Tether’s market cap hits $7B as Bitcoin continues to move sideways

On Saturday, Tether, the world’s largest stablecoin, strengthened its position in the ecosystem after its market cap hit $7 billion. This increase in Tether’s already significant share in the stablecoin market comes at a time when the markets have been gripped by fear and panic, with the Coronavirus pandemic pushing the world off-balance.

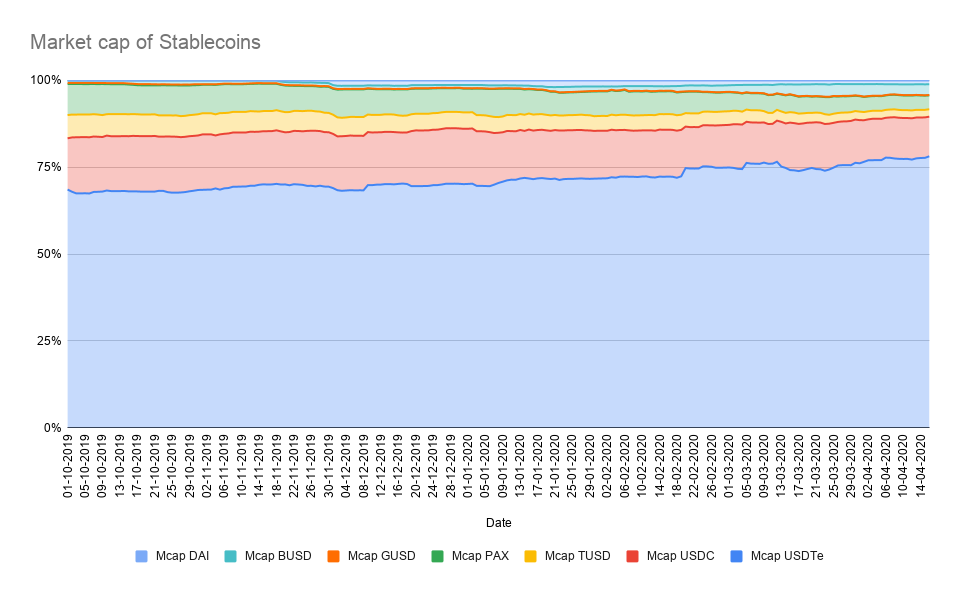

While the market cap of Tether has hit the $7 billion-mark, other stablecoins are nowhere near it. The chart herein attached represents Tether’s dominance in the stablecoin market.

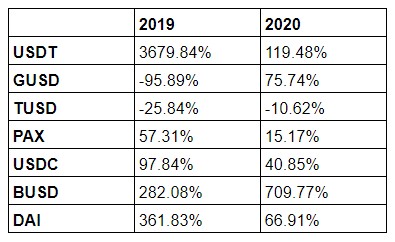

Although Tether has grown quite a lot in the last quarter, other USD-based stablecoins have also been on the rise during the ongoing pandemic. Below is a table that shows the increase in USD-based stablecoins’ market share over 2019 and 2020.

Although Tether continued to increase its market share significantly in 2020, the percentage rise in its market share was overshadowed by Binance’s BUSD recording a 709.77% hike. This is an interesting observation since back in 2019, USDt recorded a percentage hike in market share that was significantly higher than that of BUSD’s (It should be noted that BUSD was only launched in September 2019) However, despite such astronomical rises, Tether continues to be the market’s biggest stablecoin.

It should also be observed that other stablecoins, most notably USDC, also registered a stark increase in its market share.

With the U.S dollar continuing to hold the reins of being a global reserve currency, gaining exposure to it during times of uncertainty and panic would be one of the best options for investors. Others include investing in safe-have assets.

Furthermore, a recent Skew markets’ tweet also mentioned that USDt has consistently had the highest premium. The premium comes at a time when there is abnormal demand for an asset. Take, for example, the Kimchi premium, which was a premium for Bitcoin in South Korea. This premium was born out of excessive demand in that particular area. Premiums also show up at a time of frenzy, like when the markets are excited/scared and are trying to enter/exit it.

