Solana: Will FTX’s latest move affect short-term price prediction?

- Solana was up by more than 7% in the last 24 hours at press time.

- SOL’s derivatives metrics looked optimistic and suggested a further price hike.

Solana [SOL] has been under scrutiny ever since FTX announced its plans to liquidate its assets. Recently, a wallet related to FTX made a move that was interesting to look at.

Surprisingly, the move did not have a negative impact on SOL’s price as it’s daily chart remained green.

Does FTX still have an impact on SOL?

Lookonchain recently posted a tweet highlighting an FTX-related wallet’s activity.

As per the tweet, an FTX-related address unstaked 1.5 million SOL on 5th December 2023, which was worth more than $90 million.

There was more meat to the story as another wallet deposited tokens worth more than $230 million on Coinbase.

1/ FTX-related address "4Axqyo…HswTAh" unstaked 1.5M $SOL($90M) 2 hours ago and transferred it to "3vxheE…5mgkom".

And we noticed that "3vxheE…5mgkom" deposited 4.13M $SOL($248.67M) to #Coinbase 11 hours ago. pic.twitter.com/pQRNDZCvgy

— Lookonchain (@lookonchain) December 5, 2023

AMBCrypto took a look at SOL’s staking ecosystem to see whether the recent transfers had any impact.

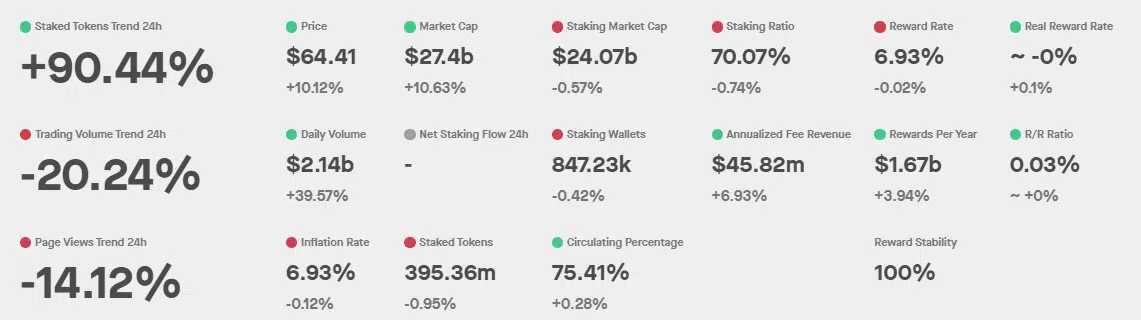

As per our analysis, we found that not much was affected as SOL’s staking ratio continued to remain above 50%. In fact, its staked token trend increased by 90% in the last 24 hours alone.

As per StakingRewards, Solana had a total of more than 847 thousand staking wallets with an annualized fee revenue of more than $45 million.

At press time, SOL had a staking market cap of over $24 billion.

However, it was interesting to note that the total number of staked SOL did register a decline in the recent past.

SOL stays afloat

Despite a massive sell-off, the token’s price did not react negatively. In fact, the token’s price gained upward momentum.

According to CoinMarketCap, SOL was up by more than 6% in just the last 24 hours.

At the time of writing, SOL was trading above $64 with a market capitalization of more than $27.4 billion, making it the sixth largest crypto.

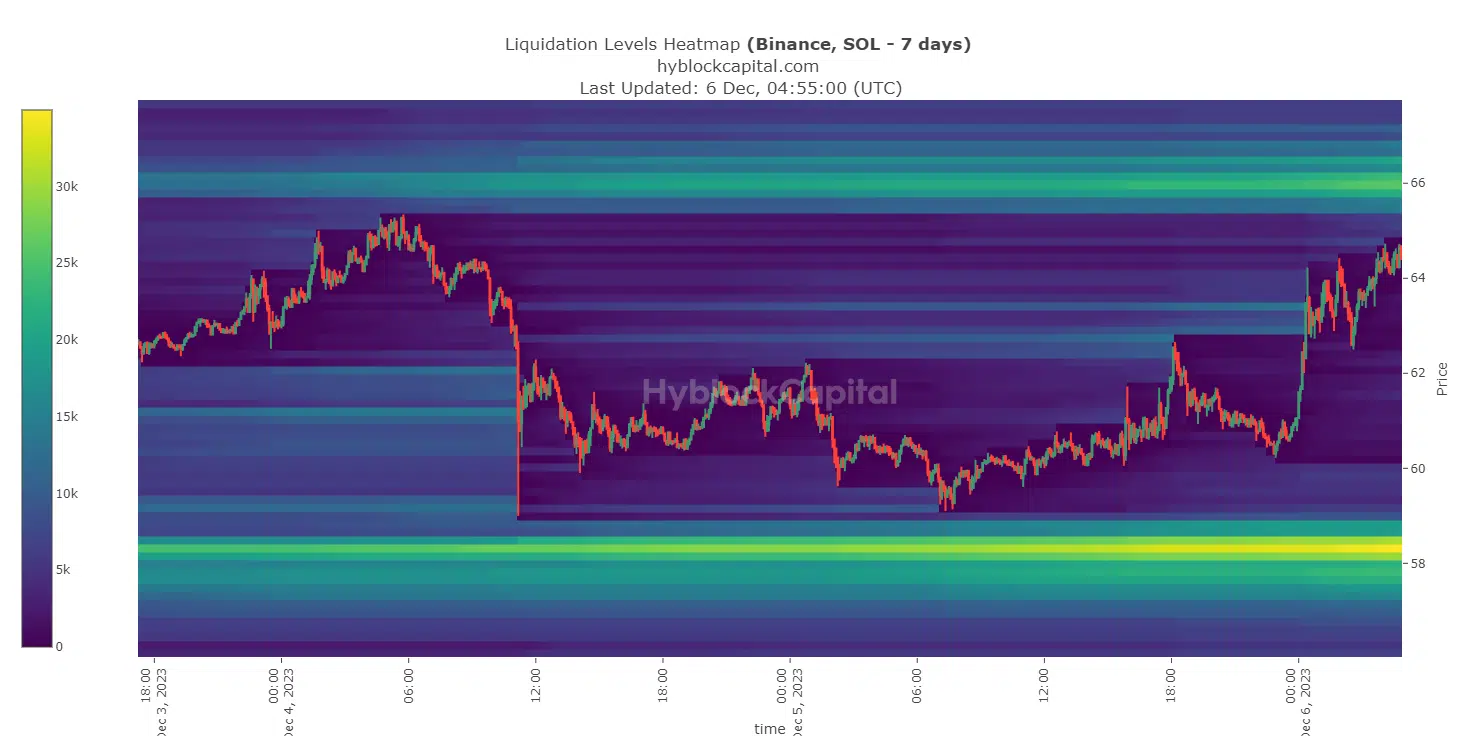

As per AMBCrypto’s analysis of Solana’s liquidation chart, the token’s price previously witnessed high sell-offs near the $58 mark.

However, since the token is now well above that mark, it has to cross another key level.

The chart clearly revealed that SOL has experienced high liquidations near $66.

Therefore, whether the token manages to go above that mark during this bull rally, it will be interesting to watch.

Things in the derivatives market also looked positive, as SOL’s funding rate registered a spike while its price rose in the past 24 hours.

This clearly meant that futures investors were actively buying SOL at a higher price.

Realistic or not, here’s SOL’s market cap in BTC terms

Not only that, but its open interest also increased. Whenever open interest increases, it suggests that the on-going price trend will continue.

Considering these metrics, it’s safe to say that the recent unstaking and sell-off did not have a negative impact on SOL’s overall health.