Surviving a Bitcoin market: Which projects will succeed?

Bitcoin, Ethereum, and the entire crypto market seem to have stabilized for now. Bitcoin’s price has found a footing and everything is fine. As for the projects and the companies built in this ecosystem, it is a whole other thing; to be precise, there seems to be a dichotomy.

Crypto’s Dichotomy

As of this writing, it isn’t a bear market and it isn’t a definitive bull market either. Crypto projects are in a cruise mode and some projects are doing absolutely the best while others are falling apart.

Lately, “billion-dollar” is being thrown around in the crypto ecosystem a lot. Investing firm, Grayscale recently hit $4.4 billion in AUM, and its Grayscale ETH Trust also crossed the $1 billion mark milestone to become a registered reporting company with the SEC along with Grayscale Bitcoin Trust.

Another project that is in the “billion-dollar” range is Celsius, which recently announced that the company hit $2.2 billion in AUM. What’s more interesting is this number is the result of doubling in the last six months.

In addition to this, the U.S. officials seized $1 billion worth of bitcoin tied to the now-defunct Silk Road dark web market.

The other side of this is the companies that are not performing well, specifically, Cred.

Cred, a U.S. crypto lender filed for chapter 11 bankruptcy after suffering from “irregularities in the handling of specific corporate funds by a perpetrator of fraudulent activity”.

Drawing Parallels

Bitcoin and cryptocurrency are nascent even though they’ve been around for 12 years. However, one thing we can relate it to is the DotCom period. Where multiple companies originated flourished and then perished.

The same is happening to many projects in the crypto ecosystem, especially considering that there is no frenzy, hype, mania. It is a time where projects with good fundamentals flourish.

Fundamentals matter at this point as we are on track to the longest bull run ever. Right now, we aren’t in a bear market, the extended bear market is finished and we are now in the slow, accumulation phase.

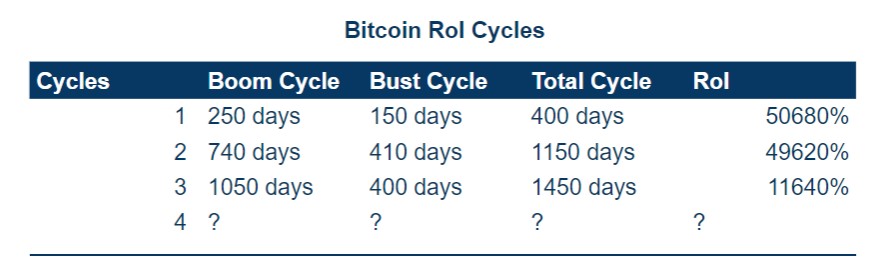

In an article that talks about the cycles of bitcoin, it was noted that the cycles are lengthening for bitcoin – each boom and bust cycle is getting longer while the returns are diminishing.

Specifically, the first cycle had an RoI of 50,000% and the recent cycle only 11640%. While bitcoin was valued in cents when it first started, it has reached a point where yielding 50,000% in RoI isn’t possible. Moreover, bitcoin is the most profitable asset and beats the likes of the S&P 500, DJI, TSLA, and even emerging market indexes.

These are the signs of market maturity and hence, only projects with good fundamentals will survive the long run, just like companies with actual value survived the DotCmon era.