This makes Bitcoin appear inexpensive

The cryptocurrency market has entered the final quarter of the year and the anticipation in the market for a price swing has been high. The Ethereum market didn’t just want to witness a boost in the price but also demanded a decrease in the network’s transaction costs. However, after looking into the hype-driven ETH market, researchers are suggesting that the demand may not be fulfilled. As high transaction fees on Ethereum become a norm, it is in turn making Bitcoin’s transaction costs seem rather inexpensive.

Ethereum transaction fee woes

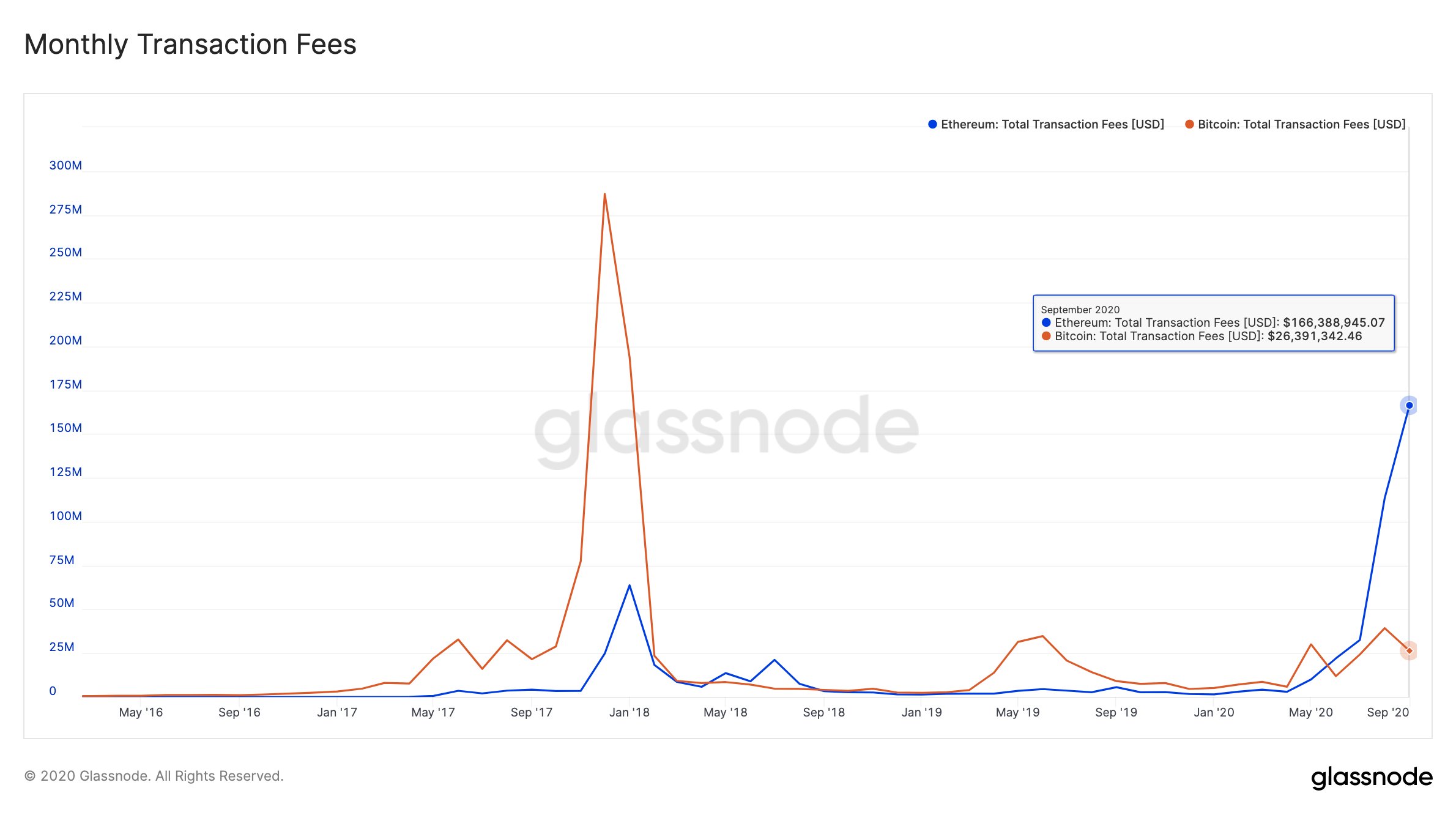

The on-chain data provider Glassnode noted that Ethereum miners made a total of $166 million from just transaction fees in September. The chart below noted the increase in fees was close to 47% compared to the previous record high charted in August.

Source: Glassnode

By now it is clear that decentralized finance [DeFi] has been responsible to drive up the transaction fees, however, the only benefitting party remains the ETH miners and of course, the ETH network. While many expect the fees to return to normal if/when the so-called “Defi bubble” pops, according to Nate Maddrey, a researcher with CoinMetrics, “high gas prices are becoming the new norm.”

The launch of few DeFi projects like UNI, SUSHI, YAM, and YFI has led to the dramatic rise in network fees. Maddrey noted that high fees will make it prohibitively expensive for some users to send transactions. The researcher added:

“Fees are not proportional to the amount of value transferred – sending $100 or $100K would cost the same amount of ETH in fees. Therefore high fees tip the scale towards whales and users who are transferring relatively large amounts, while making it harder to turn a profit investing small sums.”

Ethereum fees vs Bitcoin fees

The growing fees have made transactions on Bitcoin appear inexpensive. The Glassnode chart also highlighted the vast difference between the fees of the two assets. Whereas the BTC miners in contrast to ETH miners made $26 million from fees in September which was a difference of more than 6x.

This was the first time the cumulative fees of ETH in 2020 has exceeded that of Bitcoin’s, but the small-time traders have barely anything to take away from this. With the growing fees, the utility of Ethereum is being questioned and it may be entering a different league than other cryptos as it becomes as expensive as the centralized systems.