Tokens with low market caps, high ROIs have concentrated token distributions & can be easily manipulated

LongHash’s latest analysis of the top 1000 ERC-20 tokens by market cap has found that the tokens with low market caps have more concentrated token distributions, making it easier for the issuer to manipulate their price.

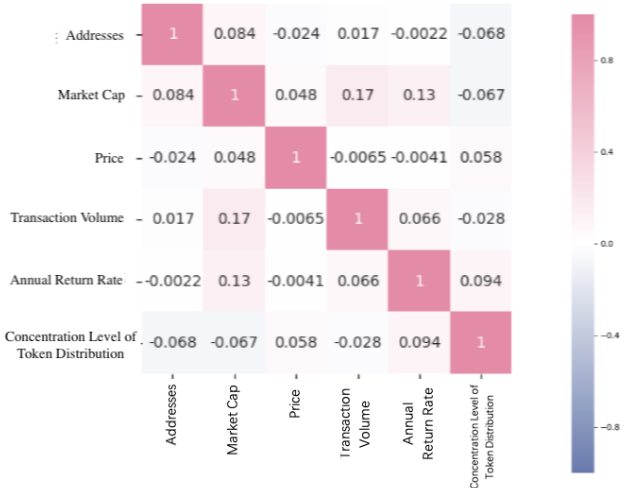

After excluding tokens and stablecoins with more than one billion in market cap, 900 projects were studied based on metrics including price, YTD return rate, transaction volume, number of addresses holding tokens, market cap, the percentage of tokens held in the token’s top 20 addresses and concentration level of token distribution, which excludes exchange addresses and other addresses holding large sums.

Among the 900 projects that the data journalism platform analyzed, 12 had a market cap of more than $100 million, while 81 of them ranged between the market value of $10 million and $100 million. A significant majority, 813 projects, had a market value of less than $10 million.

It was found that more than half of these tokens had posted a negative return rate, while a mere 38 tokens registered an astonishingly high ROI of over 500%. LongHash said,

“Most of those 38 tokens with phenomenal returns have a rather high concentration level of token distribution. In fact, for most, this level is beyond 60%, with some even exceeding 90%, meaning that 60% to 90% of the total token value is held in the top 20 addresses.”

Despite the fact that the return rate of a token is not directly correlated with its token distribution, LongHash concluded that tokens with low market caps, mostly those with low prices, have more concentrated token distribution and are easily manipulated by the issuer or a group of coordinated actors.

Source: LongHash | Correlation of tokens with market cap >10 million

It was also noted that in the case of tokens with a market value of less than $10 million, the correlation between the return rate and concentration level of token distribution has increased. This was indicative of low-cap tokens; the more concentrated a token’s distribution is, the more likely it is that the token will generate high returns.