Switzerland weighs BTC reserves – Could this spark a global trend?

- Switzerland’s exploration of BTC as a reserve asset aligns with a broader global trend

- Can Bitcoin stabilize enough to be a genuine solution for national reserves?

In a recent report, AMBCrypto highlighted an emerging trend – Countries with struggling currencies, weakened by the rising dollar, may soon turn to Bitcoin [BTC] as a strategic reserve.

Now, Switzerland has joined the conversation, and is now considering adding Bitcoin to its national reserves. Clearly, the future of Bitcoin as a key reserve asset is looking more likely than ever—but will the volatility of 2025 make or break this shift?

For this, we need to take a step back and think

After making Bitcoin a key focus of his election campaign, President-elect Donald Trump’s return to the White House signaled a massive shift – The U.S. could soon be on track to become the world’s ‘crypto capital.’

However, it’s no longer just about the U.S. A growing list of countries, battered by a surging dollar, are now exploring Bitcoin as a hedge against inflation.

Take Japan, for example. With the Yen plummeting to a five-month low against the dollar, it’s only a matter of time before the country begins scrambling for alternative stores of value.

In a similar vein, Switzerland is now exploring a proposal that could see the Swiss National Bank (SNB) include Bitcoin, alongside gold, in its reserve assets.

Why the sudden shift? Two reasons are driving this change – The need to address mounting trade and fiscal deficits, and the growing institutional backing of Bitcoin.

As major institutions step in, Bitcoin is steadily being viewed as a solid financial asset, no longer just a speculative gamble.

To build a BTC reserve, a few conditions must align

There’s no doubt that in less than two decades, Bitcoin has evolved from an experimental digital currency to a globally recognized asset. And yet, as it moves closer to being considered a reserve asset, it faces a few significant challenges.

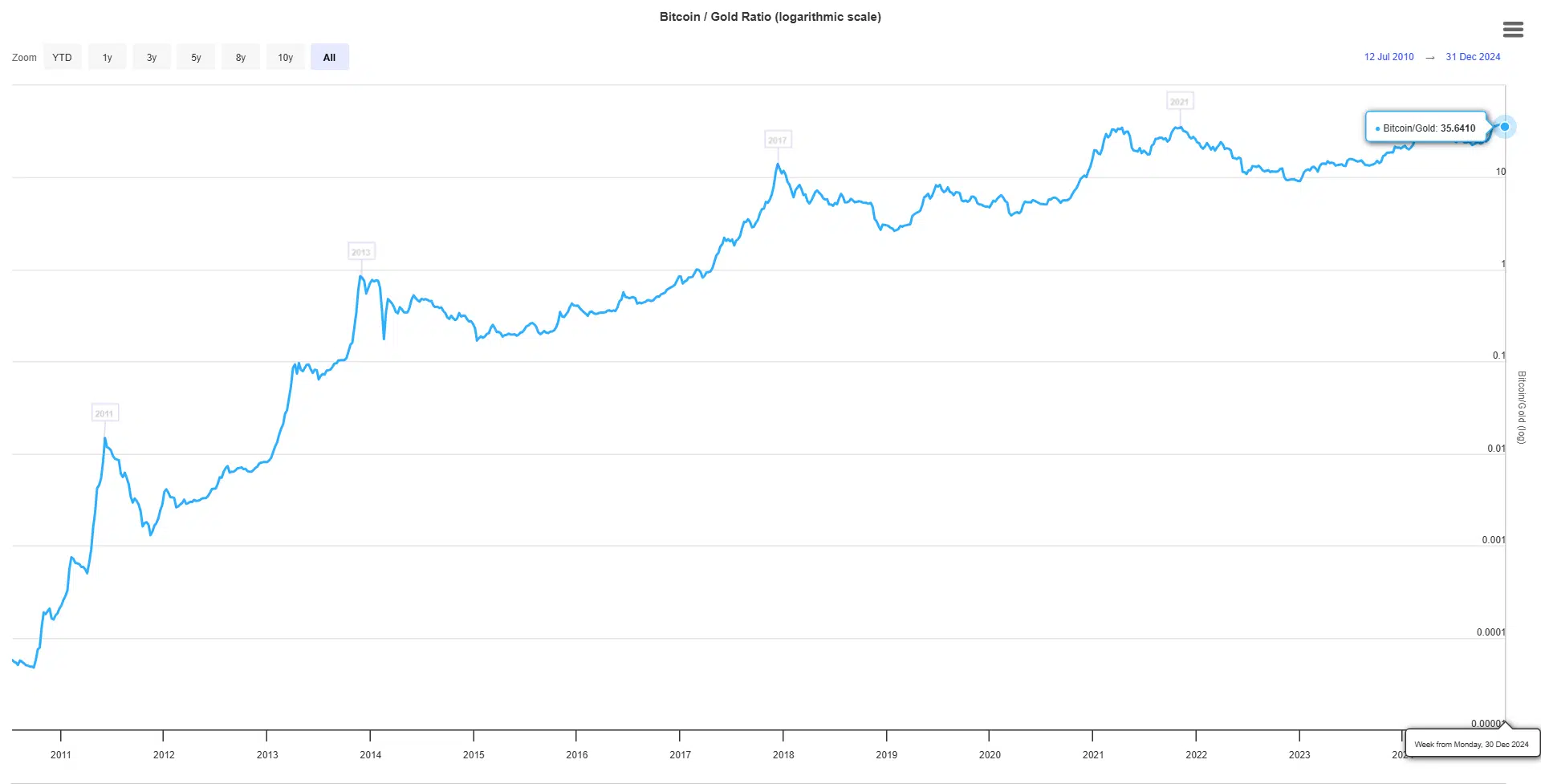

While BTC has closed 2024 with an impressive 140% year-to-date growth, far outpacing gold’s modest 27% rise, gold still holds the crown as the go-to investment for global economies.

But, could this change? 2024 has been a milestone year for Bitcoin. Beyond the historic $100k breakthrough, there’s another shift quietly unfolding in the market.

In Q4, the Bitcoin/Gold ratio broke past the 30% ceiling for the first time, suggesting that Bitcoin’s value is rising faster than gold’s, with capital flowing from the latter into the former.

Here’s the catch though – Bitcoin’s recent ‘unexpected’ plunge from $108k to $92k in just three days served as a sharp reminder of its volatile nature. So, while Bitcoin’s growth is undeniable, gold’s age-old stability and real-world utility still give it a lasting edge.

Read Bitcoin’s [BTC] Price Prediction 2025-26

Still, with Bitcoin’s track record and its increasing dominance, the idea of it becoming a strategic reserve asset is slowly moving from a distant dream to a real possibility.

For this vision to come to life, institutions must move beyond manipulation and focus on creating true value. As 2025 kicks off, the dollar’s volatility looms large.

If it swings upwards, Bitcoin could see its place solidified as a global reserve asset—A shift worth watching closely in the months ahead.