The dynamics of Ethereum’s soaring fees and fluctuating fortunes

- Ethereum fees per transaction rose to its highest level in months.

- ETH Price and volume have gradually declined in the past few days.

The rise in Ethereum [ETH] prices caused a predictable increase in daily transaction fees. As these daily fees increased, they had a notable effect on the overall network fee as well.

Ethereum fee per transaction rises

In a recent Santiment post, it was highlighted that Ethereum transaction fees reached their highest point since July.

AMBCrypto’s analysis of the fee chart revealed a peak of $5.72 per transaction on 13th November. The surge in fees coincided with the upward movement in Ethereum’s price starting around 22nd October.

However, as of the latest update, the fee per transaction has decreased to approximately $3.61. Also, this decline suggests a reduction in the number of transactions, contributing to the fee decrease.

Despite this drop, it’s noteworthy that the fees remain within the range of the highest observed in the past three months.

Network fees see highest volume in months

The increase in Ethereum’s transaction fee had a favorable impact on network fees.

According to the analysis of the fee chart on Crypto Fees, the network fees began to climb around 25th October, escalating from approximately $1 million to over $5 million.

Despite some fluctuations, the overall trend indicated a consistent upward movement in fees. The chart highlighted a peak in network fees, surpassing $12 million in recent months.

However, at the time of this update, the network fee decreased to approximately $9.2 million.

Ethereum volume and price dips

The decline in both network fees and transaction fees can be attributed to a decrease in trading volume and a drop in ETH price.

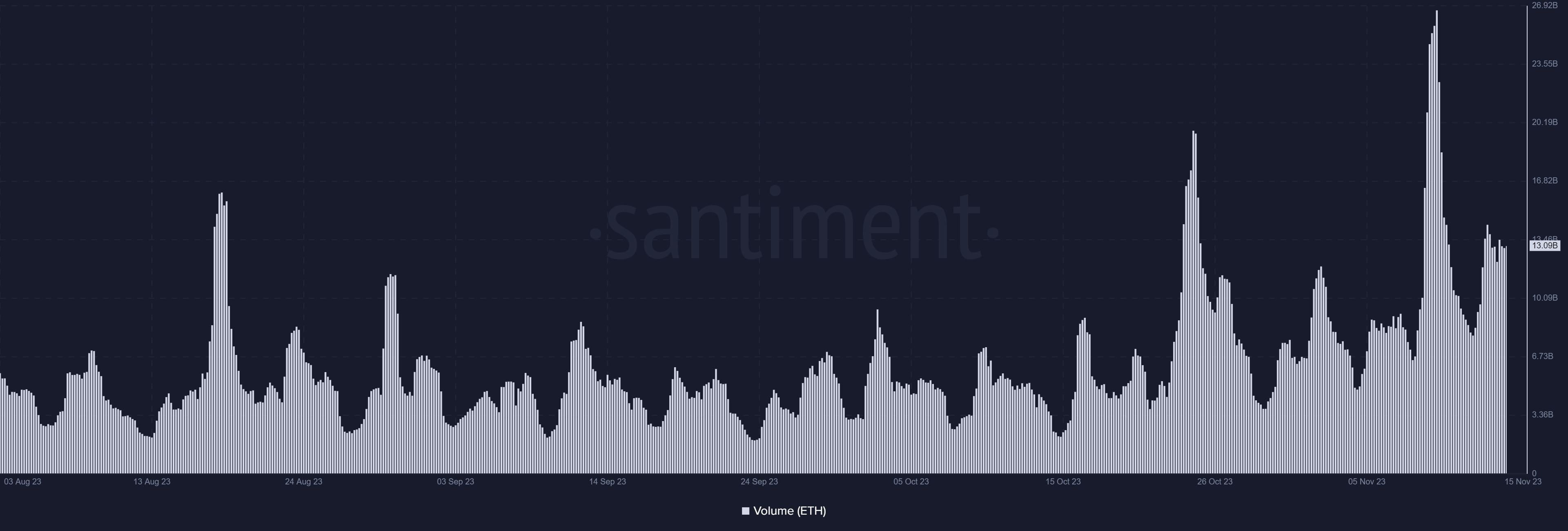

AMBCrypto’s examination of the volume chart on Santiment revealed a notable decrease from the levels observed during the recent price surge.

The volume, which was over $20 billion a few days ago, has since fallen to around $12.6 billion at the time of this writing. CoinMarketCap data also indicated a more than 6% decline in volume over the last 24 hours.

How much are 1,10,100 ETHs worth today

Additionally, AMBCrypto’s assessment of the daily price trend highlighted a downward trajectory for Ethereum. The chart indicated a nearly 6% loss in ETH’s value over the past few days, with minimal gains.

As of the latest update, ETH was trading at approximately $1,980. This combination of reduced trading activity and a declining price suggests a waning sense of excitement in the market. Also, it could potentially explain the drop in both transaction fees and total network fees.