Solana: Will SOL’s $1B USDC inflow fuel a rally to $10K?

- Solana saw a massive influx of USDC, creating a prime opportunity for investors to swap stablecoins for SOL.

- Could a $10K target for SOL be wishful thinking, or is it becoming a real possibility?

Solana [SOL] has surged past $200 in the last 24 hours, driven by a nearly double-digit jump. This time, the long green candlestick on its chart signals strong buying momentum, setting this rally apart from previous attempts.

While some may view it as a ‘temporary’ blip, especially with Bitcoin showing signs of recovery, there’s more at play. The influx of liquidity, highlighted by over $1 billion in USDC deposits, is noteworthy.

Investors seem all-in for Solana’s next big move

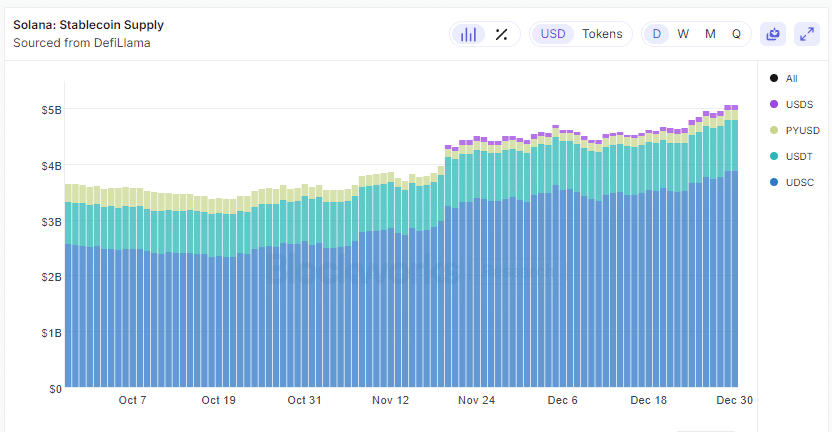

As shown in the chart below, Solana experienced a significant $1 billion surge in stablecoins last December, led by USDC. This surge indicates that investors are capitalizing on Solana in various ways, whether by taking advantage of the “dip” or staking for higher returns.

More USDC means more opportunities for savvy investors to swap it for SOL and earn solid yields through staking, lending, or liquidity pools.

With the Total Value Locked (TVL)now soaring to $58.2 million, a figure not seen in two years, Solana’s DeFi ecosystem is becoming a hotspot for those chasing high yields.

But it doesn’t stop there. With all this liquidity flowing in, there’s a buzz building that SOL could be on track to hit a $10,000 price tag. Its reputation as the “Ethereum Killer” is growing stronger each year, and investors are taking notice.

And it’s not just talk. Despite a few dips, Solana closed out 2024 with an impressive 80% growth, far surpassing Ethereum’s 44%.

Clearly, with more USDC flowing in, Solana is becoming the go-to platform for faster transactions and higher yields. At this rate, that $10K target for SOL is starting to look like a real possibility.

But fundamentals shouldn’t be overlooked

Since November, Solana’s Open Interest (OI) has remained steady between $4 billion and $6 billion. In comparison, Ethereum’s OI has soared to $30 billion, indicating that Solana still has room to grow in this area.

On the bright side, this lower OI meant fewer bets on SOL, which can be seen as less risky for investors. However, with trading volume still in the single-digit billions, it’s clear Solana has some catching up to do.

Read Solana (SOL) Price Prediction 2025-26

Solana’s recent surge above $200 has offered hope to HODLers who’ve been holding steady. Thanks to the USDC influx and growing DeFi activity, trading volume jumped 28% to $7.12 billion, forcing $6 million in short positions to close.

So, what’s next for Solana? Its blockchain has become a key player in stablecoin flows, driven by solid technology. However, reaching the $10K target will require more than just momentum—it needs to catch up with Ethereum’s fundamentals.

2025 could be a pivotal year for Solana, with its year-to-date growth already 50% higher than Ethereum’s. To make $10K a reality, Solana would need to ramp up its growth by at least four times. The road ahead is promising, but the challenge is clear.