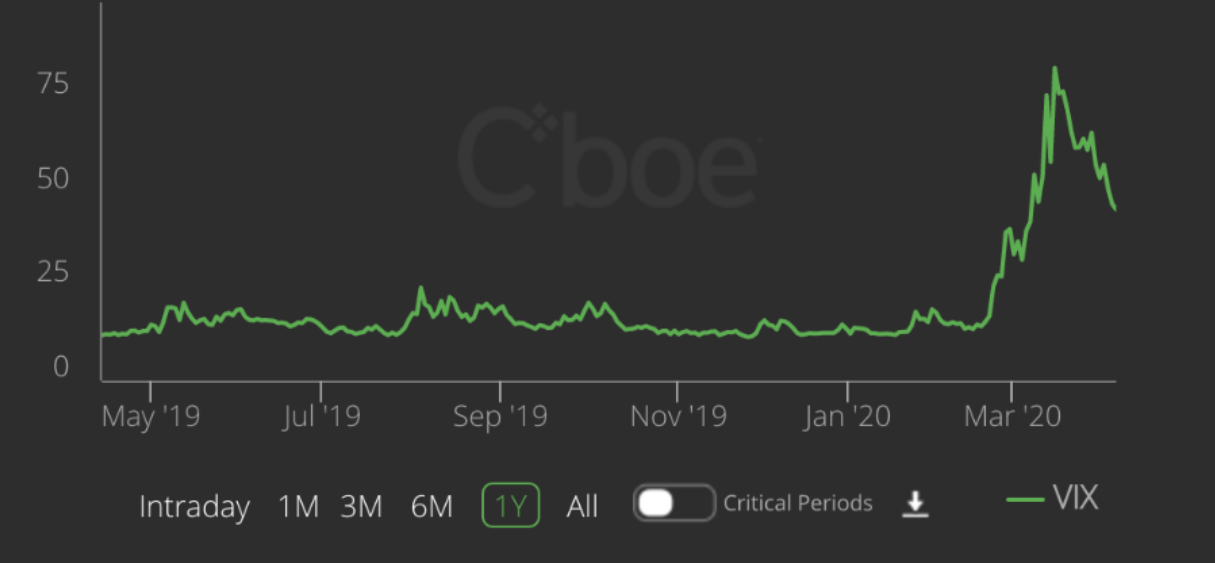

It isn’t just unemployment that’s breaking records, it’s also the volatility that is rocking the world of finance currently.

In mid-March, the Dow Jones Industrial Average, one of the largest major stock indices, plunged by over 10% to set its worst day on record since October 1987’s Black Monday. The S&P 500 suffered the worst quarterly performance in its entire history.

Germany’s benchmark DAX index was down 40% just four weeks after setting a record high. It was the fastest drop in the indexes’ history. Japan’s NIKKEI posted the biggest fall in nearly three decades with the largest intraday point drop since April 1990. The FTSE 100 has posted its worst quarterly fall in over three decades, the worst since Black Monday in October 1987.

Outside of the stock market, other assets are just as volatile.

Gold volatility has reached the highest level since November 2008 and is primed to set a new all-time high in the days ahead as the world prepares for a coming financial crisis. The physical precious metal as gold bars remains in tight shortage, with nearly every major bullion supplier experiencing supply chain issues.

Oil also dropped to the lowest prices in decades as demand for the commodity has dwindled as a result of an economy left at a standstill. Shortly after the losses, oil prices had record-breaking rallies following announcements that production would be cut in Russia and Saudi Arabia – two major producers.

Even the highly volatile cryptocurrency asset class saw record-breaking drops, with Bitcoin falling by over 50% in less than 48 hours, and many other cryptocurrencies falling by 70% or

more in 24 hours.

Profits Abound For Traders With The Right Tools and Platform

With markets in such chaos, and collapsing, therein lies two incredible opportunities. Investors can look to buy the bottom of the fallout for a once-in-a-lifetime financial opportunity, and traders can profit from each major price movement, regardless of the direction the market turns. Those who bought the bottom of the last major economic recession went on to find incredible success and generate enormous wealth. The same chance is there for any other investor to take, but actually, timing when to buy the bottom is tricky.

Instead, traders can profit left and right, as prices trend up and down amidst the peak volatility.

When prices are falling during periods of panic or when negative news is released, traders can short the market and profit from falling prices. During rebounds or when stimulus packages are announced, or when the coronavirus curve is eventually flattened, traders can long any recoveries, short-lived or long-term.

And when traders diversify their portfolio across a variety of asset classes, utilize profit-generating tools such as take profit and stop-loss orders, the most risk associated with trading can be kept to a minimum. The biggest ace up the sleeves of traders is leverage. Leverage lets traders gear their traders by putting capital up for collateral and letting traders take positions with a much larger portion

sizes than what the capital would otherwise allow.

This not only amplifies any profits by the leverage applied, but it also means less capital is put on the line to take sizable portions that turn even what would be tiny trades into big profits. Investors sick and tired of watching the paper losses in their portfolio apps from further piling up can give day trading a try. And by using leverage and the risk mitigation tactics mentioned, even new investors can quickly become profitable traders with the right platform. Whatever the scenario, there’s never been a more profitable time to be a trader, even if investors are currently taking a beating.