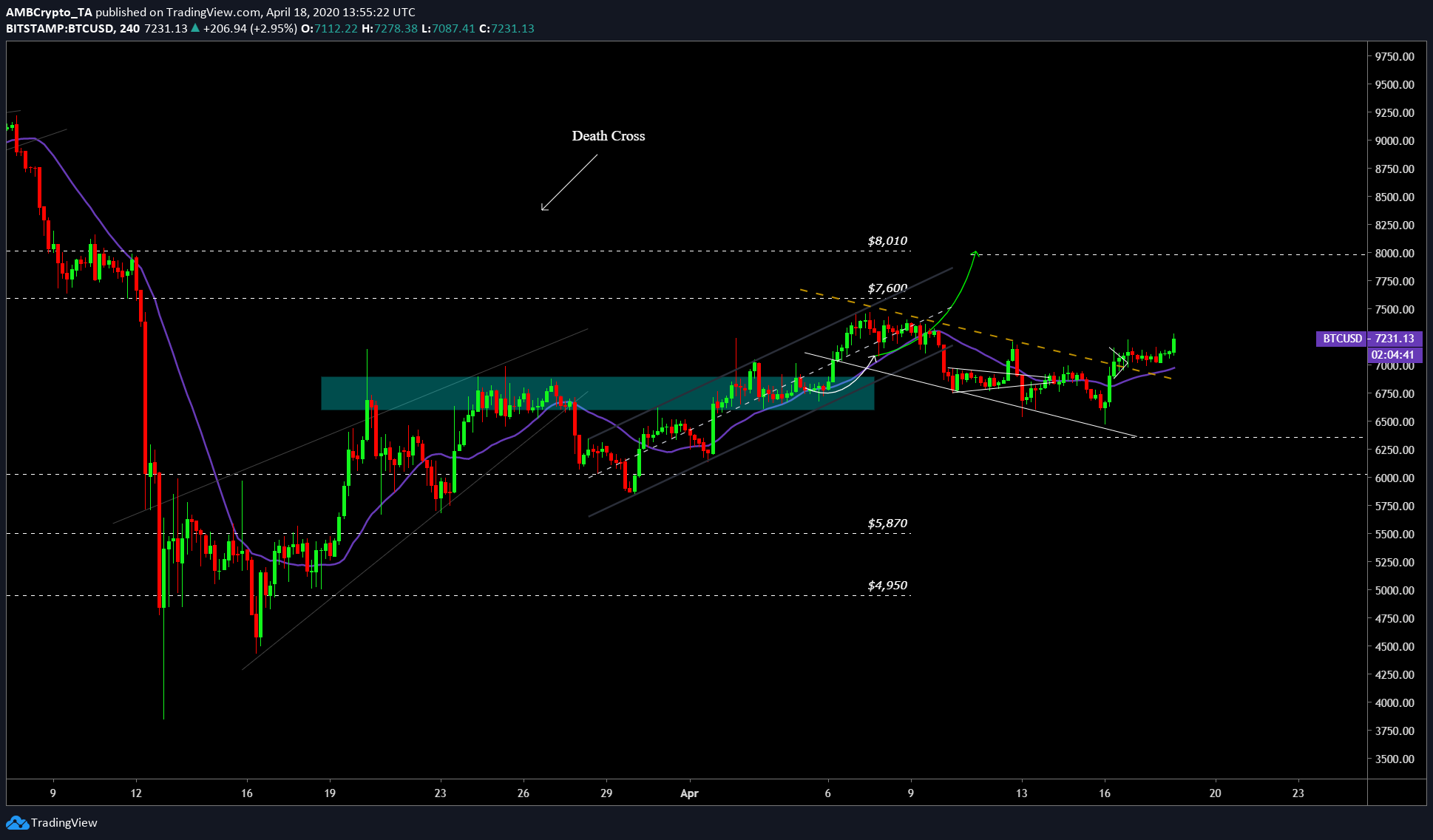

An important thing to note here is that although Tether’s market cap has increased, Bitcoin’s price has been sulking in the $6,000 to $7,500 region for quite some time now. A reason behind the absence of a Bitcoin’s price surge may be because USDt tokens are authorized, but are not issued.

Source: BTCUSD on TradingView

At press time, Bitcoin’s price had surged by 2.95% in the last hour with its price recorded to be $7,231. It had broken out of the parallel channel, indicating a bullish future for the coin.