This metric signals a bullish Bitcoin resurgence

The fickle nature of digital assets often rubs on to the traders, which leads to hasty decisions in the market. Unlike the traditional market, the movement of Bitcoin is fast-paced and the current movement facilitated by Bitcoin is the prime example.

While many expected Bitcoin to fight off the resistance at $11.1k a few days back, the asset’s inability to breach above has caused a little bit of panic. Speculations of strong correlation with the stock markets are making headlines, and certain users are drawing similarities to the March crash. However, patience is a virtue most required in the space at the moment, as fundamentally, a list of important metrics are finally adhering uniformity.

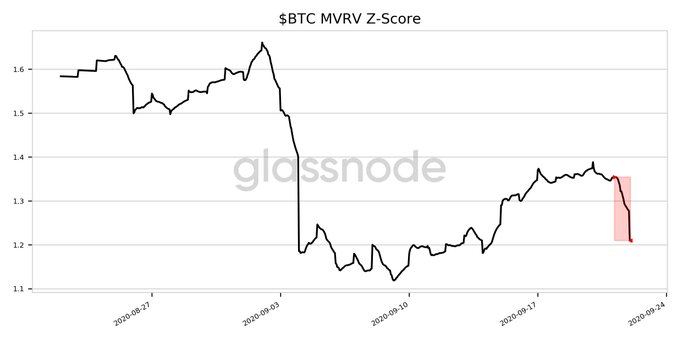

For Bitcoin, it starts with the recent drop in MVRV-z score.

Source: Twitter

According to the above glassnode chart, Bitcoin MVRV Z-Score has decreased significantly in the last 24-hours after the market plunged close to $700. This particular metric is used to identify and assess when Bitcoin is over/undervalued relative to its fair value, and the current data suggested BTC is undervalued at present.

So what seems like a detrimental turnaround should be observed from the angle that a score of 1.210 is near the bottom side of the chart. Hence, it most likely means that Bitcoin is nearing its bottom and a prominent bullish is possibly right in front of it in a few weeks of a couple of months.

Now, in order to confirm such a situation, it is important to look at other metrics as well, and the explanation becomes clearer. Bitcoin percent addresses in profit have also declined significantly over the past 24-hours, alongside a drop in Relative UTXOs in profit.

The importance of these two supposedly bearish signs are that the market is shuffling out the weak hands. In order for the market to pump, some of the sellers would definitely exit now as the buyer absorbs the selling pressure.

Will the Stock-Market Correlation play a role?

Not in the long-term, No. It is important to note that synchronized movement in the short-term is not the actual representation over the long term between BTC and the rest. Bitcoin pumped 2 weeks before any of the major stocks indicated recovery during the March crash, so the correlation at the moment is irrelevant over the horizon.

Surely, the markets are correlated in a way, that sudden outburst of volatility permeates through the entire financial industry, but it does not stick. A re-set will take place, and Bitcoin’s price is possibly looking at a profitable Q4 2020.