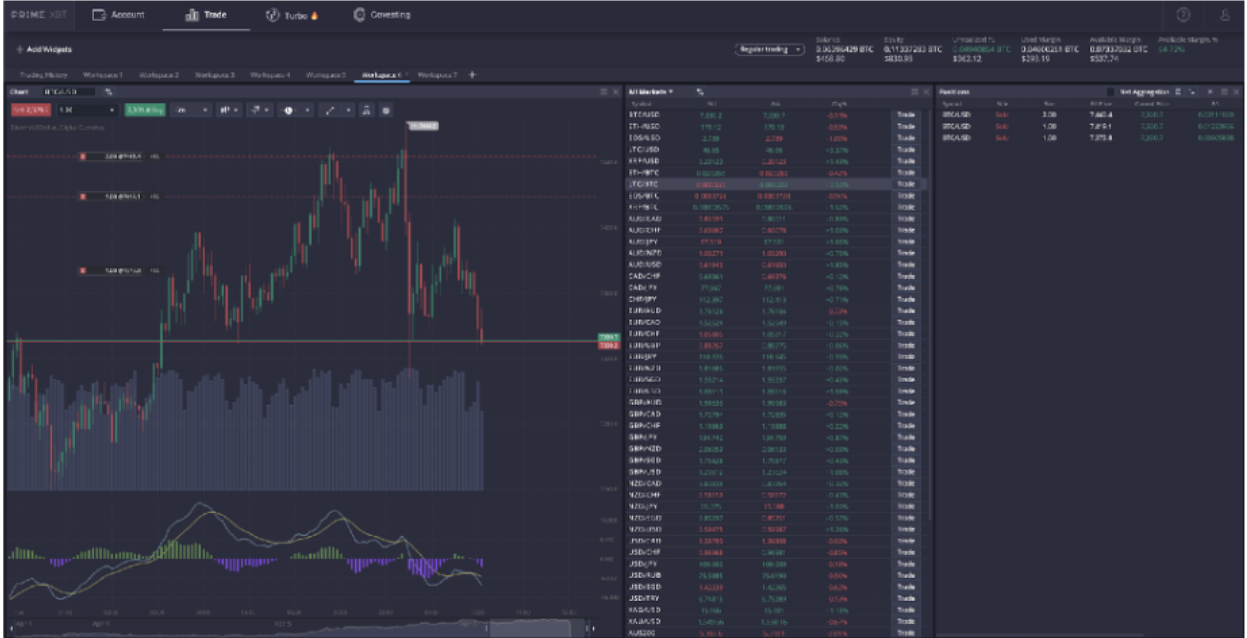

Award-Winning Bitcoin Margin Trading Platform PrimeXBT Offers Over 50 Assets

PrimeXBT is an award-winning platform that every Bitcoin trader, investor, or otherwise should consider, due to the platform offering leverage of up to 1000x on over 50 different assets – ranging from cryptocurrencies like Bitcoin and Ethereum to traditional assets like stock indices, commodities, and the world’s most popular forex currencies.

The stock indices offered by the platform include all of the major stock indices that recently set records for extreme volatility. The platform’s commodities include natural gas and both WTI and Brent oil. Nearly all of the most traded forex currencies are included, as well as CFDs for gold and silver.

While traditional traders may opt for Saxo Bank or other interactive brokers, savvy traders and those familiar with the technology surrounding cryptocurrencies prefer a Bitcoin-based margin trading platform, like the ADVFN award-winner PrimeXBT. A base currency of Bitcoin offers traders the flexibility of quickly and easily entering CFDs for commodities, stock indices, forex, and more. The advanced trading platform offers built-in charting software, risk mitigation tools like stop-loss orders, profit-generating tools like take profit orders, and up to 1000x leverage on over 50 different assets.

Professional traders can utilize the platform’s innovative tools, such as Turbo or the Covesting Fund Management Module.

Novice traders seeking to learn how to trade can visit PrimeXBT’s extensive help center filled with tutorials, and if they run into any issues, the platform offers 24/7 live support chat. Traders on the go can rely on a free mobile app for Apple iOS devices and

Android smartphones, available as a free download from the App Store and Google Play Store. Beyond just trading alone, clients are offered additional income streams through lucrative, revenue-generating referral programs and CPA offers. The referral program runs an aggressive four-levels deep of referrals, letting users grow an extensive network in no time at all.

The platform’s most active traders are rewarded with a progressive discount system for fees, effectively lowering fees by as much as 50% depending on the level of trading turnover. With a customizable user interface, low minimum deposits, and new account registrations taking less than 60-seconds with no KYC required at all, signing up for PrimeXBT is the only remaining step standing in the way between you and profits.

Conclusion

Register for a free PrimeXBT trading account today, and stop leaving the profits behind during these times of rare and extreme volatility. Yes, markets are crashing, but with PrimeXBT, you don’t need to let falling prices mean money lost. Instead, learn to profit from markets whichever way they turn, and take advantage of the coming economic crisis, rather than be crushed by it.

Disclaimer: This a paid post, and should not be treated as news/advice.