Altcoins

Toncoin: Why the altcoin market surge did not affect TON

Toncoin’s infrastructure growth paints an impressive picture as its TVL reaches $596 million.

- TON has retained the $6.3 price range.

- However, there was less activity from its daily active addresses.

Toncoin [TON] has experienced substantial growth in its blockchain infrastructure over recent months, achieving a record number of wallet addresses. Concurrently, the Total Value Locked (TVL) on its platform has shown a notable upward trend.

However, the number of active addresses on the Toncoin network has followed a more consistent and steady pattern, without significant fluctuations.

Toncoin sees a spike in addresses

Data from IntoTheBlock indicated a remarkable surge in Toncoin’s wallet addresses. The data showed that the number soared from approximately 3.6 million in January to over 39.5 million at press time.

This growth signified a significant expansion in on-chain activity over the year.

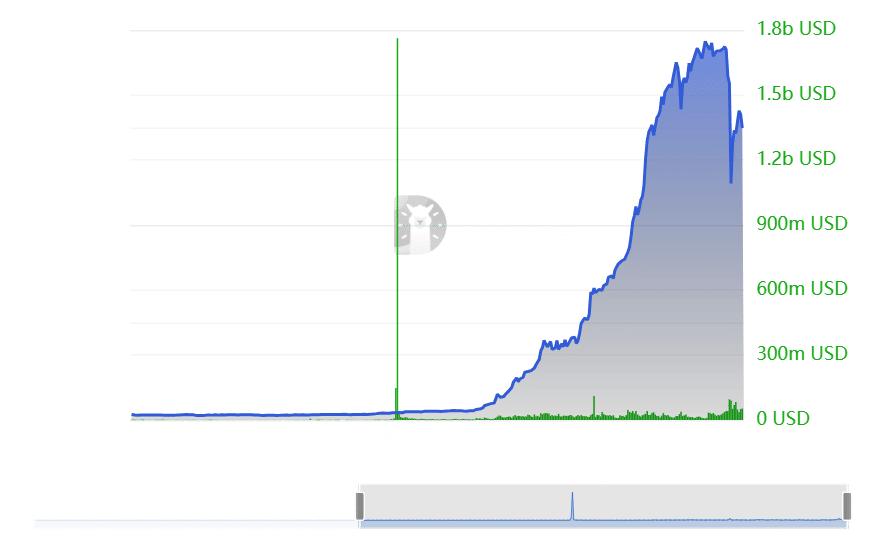

AMBCrypto’s analysis of Toncoin’s Total Value Locked (TVL) from DeFiLlama corroborated this trend of increasing blockchain engagement. The data showed that TVL rose sharply from around $14 million in January to over $596 million at press time.

However, it’s important to note a recent downturn, as the TVL peaked at over $750 million on the 29th of July before declining to its current levels.

Toncoin sees less spike in token addresses

AMBCrypto’s look at Toncoin’s daily active addresses revealed a modest but steady trend over recent months. The trend, however, doesn’t quite match the explosive growth seen across the broader network.

The peak number of daily active addresses in the last four months was 981 in April. At press time, the number was 400.

This month’s highest activity recorded was about 741 active addresses, indicating a significant variation in daily engagement on the Toncoin network over time.

TON sees less excitement

Toncoin’s price trend has displayed considerable volatility over the past few weeks, according to analysis of its daily time frame chart from AMBCrypto.

This volatility is visually captured by the widening of its Bollinger Bands, which typically indicates increased market volatility due to significant price moves up and down.

Is your portfolio green? Check out the TON Profit Calculator

As of this writing, TON was trading at around $6.3, showing a modest increase of over 1%. This slight rise followed a less than 1% increase in the previous trading session.

However, it still fell short of compensating for the over 6% decline experienced two sessions earlier.