Tether, Bitcoin, and how to revive the passé 60/40 investment rule

In light of rising institutional interest and Bitcoin’s press time RoI of 53.17% YTD, it may be the right time to evaluate what comes after 60/40. Once the mantra of Wall Street Bulls, 60/40 is now a passé strategy. Allocating 60% broadly to stocks and 40% to bonds assured relatively good returns with low-risk exposure back in the 80s and 90s. Fast forward to 2020 and now, alternative investors are eyeing Bitcoin to balance the performance of portfolios afflicted by the Fed’s 0 to negative interest rates and the unpredictability of global stock markets.

Despite the volatility associated with Bitcoin, its RoI has climbed steadily YoY. The risk-reward ratio is low when the investment period is longer than a quarter, and this has been especially true since 2019. In fact, in January 2019, BTC’s price was $3732, before it hiked by 130% to hit $8572 in June 2019.

It should also be noted that there were several profit-taking opportunities at 50%, 70-85%, and 130%. Depending on the desired returns on the portfolio, managers could capitalize on the opportunity and exit based on their risk appetite.

Source: CoinMarketCap

This year, Bitcoin’s RoI is perhaps a little underwhelming at 52%. However, before the recent collapse in BTC’s price, there were profit booking opportunities from 27 July 2020 right up to 3 September 2020. This also coincided with the post-halving price rally of this market cycle. Having established that returns are lucrative to asset managers, what is the barrier to entry?

Buying cryptocurrencies using fiat like USD is one of the top deterrents as most fiat-crypto exchanges charge a premium or high fees on entry and exit. The rising popularity and market capitalization of USDT have tackled this challenge effectively. In the past 3 months alone, stablecoins have consistently added $100M a day in market capitalization. In fact, so potent has the rise of stablecoins like USDT been, that it has risen to 3rd on the rankings by market cap, only behind Bitcoin and Ethereum and well ahead of XRP.

Source: Twitter

With its supposedly transparent reserves, high market capitalization, and low transaction fees, Tether has made it easier for new players to enter fiat-crypto markets/transfer funds across crypto-exchanges. 2020, ergo, may truly be the year of Tether.

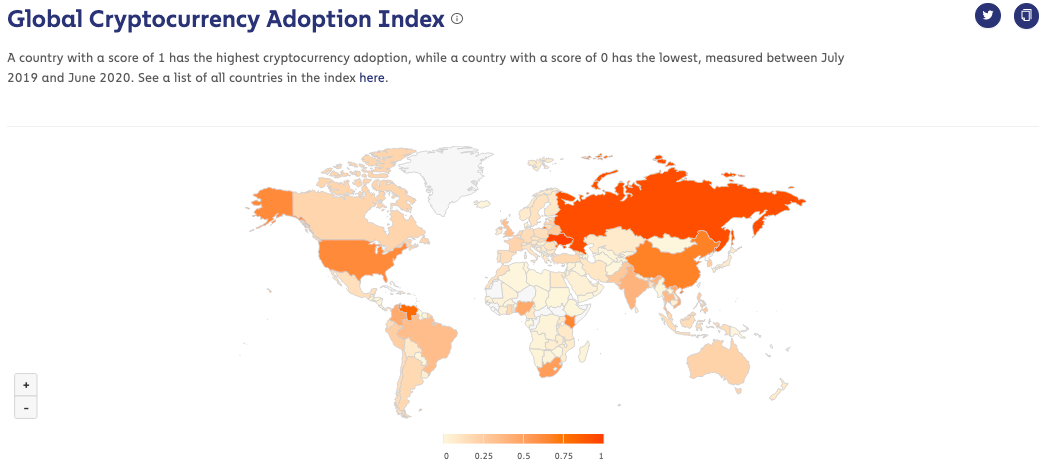

Tether provides liquidity and the opportunity to purchase Bitcoin or altcoins at market value. However, it also provides a true hedge against inflation. It has become a replacement for the USD in countries like Russia and China.

Source: Chainalysis

Transferring USD across borders for investing in international business or products comes at a high premium. However, Tether has dropped the barriers and reduced cross border transaction costs drastically. Its adoption is driving its market capitalization and its ease of access and availability is helping institutional investors save millions spent in fees and paid in premiums on exchanges globally.

Contrary to popular perception, relying entirely on the US Dollar may not be the best move in uncertain times. Hence, it is time to replace the traditional 60/40 with an optimized strategy where at least 10% is invested in Bitcoin, held for a quarter or two. Bitcoin, alone, won’t do either. As teenage Bitcoin billionaire Eric Finman once said, “Invest 10% of your income into top cryptocurrencies.”

This 10% can be invested into the top 25 altcoins ranked by market capitalization while another 10% can be held in Tether. Tether is the most crucial cog in this portfolio boosting machine. During a bloodbath, traders are left with two options – Hodling assets in their portfolios as they race to the bottom or converting them back to fiat on fiat-crypto exchanges and booking losses.

However, stablecoins like USDT give traders a third option – converting their crypto-assets to Tether and HODLing through the bloodbath, thus avoiding losses and converting to USD at low fees and near-zero volatility.

Ergo, Tether might just be the key to unlocking 60/40, while introducing a balanced basket of crypto-assets to investor portfolios in 2020.